Singapore’s Central Provident Fund (CPF) system helps you to save up for your retirement. While the interest on your CPF Ordinary Account (OA) is risk-free, investors may look at better returns on their CPF savings.

Blue-Chip stocks are a great asset class for obtaining a better yield and you can use your CPF Investment Account (IA) to invest in these stocks. In this article, I will profile top 4 Blue-Chip stocks for your CPF Investment Account.

Singapore Airlines Ltd

With the pick up in air travel and robust passenger demand, Singapore Airlines has benefitted from this trend by posting record results in the 9 months ended 31 December 2023.

Net Profit rose 35.0% YoY to a record $2,099.8 million for the nine months to December 2023 while 9-month Operating Profit came in at a record $2,162.8 million, an improvement of 8.7% YoY.

The company did not declare a dividend for the third quarter as the company declare dividend twice yearly. The company has already paid and interim dividend of 10 cents per share.

Th company anticipate that the demand for air travel remains healthy for the last quarter of FY2023/24 and the first quarter of FY2024/25.

Forward sales continue to be robust, in line with capacity increases in most markets, supported by the demand for leisure travel through

the school holidays and Easter peak in March and April 2024.

In addition, with the relaxation of visa requirements for China travelers couple with the Taylor Swift effect, Singapore Airlines will benefit from tourists who want to visit Singapore.

Nonetheless, passenger yields may come under pressure from increased competition as capacity restoration continues across the industry. High fuel prices and inflationary pressures also present a more challenging operating cost environment globally for airlines’

You can view the company website here.

Singapore Exchange Ltd

Singapore Exchange (SGX) is Asia’s most international, multi-asset exchange, providing listing, trading, clearing, settlement, depository, data and index services, with about 40% of listed companies and over 80% of listed bonds originating outside of Singapore.

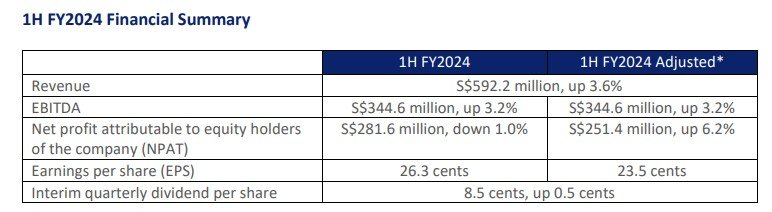

In its half year results ended 31 December 2023, SGX reported revenue increase by 3.6% to S$592.2 million. Adjusted net profit increase by 6.2% to S$251.4 million. The company declared interim quarterly dividend of 8.5 cents per share.

Mr Loh Boon Chye, CEO of SGX commented that “the year ahead could see muted global economic growth and geopolitical concerns that may affect market sentiment and risk appetite.

Nonetheless, the resilience of our multi-asset strategy as well as healthy financial position and discipline will enable us to capitalise on conditions across cycles.

To drive growth, we will focus on expanding our solutions to capture opportunities in Asia, grow our emerging products and further strengthen our global distribution and network.”

SGX being a monopoly exchange in Singapore could be the one of the 4 Blue-Chip stocks for your CPF Investment Account. You can view the company website here.

DBS Group Holdings Ltd

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia.

The bank declared a whopping 54 cents quarterly dividend and proposed a 1-for-10 bonus issue. The added that annualised ordinary dividend going forward will be $2.16 per share over the enlarged share base.

DBS CEO added that while interest rates are expected to soften and geopolitical tensions persist, DBS franchise strengths will put them in good stead to sustain performance in the coming year.

Hence, DBS is definitely one of the top 4 Blue-Chip stocks for your CPF Investment Account. You can view the bank website here.

Singapore Telecommunications Ltd

Singapore Telecommunications (Singtel) is a leading communications technology group in Asia, and has played a key role in Singapore’s development as a telecommunications hub for the region over the course of its 140-year history.

Headquartered in Singapore, Singtel provides an extensive range of telecommunications and digital services to consumers and enterprises through its three business groups – Group Consumer, Group Enterprise and Group Digital Life.

In its 9 month results ended Dec 2024, revenue came in at S$10,621 million while net profit grew 53% to S$2,602 million. No dividend was declared given that Singtel pays dividend twice a year.

Singtel CEO mentioned that Singtel underlying financial results in the third quarter were stable despite a tough macroeconomic environment and persistent currency headwinds.

NCS kept up its positive momentum with strong bookings while Optus was supported by growth in the mobile segment.

Singtel is confident that with its strong balance sheet and priorities to improve the operational efficiencies of its core business will be able to drive long-term value and returns and thus increasing its dividends payout to shareholders.

You can view the company website here.

Conclusion

These are the top 4 Blue-Chip stocks that you may add to your watchlist for your CPF Investment Account. As always, investors need to so their own due diligence before investing with your CPF Investment Account.