Truth be told, I am pretty ashamed of myself.

Even though I have done many different kinds of investments for myself and my wife, we haven’t really craft out a plan for our kids’ education funds other than buying some little stocks here and there.

Not wanting to delay it further, i set my sight on going for a regular savings plan (RSP) because i wanted a disciplined and hassle-free way to invest for my kids (i am already spending quite a lot of time analyzing my own investments).

There are many benefits of doing this versus investing in individual stocks too – which i will share below.

Benefits of Regular Savings Plans (RSP)

For starters, a Regular Savings Plan (RSP) is only half of what it sounds like (i.e. A plan for you to save regularly).

A RSP is a monthly investment plan that helps you invest your regular savings into an assorted array of investments such as ETFs or Unit Trusts.

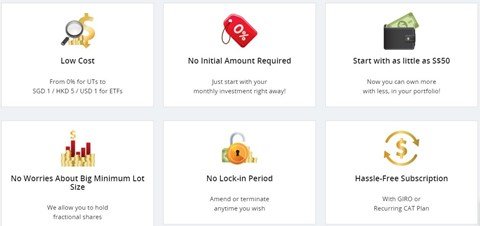

There is a multitude of benefits by using RSP which can be summarized in the picture below:

Sourced from FSMOne RSP

The 2 biggest advantages that stand out to me are the ability to get started with as little as S$50/month and the low on-going costs too.

How to achieve financial goals with RSP

One more important of the RSP is to help us meet the desired financial goals. And as mentioned, my aim is to set aside this RSP to offer my kids this ‘parental scholarship’ in 20 years to come.

So the 1st step is to find out how much the university course fees will cost in 20 years time.

According to Moneysmart’s article, the current fees range from S$28K to S$36K. I think those private/overseas ones will be more expensive, so i want to play safe and take S$35K for 1 kid. That’s S$70K (O_O) for 2 kids.

And Dollarsandsense.sg has mentioned that the average increment in local tertiary education over the last 6 years is 3.2% per annum.

Projecting it 20 years down the road, S$70,000 today would almost double to a whooping S$131,429 for 2 kids.

Now then, the next step would be to work backwards and see how much i need to invest every month to hit that target.

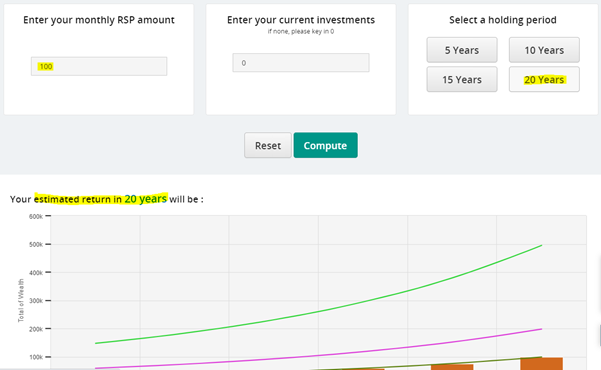

Luckily, FSM has this calculator for me to play around with.

Sourced from FSMOne

Judging from the table above, I have 2 options:

1) Invest $500/monthly in safe instruments yielding 2% annually to hit my target 20 years down the road OR

2) Invest $200/monthly into instruments which can grow 10% yearly to achieve $151,900.

Of course I would be picking the 2nd option!

Below, I would go through my own process of digging into the Unit trusts and ETFs one can consider to achieve the high returns over the long run.

What to choose for RSP

After knowing both the monthly quantum and return rates required, its time to dive into choosing the suitable investments.

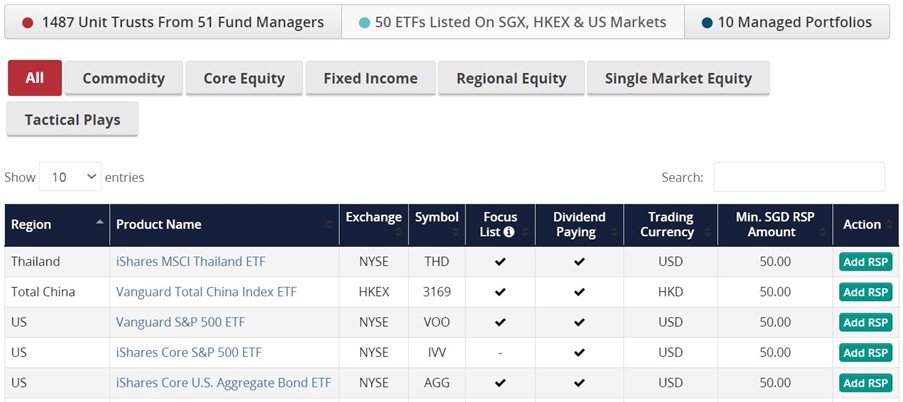

FSMOne offers a huge ton of options – more than 1,200 unit trusts, 50 ETFs and 10 managed portfolios as seen below.

