Before we get started, do take note to apply for the Savings Account first (before the Credit Card) because it will allow you to get access to the various Partner offer deals!

You can also check out my video on Trust Bank’s Partner Offers:

https://www.youtube.com/shorts/eDHXZP3B-T0

- $35 NTUC Vouchers ($10 from referral, $25 from 1st card spend)

- 1 KG rice and

- 1 Breakfast Set in Kopitiam outlets

Go to any FairPrice outlet and you will probably see this:

Yes!

FairPrice Group and Standard Chartered has just launched a brand new Singapore Digital Bank called Trust Bank.

It has won one of the five Monetary Authority of Singapore (MAS) digital bank licenses and obtained its full bank licence in December 2020.

Trust Bank is taking the fight to GXS Bank – a collaboration between Grab and Singtel, is the other digital bank which was launched on Aug. 31 2022 to selected customers and their employees.

Trust Bank is offering 3 products:

- Savings account

- Credit card

- Insurance policy

In my review, I will cover just the first 2 ones: Credit Card rebate % and Savings Account promotions (because that’s what you would be interested in). So, let’s jump right in!

Trust Bank Savings Account

This is a fairly straightforward offering where they want lure customers to deposit money with them by dangling a relatively high interest rate of (up to) 1.4% p.a.

Base Interest is 1% p.a. + 0.2% (0.4% if you are Union Member) when you make 5 purchases with your Trust Card (covered more later).

Personally, I don’t fancy the savings account so much because its just 1.4% interest p.a.

Much higher interest rates can be achieved with either UOB or OCBC once we meet certain criteria like salary deposit and min. card spending etc.

However, the Trust Bank’s credit card is what caught my attention…

Trust Bank Credit Card

First of all, before dabbling into all the mumbo-jumbo about Linkpoints, we need to know this:

100 Linkpoints = Redeem S$1

So 1 linkpoint = $0.01 (easy math :p)

Next part is to establish if you are a NTUC Union Member or not.

NTUC Union Member

For the benefit of doubt, NTUC Union Membership is a Paid one and it is priced at $117/year.

Non-NTUC Union Member

I believe most of us fall into this category. And this is what we will get:

Remember we mentioned that 1 Linkpoint = $0.01? Here comes the calculation…

A 7.5% monthly bonus capped at 5,500 Linkpoints = $55 max.

Since you need to hit a min. S$450/mth excluding FairPrice purchases, it means you have to spend a total of S$450 + S$733.33 = S$1,183.33/mth to be entitled the $55 rebate bonus.

If you can hit the $1,183.33 for 3 consecutive months, you will earn another $75 bonus (in Linkpoints) for every quarter = $25/mth.

Simply put, if you spend a min. total of $1,183.33 (FPG and outside of that), you will get $80 worth of LinkPoints, equivalent to a 6.7% cashback card (pretty awesome if you can manage the spending well!).

That said, do read the fine print where the 15% savings* is a promotional offer and may be revised to 8% after Dec 31, 2022.

Caveat: Hit a minimum of S$450 monthly (excluding FairPrice Group spend and ineligible transactions) & do it for 3 consecutive months.

