Picture this: you’re tracking a promising stock that’s about to skyrocket.

You’ve done your research, analyzed the charts, and everything points to a golden opportunity.

But when you finally decide to make your move, you realize you’re short on funds. The stock soars, and you’re left with nothing but overwhelming regret of a missed opportunity.

But fret no more, fellow investors!

To mark their 10th anniversary, Tiger Brokers has introduced the innovative Cash Boost Account (CBA), a game-changer for traders looking to seize every market opportunity.

Tiger Brokers: Revolutionizing the Investment Landscape

Before we delve into the details of CBA, let’s acknowledge Tiger Brokers’ impressive track record. Tiger Brokers has carved a reputation for itself over the past decade as one of the best low-cost stock brokerages in Singapore.

Known for their robust platform, competitive fees, and exceptional user experience, they have empowered countless investors to achieve their financial goals.

Case in point – they are also the first Fintech broker to introduce Contra Trading, a brand new feature that lets you buy stocks without needing the full upfront capital. Now, with the Cash Boost Account, they’re taking things a step further.

What is Cash Boost Account (CBA)?

Think of CBA as a supercharged Contra account. Contra trading allows you to buy stocks without needing upfront capital i.e. trade “now” and settle “later.”

This means you can potentially capture market opportunities even when your account balance is minimal.

For instance, if you are looking to ride on Booking Holdings as it delivered a good set of revenue and earnings, you may be bewildered that 1 share will already set you back US$3,990 (~S$5,376).

You are short on funds and wish to take advantage of Contra Trading using Tiger Brokers CBA…

And here’s 5 quick steps to get started:

- Sign up an account with Tiger Brokers (if you don’t already have one)

- Go to ‘Portfolio’ tab in the App & apply for ‘Cash Boost Account’

- Confirm your trading limit of SGD 20,000 or more upon approval (very fast!)

- Inside Tiger Trade app, switch to your Cash Boost Account.

- Trade Now, Settle Later without depositing funds for the full position

Live Contra Trade Example: Buying and Selling TESLA Shares

Now, let’s dive into a REAL Contra Trade using Tesla (TSLA) as our spotlight stock.

In this 1 minute video below, I will showcase how to make sure you select the CBA account, Buy and Sell a stock within seconds:

In short, this quick example highlights how the CBA enables you to leverage market opportunities quickly and efficiently.

Why Use Cash Boost Account: Benefits and Advantages

Now lets check out several compelling benefits of CBA:

- Trade Now, Settle Later

CBA allows you to execute trades immediately upon limit approval, without requiring an initial deposit.

Say goodbye to missed opportunities – whether it’s a hot tech stock like Nvidia or a promising biotech company getting its FDA license for a particular drug, you can jump in right away.

- Competitive Pricing

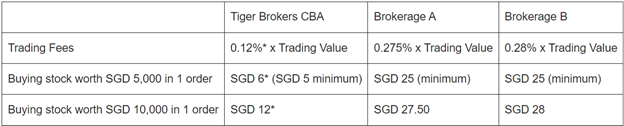

Tiger Brokers CBA also boasts some of the lowest fees for contra trading compared to other brokers which charge at least 0.275% or a minimum S$25 per trade.

Here’s the breakdown:

- Platform Fee: Just 0.12% of the trade value, with a minimum of USD/SGD 5 or HKD 40 (depending on the market).

- Commission Fee: Only 0.1% of the trade value, with a minimum of USD/SGD 4.99 or HKD 35. Plus, there’s an extra perk!

Open a new Cash Boost Account and complete your first trade to get a 30-day commission-free trading card. This card basically cuts your fees in half, letting you pocket more profits.

*Pass-through fees and T&Cs apply.

- High Trading Limit

As previously mentioned, CBA grants you a trading limit of SGD 20,000 or more upon approval.

This expanded capacity empowers you to explore a broader range of stocks and seize those fleeting moments when market dynamics shift.

- Interest-Free Period for Losses

Here’s where CBA truly shines.

You’ll enjoy an interest-free period on any losses incurred until the 8th trading day for Singapore and Hong Kong markets, and 7th trading day for the US market (be sure to check the T&Cs for the latest changes).

This grace period gives you valuable time to react to market movements and potentially turn those losses around.

