This upcoming ‘Union Gas Holdings’ IPO on the Catalist Board should be familiar to you and your household.

I still remember vividly the times when my grandma will call the people to deliver the Gas Cylinder to our house. She always has a spare cylinder just in case the old one runs out of gas and i will be the one replacing it for her 🙂

Anyway back to the topic, you can find its offer document here and product highlight sheet here. We have also listed 5 things on what you need to know about Union Gas IPO below:

1. Union Gas Holdings’ Profile

Union Gas Holdings provides fuel products in Singapore with over 40 years of operating track record. Its businesses can be classified into 3 segments:

- Union Energy: Sells bottled LPG (liquefied petroleum gas) cylinders and related accessories to domestic households

- Union Gas: Operates a fuel station selling CNG (compressed natural gas) to vehicles and industrial customers

- Union Gas: Sell and distribute diesel to both retail customers and commercial customers

2. IPO Details

The company will be offering 60 million invitation shares at S$0.25 apiece. This is split into

- 1.28 million shares offered to the public

- 58.72 million shares will be for institutional investors.

Out of the 60 million shares, 30 million will be new shares while the remaining 30 million will be vendor shares. You can think of vendor shares in terms of existing shareholders offloading their shares.

Mr Teo Kiang Ang, founder of the company, will own 140 mil shares out of 200 mil shares (70%) of the company post IPO.

Application for the subscription of shares will close on 19 July 2017 at 12pm, and trading of shares will commerce on 21 July 2017.

3. Use of Proceeds

The Group aims to raise net proceeds of about $5.72 million. The use of proceeds will be as follows:

- S$4 million (53.33%) for acquisition of dealers for its retail LPG business

- S$1 million (13.33%) for the supply and retail of piped natural gas to customers in the services and manufacturing industries in Singapore

- S$724,000 (9.66%) for general working capital

4. Financial Highlights

For its past 3 years, revenue has dropped by 20% from S$44.5 million in 2014 to S$35.7 million in 2016. This is mainly due to a decrease in revenue from their retail LPG business and CNG business.

That said, they are able to sustain growth in their bottom-line with CAGR of 18.48%. This is due to a decrease in average cost of purchase of bottled LNG cylinders and HSFO prices. As such, their earnings per share has increased by 66% from 1.19 cents in FY2014 to 1.98 cents in FY2016.

You can think of it as that Singapore price for gas is based on the HSFO price, which is linked to crude oil prices. Therefore, with the continual decline in crude oil prices, cost of purchase of natural gas is cheaper.

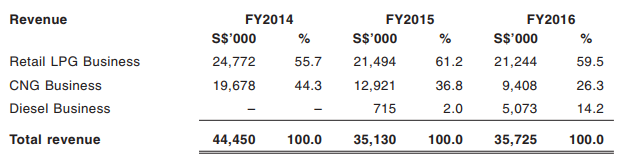

Lets also zoom in to its Revenue by the various segments.

Majority of its revenue is derived from its retail LPG business, which account for 59.5% in FY2016. The second main source of revenue is from its CNG businesses, at 26.3%.

A worrying sign is that over the past 3 years, we can see a consistent fall in demand for both its LPG and CNG businesses. Sales volume for LNG has decreased by 2.6% while CNG has fallen by 38.8%.

Although its diesel sales volume has increased significantly by more than 8-fold, we should note that its diesel business takes up only 14.2% of its revenue.

5. Cash Flow & Dividends

On a positive note, Union does not have any borrowings or debts. Their current assets are also sufficient to cover its total liabilities.

With regards to their cashflow, its operating activities have been consistently bringing in cash over the past 3 years. However, in FY2016, its cash pool dwindled by 72% to stand at S$1.15 million.

This is due to a huge amount spent on purchases of motor vehicles and the offset of dividends declared of S$4.27 million to UEC.

As for its dividend policy, Union intends to distribute dividends of not less than 50% of their net profits to their shareholders in FY2017. With its current earnings, dividend yield will be around 4%.

From its offering document, Union states that there is a risk that the issue proceeds are insufficient to cover its growth plans.

Therefore, they may need to obtain debt or equity financing to implement these growth opportunities. As such, there is no guarantee that they can distribute dividends to its shareholders in future.

SCA Take

As we speak, more people are turning towards electric stoves and using gas pipes from SP Power (where you turn on when you get your HDB flat). Hence, we foresee that the usage of LPG cylinders to face further pressure in the years to come.

Furthermore, if crude oil prices were to increase substantially, HSFO prices is expected to rise in tandem. Low costs of natural gas may be hard to sustain in the upcoming years, hence diluting the profits of Union.

We think that this is the reason why the company has chosen to list now despite being around for over 40 years. The company has achieved some sort like a saturation point in Singapore and the lower costs enable them to show much higher profits during these past few years.

In a nutshell, unless you are looking for a quick buck by selling on its opening, you may want to think twice before investing in it for the long haul. Union Gas IPO has a P/E ratio of 12.6 which is relatively fair.

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!