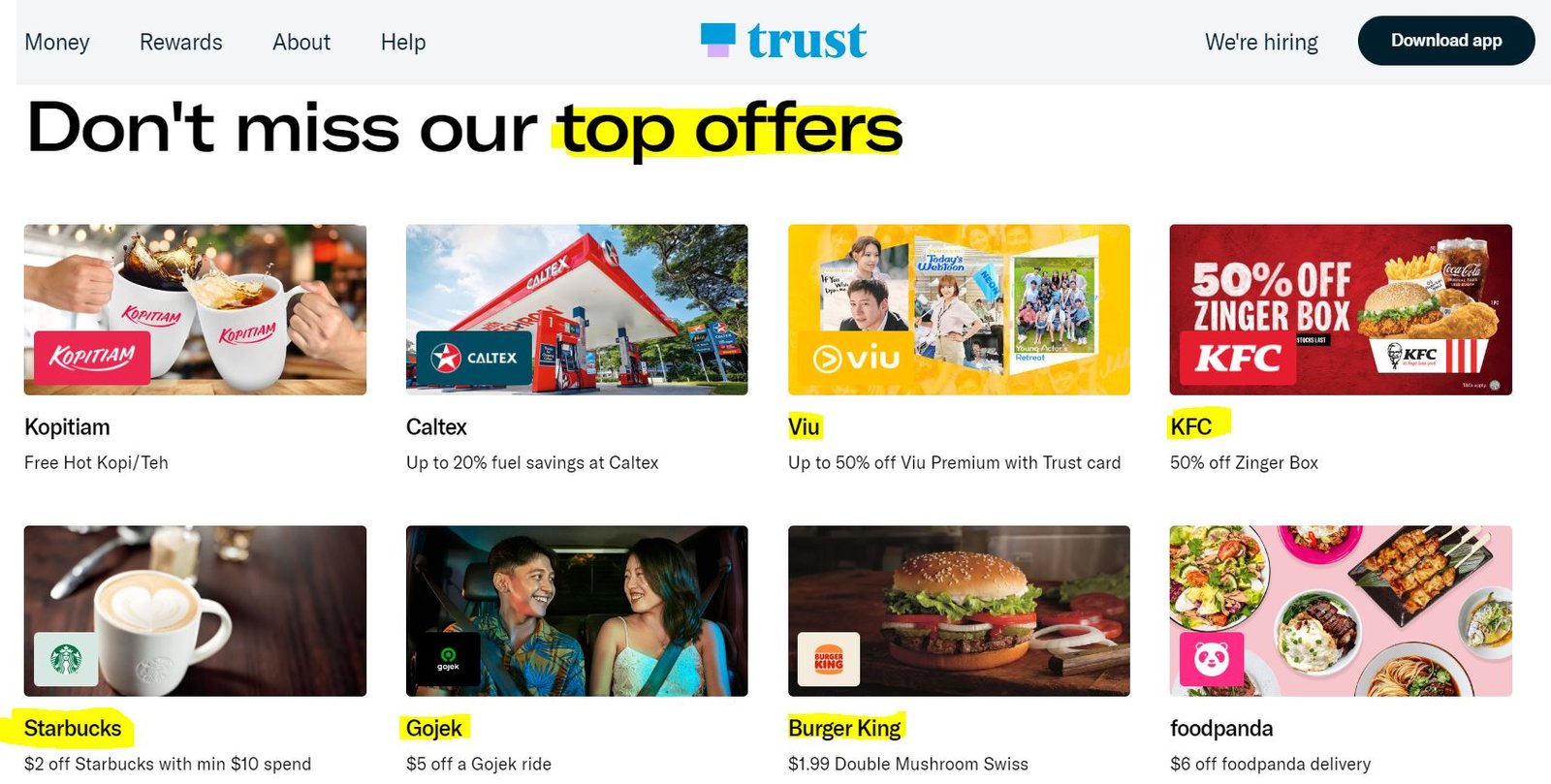

Trust Bank Partner Offers/Coupons

The most interesting of them all is probably the Trust Bank Partner Offers/Coupons.

KFC, Viu, Starbucks and Burger King are just one of the many merchants part of this Trust Bank’s offers.

Just take note of the validity period and the T&Cs involved.

For example, the offer is only available if you present and pay with your Trust card and valid for 1st 10K redemptions ending 30 Sep 2022.

Before we end off, check out my video on Trust Bank’s Partner Offers:

- $35 NTUC Vouchers ($10 from referral, $25 from 1st card spend)

- 1 KG rice and

- 1 Breakfast Set in Kopitiam outlets

All in all, in my own opinion, Trust Bank is going to be pretty successful with such an extensive network of merchants and being able to tap on the Fairprice Group’s entities like Kopitiam, Cheers and Unity too.

Let’s not forget about the alluring NTUC e-vouchers too! Sign up now with my referral code: YQVFSN6Z =)