The HK stocks rebound is on a roll yesterday (16 Mar) with some big names like HK-listed Alibaba Group and NetEase surging 27.3% and 23.4% respectively!

If you still unaware, the China govt made a strong push to stabilize battered financial markets, promising to ease a regulatory crackdown, support property and technology companies and stimulate the economy.

To recap, the ongoing selldown was led by China regulators taking issues on the following:

- Highly-leveraged real-estate companies like China Evergrande

- E-commerce leader Alibaba Group which began like Jack Ma and led to the investigation on Alipay

- Food-delivery giant Meituan, which had to lower the fees that it charges restaurants for delivery to alleviate F&B outlets’ expenses

- Tencent Holdings which faces a probe to break up the conglomerate and also face suspension on new game titles

With this in mind, let’s zoom in on some of these ‘blue-chip’ HK stocks which still have lots of room for share price appreciation [>50% potential upside based on 1 year target price].

#1 Alibaba Group

Alibaba Group operates through four segments: Core Commerce, Cloud Computing, Digital Media and Entertainment, and Innovation Initiatives and Others.

Some notable platforms include:

- Taobao Marketplace, a social commerce platform

- Tmall, a third-party online and mobile commerce platform for brands and retailers

- AliExpress

- Lazada

- Cainiao Network logistic services platform

- Ele.me – an on-demand delivery and local services platform

- Koubei – a restaurant and local services guide platform; and

- Fliggy – an online travel platform

Additionally, the company operates Youku, an online video platform; Alibaba Pictures and other content platforms that provide online videos, films, live events, news feeds, literature, music, and others.

Overall, analysts are giving an average TP of HK$165.33, translating to an upside potential of 82.3%.

From the above forward est. of its financials, Alibaba is expected to grow its revenue around 37% by FY2024 and more than double its net earnings from HK$79 bil to HK$177.6 bil.

Based on FY2024’s EPS of HK$9.75, Alibaba is trading at 9.3x FY2024 price-to-earnings (P/E) ratio.

