ST Group Food Industries Holdings Ltd (ST Group) was successfully listed on the SGX on 3 July 2019. As of 8 July 2019, it is trading at S$ 0.27 per share, one cent above its placement share offerings at S$ 0.26 per share.

Hence, ST Group has a market capitalisation of S$ 66.42 million currently. In this article, I’ll be covering 7 things that you need to know about ST Group before investing.

#1: Business Model

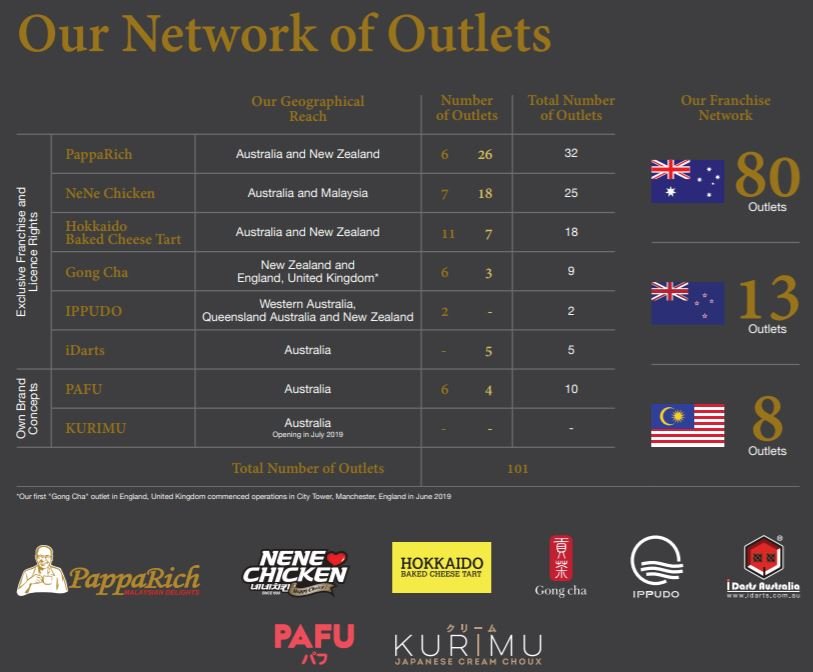

ST Group is an established F&B Group based in Australia. It secures a handful of exclusive franchise and license rights to run six popular F&B brands across cities in Australia, New Zealand, and Malaysia.

These brands include PappaRich, Gong Cha, NeNe Chicken, IPPUDO, Hokkaido Baked Cheese Tart, and iDarts.

It derives income from 4 business segments:

- F&B retail sales from its outlets owned and operated by ST Group.

- Sub-Franchising & Sub-Licensing of brands to sub-franchisors & sub-licensees.

- Sales of F&B Ingredients to its Franchise Network from its Central Kitchen.

- Machine Income from electronic dart machines installed at iDarts.

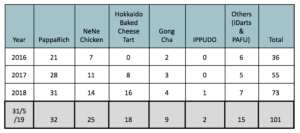

It has grown its number of outlets from 36 in 2016 to 101 presently.

#2: Financial Results

ST Group has achieved growth in both revenue and shareholders’ earnings over the past three years.

Revenue had increased from A$ 24.2 million in 2016 to A$ 36.5 million in 2018. It is attributable to rising F&B revenue and franchising fees from PappaRich, NeNe Chicken, and Hokkaido Baked Cheese Tart resulting from their network expansion.

Its shareholders’ earnings had increased from A$ 1.03 million in 2016 to A$ 2.72 million in 2018, which were in line with its increase in sales during the period.

| Year |

2016 |

2017 |

2018 |

| Revenues (A$ ‘000) |

24,204 |

30,314 |

36,479 |

| Shareholders’ Earnings (A$ ‘000) |

1,034 |

2,312 |

2,728 |

| Earnings per Share (EPS) (Singapore Cents) |

0.42 |

0.99 |

1.15 |

#3: Balance Sheet Strength

In 2018, ST Group has issued non-redeemable convertible preference shares for S$ 6.71 million.

