The REIT sector has been hit badly by the rising 10 year US treasury yield and the Fed might not cut rates this year due to persistent inflation in the US.

As a result, the FTSE REIT index has fallen 13.48% for the first half of the year. The REIT sector may not improve in the second half of the year if inflation persist and the 10 year US treasury yield remain above 4%.

Hence, investors need to be very selective in buying REITs especially if they are investing for income. You need to look for REITs with very resilient business model that can withstand high interest rates and be able to survive in the event of an economic recession.

Bloggers who keep mentioning to buy REITs with strong sponsors and high-quality properties are wrong. This method of investing in REITs does not work anymore in the new era.

For example, CapitaLand Ascendas REIT is back by strong sponsor. However, their Changi Business Park properties are having problems now due to rising vacancies.

Another example, is Mapletree Industrial Trust. The REIT light industrial properties has a very low occupancy of 52.1%. In addition, the data centres in the US is not doing well too with occupancy rate dropping to 87.7% compared to the previous quarter of 91.0%.

As a result, MIT share price has dropped 15.6% year to date and is worse than the fall in the FTSE REIT index of 13.48%. Many investors fall into this trap thinking that MIT is so called under a strong sponsor.

Strong sponsors may have a better chance of surviving in a severe economic recession but it does not guarantee you of making money or collecting increasing dividends.

It definitely also does not mean the REIT manager will not make a dilutive rights issue at the expense of shareholders. Capitamall Trust did a very dilutive rights issue at S$1.00 per share in 2008.

With the above in mind, I highlight 2 Singapore REITs which could provide investors with peace of mind.

Parkway Life REIT

Parkway Life REIT (PLife REIT) is one of Asia’s largest listed healthcare REITs. The REIT owns properties used for healthcare and healthcare-related purposes.

As at 31 December 2023, PLife REIT’s total portfolio size stands at 63 properties totalling approximately S$2.23 billion.

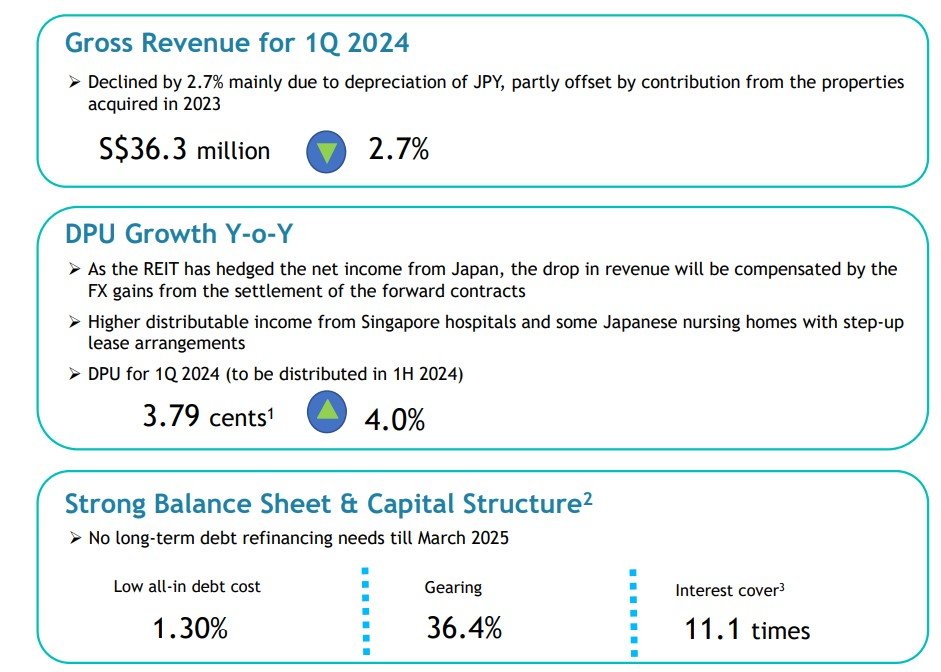

For 1Q 2024, PLife REIT reported gross revenue dropped by 2.7% to S$36.3 million while DPU for 1Q 2024 increase by 4% to 3.79 cents. Gearing is still healthy at 36.4% with interest cover is very high at 11.1 times. The cost of debt is also very low at 1.3%.