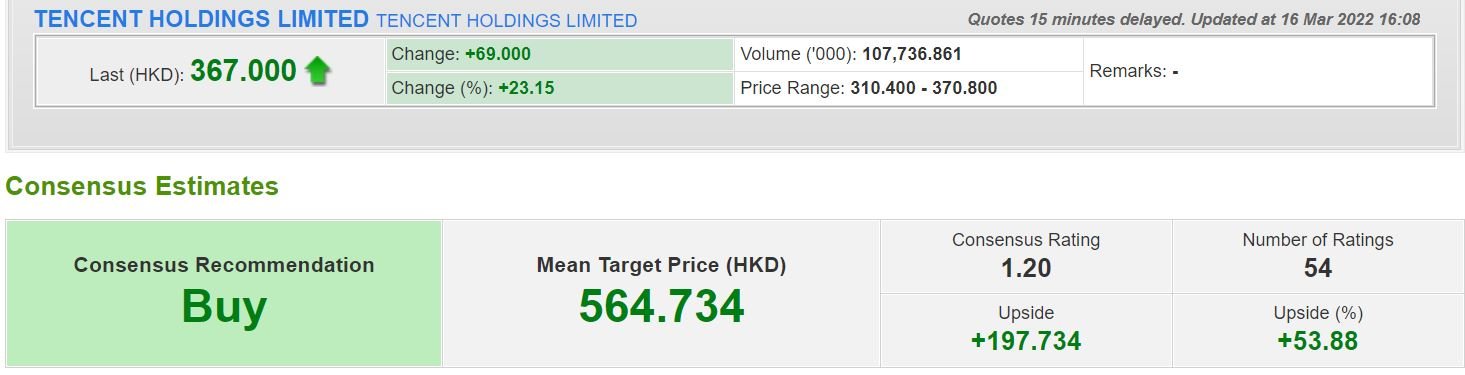

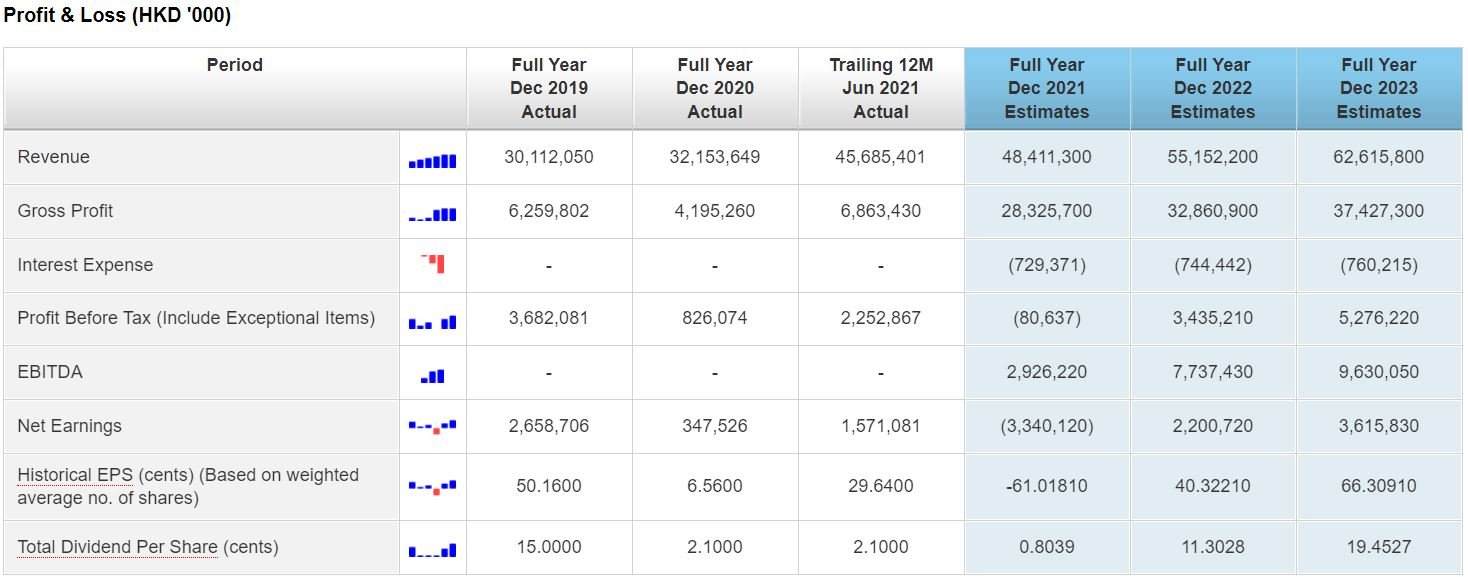

#2 Tencent Holdings

Tencent is a world-leading internet and technology company that develops innovative products and services to improve the quality of life of people around the world.

Check out its digital ecosystem below:

As an avid strategy game player, I love Brawl Stars and Clash Royale – both of which are made by SUPERCELL studio and they rack in billions of dollars for Tencent yearly!

On top of all the global investments, Tencent also offers a range of services such as cloud computing, advertising, FinTech, and other enterprise services to support the clients’ digital transformation and business growth.

Overall, analysts are giving an average TP of HK$564.73, translating to an upside potential of 53.9%.

From the above forward est. of its financials, Tencent is expected to grow its revenue around 40% by FY2023. However, analysts predict that its net earnings will actually fall from HK$225.2 bil trailing 12M Sep 2021 to HK$213.9 bil as of FY2023.

Based on FY2023’s EPS of HK$21.88, it is trading at 16.8x FY2023 price-to-earnings (P/E) ratio.

Read more on the corporate presentation here.

#3 Meituan Holdings

As China’s leading e-commerce platform for services, Meituan’s business revolves around the “Food+ Platform” strategy, and is centered on “eating” as its core.

Meituan operates several well-known mobile apps in China, including Meituan, Dianping, Meituan Waimai and others.

Its business comprises over 200 service categories, including catering, on-demand delivery, car-hailing, bike-sharing, hotel and travel booking, movie ticketing, and other entertainment and lifestyle services, covering over 2,800 cities and counties across China.

