In lieu of the higher interest rates and gloomy macro-environment, S-REITs has taken a beating in the past year.

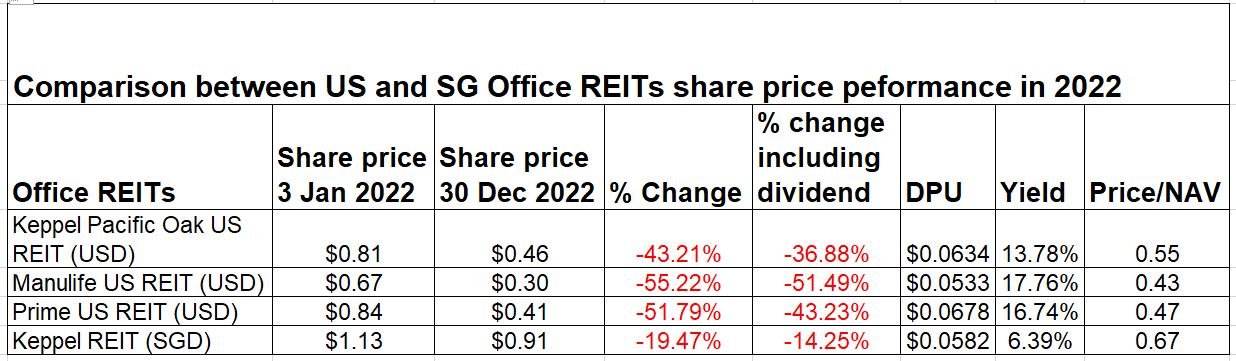

The FTSE ST REITs index was down >14% in 2022 with US Office REITs faring the worst as compared to other sectors.

Comparison of US vs SG Office REITs

Office REITs: Value Traps or Bargains?

While we can’t answer the question for sure, there are a few key traits we can look out for to determine whether US Office REITs are value traps.

We look at whether the REITs have “over-promised” but “under-delivered” in terms of:

- DPU growth

- Gearing ratio

- Cost of debt

- Where the properties are located and

- US economic outlook

Let’s dive into each of the factor below.

1. DPU growth

In terms of DPU growth, from the above table, Keppel Pacific Oak US REIT (KORE), has seen slight DPU growth for the past 3 years. On the other hand, Manulife US REIT (MUST) and Prime US REIT (PRIME) have seen their DPU declined.

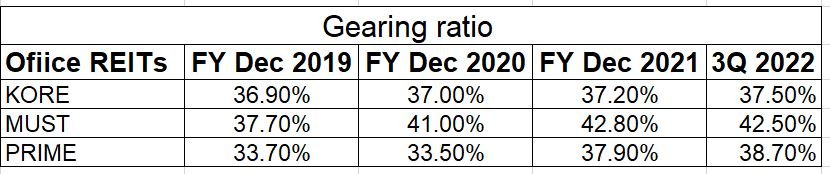

2. Gearing Ratio

From the above table, its no wonder MUST was the worse performing US office REITs. The REIT was aggressive in its gearing ratio where it went from 37.7% in 2019 to 42.5% in its latest 3Q2022. The above 40% gearing ratio is a big red flag in itself.

PRIME REIT, the second worse performing one, also leveraged up its balance sheet to 38.7% in it latest third quarter business update. From here, you can see why KORE outperform the other two REITs and will likely remain so in the future.

3. Cost of debt

Regarding cost of debt, all the 3 REITs has seen their cost of debt increased and we could expect it to increase further if the Fed decides to increase interest rates further.

This will make US domiciled REITs less attractive to invest in.

4. Location of properties

The location of the properties is also a factor that need to be considered whether the REITs are valuable or just another ‘boat’ lifted from the low interest rate tide.

Unlike small countries like Singapore and Hong Kong, the US is a big country which will then be subjected to migration issues between states and cities.

Hence, we need to also take note of the migration pattern of the population where there are now more people who prefer to live in less populated and more affordable sub-urban cities. This will ultimately affect the value of their properties and rental income.

In this aspect, KORE benefits from a shift in migration patterns from California to Texas given that they own a number of properties in Texas.

5. Macro-economic outlook

This is the most important factor we have to consider as well.

If the US fall into a deep recession in 2023, demand for office space will decrease and could result in negative rental reversions.

More importantly, the work-from-home trend is pretty strong in U.S. and it results in much lesser demand for office space going forward.

Conclusion: Are US Office REITs value traps or bargains?

From the above data points such as a grim economic outlook and slow/negative DPU growth, personally I will be wary of buying US office REITs despite their attractive valuations.

This is because the REITs share prices could remain depressed for an extended period of time and there are better REIT opportunities out there. Stay tuned to our blog for more REIT content!

*You can check out KORE website here. You can view PRIME website here and MUST website here.*