1 Common Investing Question

Many retail investors often face this issue/question:

“I have bought these stocks at a high price and now trading at much lower prices.

Should I keep them or sell them and reinvest in other stocks?”

I’m sure most of us have encountered this question at some point in our investing journey.

Before going into the hard facts of what steps should be taken, let’s experience the emotions one would feel when faced with this kind of situation…

Faced with a Dilemma

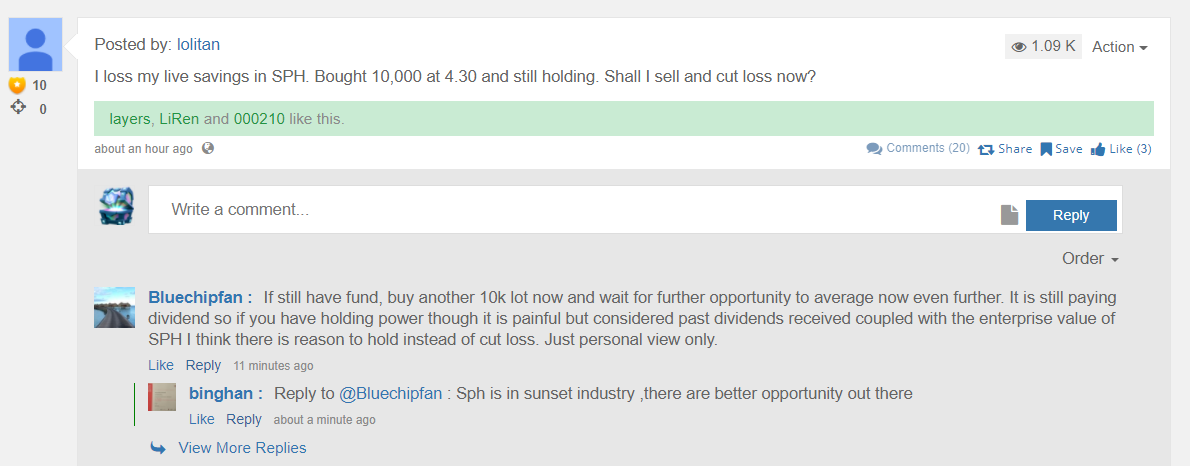

Let’s review the InvestingNote’s comment by a member below:

For this user – Lolitan, his stock SPH (SGX: T39) is losing big time from $4.30 to S$2.6 (down 40% at time of writing).

He is looking to sell, but deep down, he is probably still holding to it and thinking:

“The paper loss is not realised until I sell it, maybe it will bounce back and I will sell when that happens!”

On the other hand, he may also be thinking if he should

“offload the holdings, and utilize his capital in another security with more promise.”

In a perfect world, everyone aims to profit from buying low and selling high. Unfortunately, the reality is just the opposite.

In Peter Lynch’s book One Up on Wall Street, he mentioned about the silly things people say about stock prices and one of the quotes go like this,

“If it’s gone down this much already, it can’t go much lower”.

One classic example is Noble Group Limited (SGX: CGP) where it has fallen from its grace

- due to ‘poor market conditions’,

- previously inflated valuations and

- huge impairments which dragged its financials into a whole sea of red.

Its stock price plummet from a high of S$17.5 to only S$0.435 at the time of writing, after a 10:1 share consolidation exercise done in March 2017.

Should You Buy/Hold/Sell?

In order to stay calm and think straight in the face of the price decline, ask yourself the following questions:

- Why did you buy the stock?

Asking this question helps you reflect back on your investing style and what went through your mind when you first bought the stock.

Did you buy it because of hearsay or its strong fundamentals? Did you do your due diligence? - Why the decline in share price?

What events happened leading to the drop in share price? Is it due to temporary bad news or permanent poor business operations. - Does that change affect your reasons for investing in the company?

Is the change material enough that you would not consider the company again if you were to invest your money?

If you have bought into a stock due to a “hot tip” or impulsively, it is usually better for you to offload the position in the company and reinvest the money somewhere.

On the other hand, never let the stock prices bother you. A great company can trade at a hefty 80% discount but you should not sell it just because the share price is heading downwards.

In fact, you should be scooping these bargains up. Because one day, the market will see their value and push back the share prices again in the long haul.

Our Take

Many investors only focus on the reasons why they would invest in a company and do not have a pre-determined selling strategy in mind. As such, they can be totally caught off guard when their entire stocks’ portfolio plunge to an all-time low (i.e. 50% crash during downturn).

At the end of the day, losing money is part and parcel of investments but what is more important is to always look back at your purchase decisions again when something goes wrong.

Ultimately, your course of action (learning how to bite the bullet when you make mistakes OR holding tight to great companies during huge volaility) is the key thing that can help you be a successful stock investor (or not).

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!