Leveraging its advantages in innovative technology, Meituan partners with a vast number of merchants and diverse partners to provide consumers with a higher quality of life. In doing so, Meituan is accelerating the digitization of the lifestyle services industry across both demand and supply.

Overall, analysts are giving an average TP of HK$283.92, translating to an upside potential of 102.8%.

From the above forward est. of its financials, Meituan is expected to grow its revenue around 92% by FY2023.

The icing on the cake is that analysts predict that it will become profitable by FY2023 as their revenue outpaces the expenses.

Based on FY2023’s EPS of HK$1.52, it is trading at 92x FY2023 price-to-earnings (P/E) ratio.

#4 Xiaomi

Xiaomi is one of the world’s leading smartphone companies. The company’s market share in terms of smartphone shipments ranked no. 2 globally in the second quarter of 2021.

The company has also established the world’s leading consumer AIoT (AI+IoT) platform, with 374.5 million smart devices connected to its platform (excluding smartphones and laptops) as of June 30, 2021, excluding smartphones and laptops.

Xiaomi products are present in more than 100 countries and regions around the world.

In August 2021, the company made the Fortune Global 500 list for the third time, ranking 338th, up 84 places compared to 2020.

Overall, analysts are giving an average TP of HK$13.4, translating to an upside potential of 84.9%.

From the above forward est. of its financials, Xiaomi is expected to grow its revenue around 49% by FY2023.

However, it is expected that its net earnings will stay flat by FY2023, probably due to their capital expenditure in the Electric Vehicle space.

Based on FY2023’s EPS of HK$1.33, it is trading at 10.1x FY2023 price-to-earnings (P/E) ratio.

Read more on the corporate presentation here.

#5 Haidilao

The brand Haidilao was founded in 1994. With over 20 years of development, Haidilao International Holding Ltd. has become a world-renowned catering enterprise.

By the end of June 30, 2020 ,Haidilao has opened 935 chain restaurants in China, Singapore, U.S., South Korea, Japan, Canada ,the United Kingdom, Malaysia , Vietnam,Indonesia and Australia.

However, things took a turn for the worse when COVID-19 hit. As of the latest profit warning announcement, the Group is expected to record a net loss for the year ended December 31, 2021 of approximately RMB3.8 billion to RMB4.5 billion, as compared to the net profit of the Group for the year ended December 31, 2020 of approximately RMB309.5 million.

The expected loss is mainly attributable to

(i) one-off losses on disposal of long-term assets, impairment losses and others, which in aggregate amounted to approximately RMB3.3 billion to RMB3.9 billion, due to the closure and suspension of operation of more than 300 restaurants during the year of 2021 and

(ii) continuous changing and recurring global pandemic, the rapid expansion of the restaurant network in 2020 and 2021, as well as the internal management

issues of the Company.

After years of ongoing expansion, the company decided to ‘sharpen the saw’ by implementing this rule – if the average table turnover rate of Haidilao restaurants is less than 4 times/day, no new Haidilao restaurants will be opened on a large scale in principle.

Read more about the ‘Woodpecker’ plan here.

Overall, analysts are giving an average TP of HK$19.78, translating to an upside potential of 61.8%.

From the above forward est. of its financials, Haidilao is expected to grow its revenue around 37% by FY2023.

After taking into account the sharp loss of HK$3.3 bil in FY2021, analysts expect things to rebound and their earnings to hit +ve HK$3.6 bil in FY2023.

Based on FY2023’s EPS of HK$0.66, it is trading at 18.5x FY2023 price-to-earnings (P/E) ratio.

