Occasionally, we will review your survey responses and write on the stocks that you submitted to us. So do continue to send us your stock ideas here!

And for this week, we have a stock which has seen a 60% jump in share price since the start of the year.

On 3 Jan 2017, its price closed at S$0.38 and hit a high of S$0.60 as of 24 May 2017.

You can refer to the chart below for its stock price over the past 6 months.

Yes, the stock we are looking at is none other than Asian Pay Television Trust (APTT in short). Now, the million-dollar question on everyone’s minds is… will APTT continue to rise further?

Company Profile

Before we delve into our analysis, let us look at what APTT does.

APTT is a business trust which provides basic cable TV and premium digital cable TV services. It also provides services, such as broadband Internet access and premium digital television programming services to households and businesses.

Their businesses run in Taiwan, Hong Kong, Japan and Singapore.

Profitability

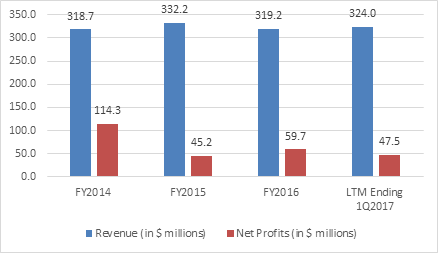

Looking at its revenue over the past 3 years, there has been little change ranging from 4-5%. For its latest earnings for 1Q2017, the trust reported total revenue of $82.6 million compared to $77.8 million a year ago. That translates to a 6.2% increase in revenue.

However, we should note that this is due to a strengthening of the Taiwan dollar by almost 8% so far this year. In Taiwan dollars (NT$) terms, total revenue for the quarter was actually 1.4% lower.

Turning to its net profits, there is a significant drop after FY2014 by about 60%! It used to stand at $114.3 million in FY2014 compared to the current net profits of $47.5 million.

The figures are graphed below for your easy reference.

Distribution

With regards to its distribution, the Trust intends to distribute 100% of its distributable free cash flows to shareholders. Distributions will be made on a quarterly basis each year.

We can observe a downtrend in its distribution per share over the years. It currently lies at 6.5 cents, a 51% drop compared to 13.4 cents in FY2013!

You can refer to the table below:

Moreover, its payout ratio is consistently above 100%, which means that its earning is insufficient to cover the distribution to unitholders. Hence, APTT may have to take on more debts or tap into their reserves to finance the distribution.

Over the years, its long-term debt has increased by 37.8% from S$943 million in 2013 to S$1300 in 2016. A further look at its retained earnings shows a consistent dive into the red every year.

There is no doubt a distribution yield of 11.02% is attractive. But it is a question whether APTT can sustain its dividend payout over the long term.

Conclusion

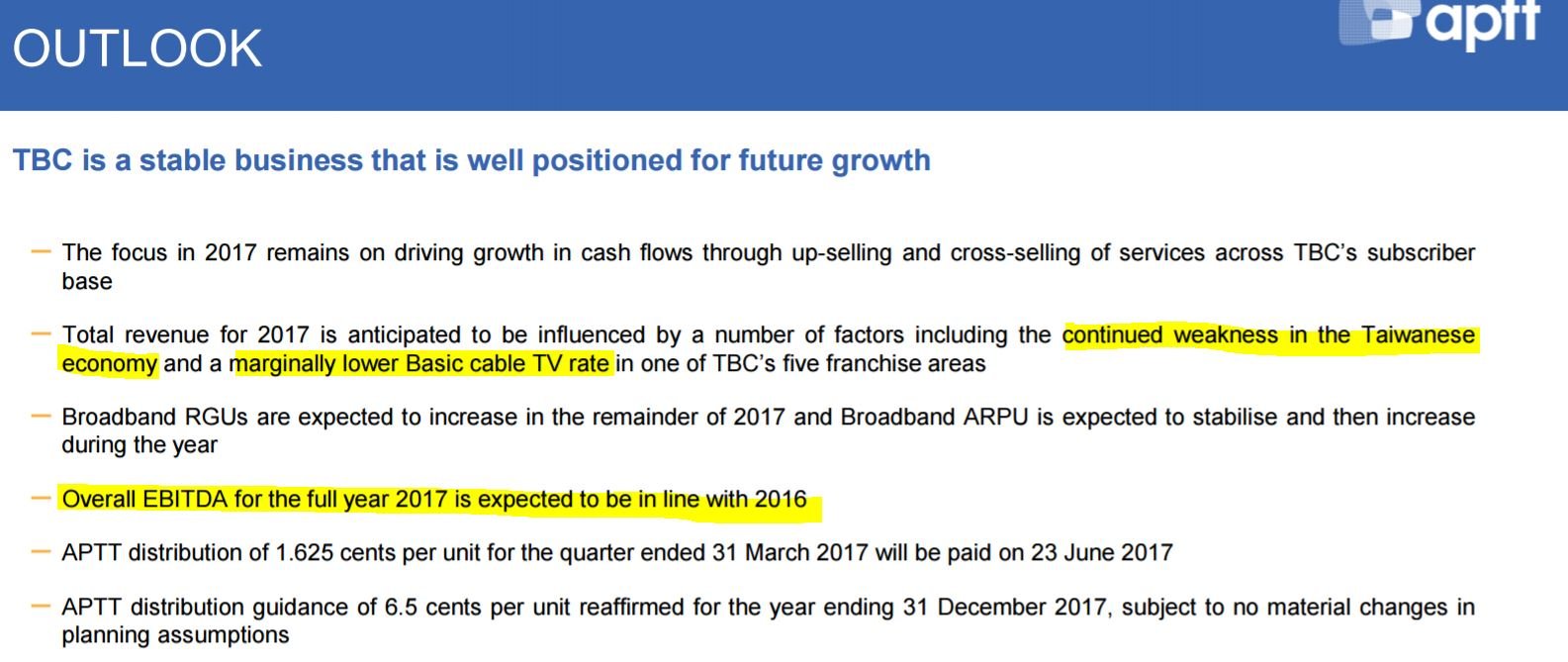

A quick check on its 1st qtr 2017 results also painted a lackluster outlook for the group. With stagnant top-line growth and huge debt burden, our view is to stay far away from the

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!