Disclaimer: Always review the terms and conditions specific to your region.

How Does Cash Boost Account Work?

Here’s a step-by-step guide on how to open and use the CBA for your trades:

- Open an Account: Sign up for the Cash Boost Account through Tiger Brokers’ platform (check out video guide link here).

- Fast Approval: Once approved, you’ll be assigned a trading limit. The Cash Boost Account comes with a default credit limit i.e. SGD 20,000. You can apply to increase the limit if needed.

- Start Trading: To start, simply place a buy order, without needing an upfront deposit.Once the buy trade is done, it will become an Unsettled Buy (Outstanding Buy).

For SG and HK market, you will have until T+4 (Contra Period) to perform a corresponding sell trade (Contra Sell) before force-selling date.

For US market, you will have until T+3 (Contra Period) to perform a corresponding sell trade (Contra Sell) before force-selling date.

- Settlement of Funds: After completing a sell trade, a Contra is established.

You will need to settle the difference between your buying and selling prices.

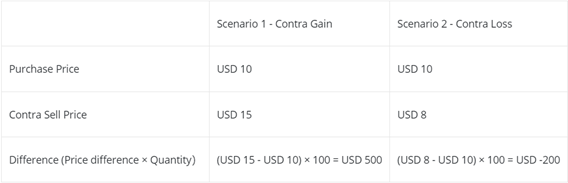

If this difference is positive, known as a “Contra Gain,” you keep the profit. If the difference is negative, known as a “Contra Loss”, you will need to pay the shortfall. Let’s consider an example where Tom buys 100 shares at USD 10 each and sells them three trading days later through a Contra Sell:

Trading-related fees are omitted in the illustration.

Scenario 1: Tom makes a Contra Gain of US$500. This amount will be credited to his Cash Boost Account.

Scenario 2: Tom incurs a Contra Loss of US$200. He will need to deposit this amount into his Cash Boost Account as soon as possible to avoid interest charges.

- Settlement Dates: You should also pay attention to the settlement dates.

As shown above, you have T+6 (SG, HK) or T+5 (US) to settle your trades interest-free.

If you do not settle within the interest-free period, standard interest rates will apply on the outstanding amount.

CDP Linkage

On top of the Contra Trading feature, CBA will be offering CDP linkage from 1st August 2024 onwards!

This will allow users to link their CDP account to Tiger’s awesome platform and enjoy the lowest Singapore market fees.

Exciting Promotions – Prime + Cash Boost Account (CBA)

To celebrate their 10th anniversary, Tiger Brokers is offering some exciting promotions:

- All Users: 0 COMMISSION* trading for SGX market in celebration of Singapore’s 59th birthday! Link here -> https://www.tigerbrokers.com.sg/activity/market/2024/sgx-sharing

- New Users: Open a Prime account and receive welcome rewards up to US$3,600. Link here -> https://www.tigerbrokers.com.sg/activity/forapp/welcome/sgp.html

- Existing Users: Open a Cash Boost Account (CBA) and stand a chance to win up to 14 AAPL shares (worth US$3,000!).Link here -> https://www.itiger.com/sg/marketing/SCAPASIA?lang=en_US&invite=SCAPASIA

- Exclusive (SmallCapAsia) Bonus: Be among the first 100 to sign up a Cash Boost Account with my link will receive an additional SGD 10 cash bonus!

All in all, don’t miss out this great deal* of rewards worth USD 3.6k + USD 3k + SGD 10 = ~S$8.9k in total!

*Terms and conditions apply.

Conclusion: Trade Now, Settle Later

The Cash Boost Account is a game-changer for active traders.

It empowers you to seize fleeting market opportunities without worrying about upfront capital. Remember, “Trade Now, Settle Later” is the mantra of CBA.

So, why wait?

Open a Cash Boost Account with Tiger Brokers today and transform your trading experience by clicking on the link below:

https://www.itiger.com/sg/marketing/SCAPASIA?lang=en_US&invite=SCAPASIA

Disclosure: Terms and conditions apply for all promotions. Please refer to Tiger Brokers’ official website for detailed terms and conditions related to the promotions mentioned in this article.

This article is sponsored by Tiger Brokers. As always, conduct your due diligence and make informed decisions based on your individual circumstances.