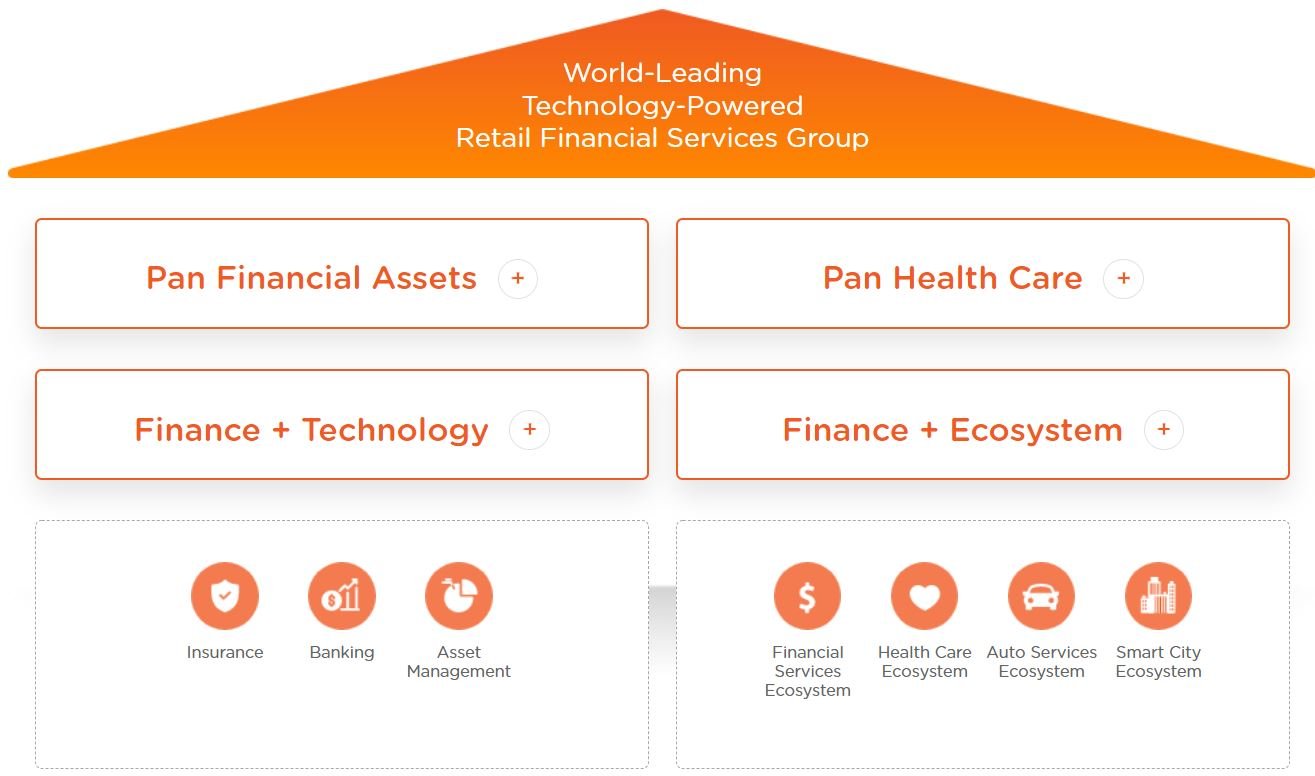

#6 Ping An

The last on our list is a big Fintech company in China – Ping An Insurance. It is a world-leading technology-powered retail financial services group which takes pride in the 4 main eco-systems as shown below:

You can also see how big it is when there are 4 listed companies under just its ‘Tech’ division:

Read more about the company from its 3Q21 results presentation here.

Overall, analysts are giving an average TP of HK$82.6, translating to an upside potential of 65.1%.

From the above forward est. of its financials, PingAn’s revenue will actually come down around 29% by FY2023.

On the flip side, net earnings are expected to improve 40% by FY2023 as China eases rules on the technology firms.

Based on FY2023’s EPS of HK$11.3, it is trading at merely 4.4x FY2023 price-to-earnings (P/E) ratio. On top of that, it offers an indicative dividend yield of 6.6% based on HK$3.33 dividends per share.

Our take on HK stocks rebound

Given that the discriminate sell-down has been largely attributed to the Chinese Government’s regulatory pressure (Alibaba getting smacked so many times in past 1.5 years), the worst seems to be over.

It is not often that you see blue chip MNCs like Alibaba or Tencent trading below 20x P/E ratio although some of the anti-monopoly pressure will still be there.

Hence, it makes sense to look at other smaller HK-listed stocks that goes in line with the Chinese government (rather than against it) because the market size in China is just humongous.

Want to know more HK or SG stock ideas amid the market rebound? Join our mailing list here and we will send you these juicy insights once they’re available!