Many investors and bloggers avoid PLife REIT due to it low yield. However, the share price and DPU performance tell us a different story. DPU has been on an increasing since the REIT first listed.

The share price perform better than the FTSE REIT index and is down only 5.15% year to date. In the event of a severe economic recession like in 2008 which will surely happen in future, PLife REIT which is in the healthcare business will perform better than other REITs.

In fact in 2008, PLife REIT still increase its DPU and did not ask shareholders for money! You can view the REIT website here.

Frasers Centrepoint Trust

Frasers Centrepoint Trust (FCT) is one of the largest suburban retail mall owners in Singapore. FCT’s property portfolio comprises nine retail malls and an office building located in the suburban regions of Singapore.

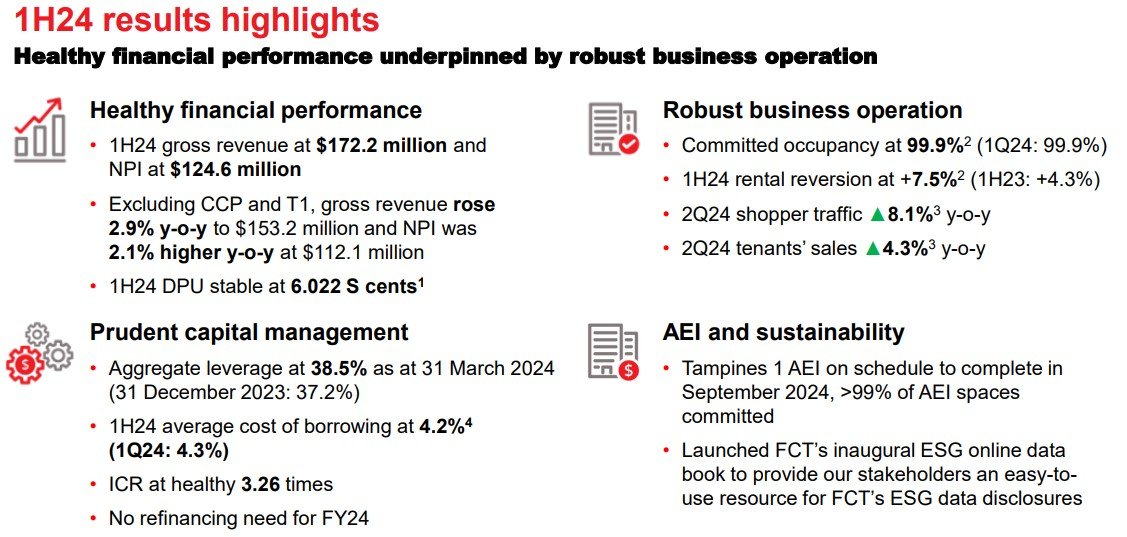

For 1H 2024, FCT reported gross revenue of S$172.2 million and net property income of S$124.6 million. DPU dipped slightly by 1.8% to 6.022 cents.

Gearing remain manageable at 38.5% with average cost of borrowings at 4.2%. Interest coverage ratio is also healthy at 3.26 times. FCT share price dropped by 5.33% year to date which is far better than the drop in the FTSE REIT index.

FCT is well poised to maintain its steady DPU in the event of a severe economic recession as suburban malls are where the food and supermarkets are located. If there is an economic recession, people still need to eat and buy groceries.

You can view the REIT website here.

Conclusion

I highlighted these 2 Singapore REITs which could provide investors with peace of mind in the event of of an economic recession. These 2 Singapore REITs should be able to maintain steady DPU even in times of economic uncertainty.

Investors need to do their due diligence before investing in these 2 REITs.

Office, industrial, logistics properties will be more badly hit as tenants may either reduce their rental space, ask for lower rent or even worse goes into bankruptcies and hence should be avoided.

[…] Is Mapletree Pan Asia Commercial Trust A Good Buy? [Fundamental Analysis] by Consulting Dan 5) These 2 Singapore REITs Provide Investors with Peace of Mind by SmallCapAsia 6) First Buy in 2H2024 – Frasers Centrepoint Trust and Mapletree Logistics Trust by Towards […]