For starters, a Managed Portfolio is a service provided by the FSM Team who builds, monitors and balances your portfolio for you.

Given the huge array of options to choose from, it would take another whole long article to dive deep into picking the Unit trusts/ETFs.

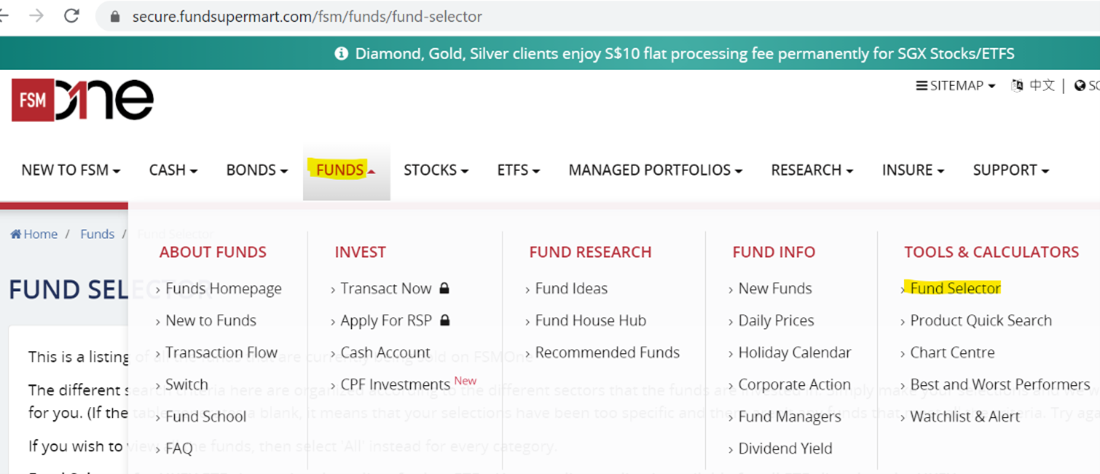

That said, a good starting point can be to go for FSM’s Fund Selector feature to narrow the list of funds suitable for each unique investor.

Below is a quick step-by-step guide on how to do so.

Unit Trusts – Step by Step Guide

Step 1 – Go to FUNDS -> Click on “Fund Selector” as shown below.

Step 2 – Narrow down the funds through different criteria such as risk ratings, geographical sectors, whether they are part of the RSP list and more.

Step 3 – Click on the “Generate Funds Table”.

Step 4 – Click on the “Performance Table” and you can now sort the funds by 5 year and 10 year performance (remember, longer year performance = more steady returns).

*Those have do not have the 5 year and 10 year numbers signify that the funds are new and not set up for more than that period.*

Step 5 – Find out more about each individual fund by clicking on the name. Download its Fund Factsheet and you can do your own research on things like its performance, expense ratio, top 10 holdings and more.

Step 6 – Once you have decided on 1 fund after your due diligence, you can just click the “Add to Cart” shopping icon.

Fill up some information, check out the order and Voilà! You’ve successfully started your RSP plan and one step closer to your financial goals.

ETFs – FSMOne Focus List

On the other hand, investors can also go for another popular instrument – Exchange Traded Funds (ETFs).

From the above, you can see that the ETFs are organized according to their category e.g. core equity / regional equity / tactical play and more.

Some of the common ETFs that investors can resonate with include:

- NikkoAM-StraitsTrading Asia ex Japan REIT ETF

- SPDR® Straits Times Index ETF

- SPDR® Gold Shares

- Vanguard S&P 500 ETF

More importantly, these 50 ETFs available for RSP are all classified under the FSM Focus List – a list which is curated by iFAST Stocks and ETFs Research Team.

Its goal is to serve as a good starting point for investors by bringing across the best ETFs for every equity and fixed income market across the globe.

You can check out this interesting article which describes the criteria they used to select these ETFs and how you can do the same too.

Conclusion

To recap, a RSP (Regular Savings Plan) is an automatic savings investing plan that forces you to accumulate your wealth steadily from as low as $50 each month.

Other than the 1400+ unit trusts and 50+ ETFs we have talked about, there are still many financial products investors can choose from under FSMOne.

For those who want to find out about What and Where to invest can look no further than FSMOne’s virtual investment conference here.

Held across 6 days from 9 – 26 January 2021, investors can look forward to many renowned investment speakers and their market outlooks heading into 2021.

Best part of all? There will be promotions and prizes given out during this period too.

In order to level up your investing game and not miss out on all the valuable insights, join FSMOne’s annual flagship event “What and Where to Invest” here right now!

This post is written in collaboration with FSMOne.com but all opinions are of our own.

[…] 3 Things To Know About Boustead Industrial Fund | Boustead Projects Read More […]

[…] […]