Selling stocks is easy but knowing when to sell stocks is NOT.

More often than not, amateur investors focus too much on what to buy but doesn’t have an exit plan in place. They panick for many reasons:

- Share price go up too high (should i cash in?)

- Share price crash to the doldrums (should i cut loss or hold on?)

- Significant change in business operations (Electronic components Serial System hopped on the Durian selling craze).

Hence, buying a stock at a right price is only one part of a successful investment, knowing when to sell is also critical.

My Selling Mistake

A long time ago, I bought into Facebook when it was trading at ~US$25 shortly after its IPO. I sold it for US$40 to lock in some quick gains, thinking that social media is over-hyped.

It doesn’t take too long for me to realize the mistake as Facebook continues to grow by leaps and bounds after that. And i would have made a 10x bagger (1,000% return!) if i wouldn’t have been so fixated on the short term gains!

Without further ado, here are 4 good tips on knowing when to sell and also to prevent you from repeating my sobbering mistake…

1. Deteriorating Fundamentals

As mentioned, the main situation you should sell your stock is when you notice deteriorating fundamentals in a company that you hold.

The business environment is full of competition and even blue chip companies will face headwinds and run into trouble. It is the job of an investor to identify whether the company is in a temporary headwind or a permanent trouble. If it is the latter, you should sell the stock.

Let me give you an example.

In recent years, the Singapore’s leading media organisation, Singapore Press Holdings Limited (SGX: T39), is facing some trouble in their media content publishing business.

In 2017, more than 70% of the group revenue was contributed by media segment but they are now continually moving into the property business if you have noticed.

Times are changing on how we all consume content nowadays, from traditional media such as newspapers and magazines to social media, mobile and the internet. From 2013 to 2020, SPH has recorded a continuous decline in both group sales and operating profits.

The decline was mainly attributed to a continuous drop in sales from its media division due to falling readership for its newspapers over the last 5 years. Its share price has slumped from the peak of S$4.00 in 2016 to just S$1.04 today (i have already foresee the uncles and aunties raising their arms revolting).

Anyway, if you noted the headwinds moving toward SPH, you could have sold your stake and avoided the bloodbath.

2. You made a mistake

It is common for people to make mistake sometimes. When you found that you had made an analytical mistake, you should sell the stock, even if it means a loss will be incurred. The key to successful investing relies on analyzing data and information instead of your own emotions.

Sometimes, however, the information can be misleading, or perhaps we misread it, and a mistake was made. If this is the case, then move on.

The one difference when people made a mistake is that some let it affect them more than others. More money is lost by people who’ve held on to bad, losing businesses hoping to get their money back someday.

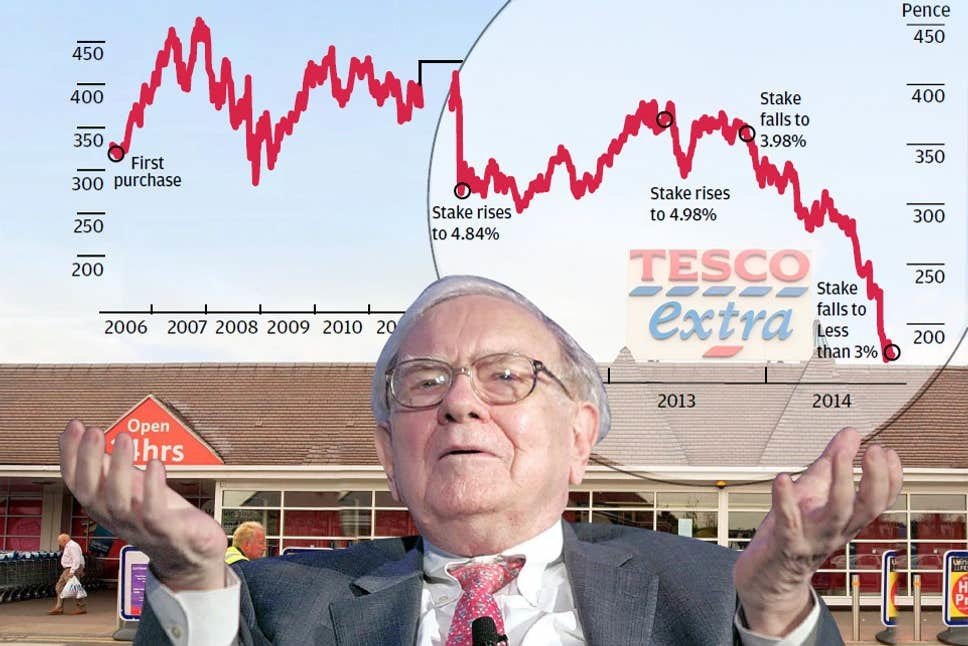

Even the legendary investor Warren Buffett made a mistake when he bought UK-listed Tesco and sold it after some 7-8 years. That said, he considers it a learning mistake.

The takeaway is that if you’re able to learn from the error, it may be the best investment that you make. Otherwise, you may end up holding your losers and selling winners.

3. Better Opportunities

Another time to sell a stock is when you found a better opportunity. Opportunity cost is defined as a benefit that could have been obtained by selecting an alternative.

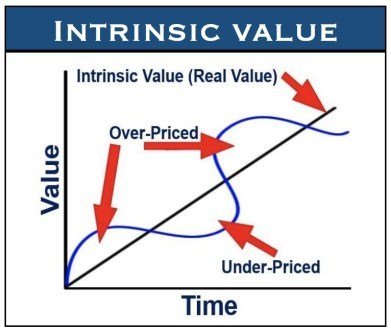

Therefore, it is important to have your own intrinsic value for every share you want to buy. It helps to compare the potential gains that could be obtained by owning another stock. It is better to sell a stock that is reaching its fair value or one that doesn’t seem to be working out for some reason.

However, it could be extremely difficult to accurately identify the opportunity cost. There are several metrics that can help such as free cash flow yield and P/E ratio. Hence it is important to perform your due diligence so that you know which stock can help to generate a better result.

4. #Bonus – Approaching Fair Value Range

When analyzing, valuing, and buying stocks, it’s important to estimate an intrinsic value or a fair value range beforehand.

An intrinsic value could serve as a guide for us to gauge whether a stock is cheap or expensive compared to its value. Once share price approaches this range, one can consider selling the stock if you don’t see any further upside.

One crucial tip here: You should not simply rely on your original target to sell and should always keep your intrinsic value estimate updated every quarter or so.

It is because when a company grows and becomes more successful, its intrinsic value should grow in tandem since the company’s fundamentals have improved.

Here is a quote from Benjamin Graham,

“In the short run, the market is a voting machine but in a long run, it is a weighing machine”.

In the short run, share prices often diverge significantly from its intrinsic value. Over the long run, the share price of a company will eventually match its intrinsic value. It is the time to sell when the price of a stock you own exceeds its intrinsic value.

While you’re at it, do you want to learn how to invest and compound your wealth steadily with your own system? You’re in luck because we have developed an Unique Investing System just for you via a simple 10-Step Checklist.

Simply click to DIY your one-and-only Investing System today!