This has resulted in a hike in current ratio for it has substantially boosted its cash reserves and a dip in gearing ratio due to a rise in total equity.

| Year |

2016 |

2017 |

2018 |

31/12/18 |

| Gearing Ratio (Non-Current Liabilities / Total Equity) |

72.9% |

59.8% |

27.5% |

30.0% |

| Current Ratio (Current Assets / Current Liabilities) |

0.60 |

0.61 |

1.10 |

0.99 |

| Cash & Cash Equivalents (A$ ‘000) |

1,031 |

1,559 |

7,429 |

5,057 |

#4: Use of Proceeds

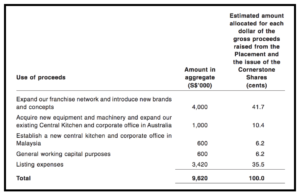

ST Group intends to raise S$ 9.6 million in gross proceeds from its placement of shares. Out of which, it plans to utilise:

1. Expand Franchise Network & Introduce New Brands (A$ 4.00 million)

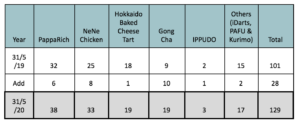

For the next 12 months, ST Group plans to open 28 F&B outlets and thus, lifting its number of outlets to 129 outlets. They include:

2. Expand Central Kitchen & Corporate Office in Australia (A$ 1.00 million)

ST Group plans to purchase brand new equipment and machinery to automate certain F&B production and packaging processes and to maintain the freshness of its F&B ingredients for a longer period of time.

Therefore, it intends to boost the quality of its F&B supplies from its Central Kitchen to its franchise network. Also, it intends to invest in a new enterprise resource planning (ERP) system for the purpose of streamlining its business processes.

3. Establish a Central Kitchen & Corporate Office in Malaysia (A$ 0.60 million)

This is intended to support its expansionary activities in Malaysia. Presently, ST Group has eight outlets of NeNe Chicken operating in Malaysia.

It plans to open three additional outlets over the next 12 months.

4. Working Capital and Listing Expenses (A$ 4.02 million)

Read also: https://www.smallcapasia.com/kopi-anyone-look-three-listed-fb-singapore/

#5: Management

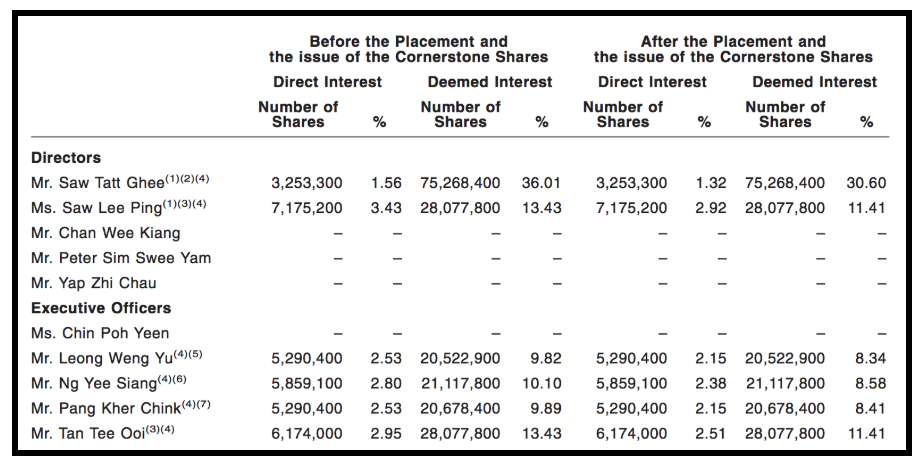

Saw Tatt Ghee remains as the largest shareholder of ST Group with a combined interest of 31.92% in the company. He holds the bulk of his interest in ST Group in STG Investments Pty Ltd and Centurion Equity Pty Ltd. He is appointed as the company’s Executive Chairman and CEO.

Saw Lee Ping is a sibling to Saw Tatt Ghee and is the Executive Director and the CAO of the company.

#6: Key Risks

Inevitably, ST Group is subjected to the following risks:

1. Reliance on Master Franchise Agreements

ST Group is dependent on PappaRich Master Franchise Agreements for income. It has 32 PappaRich outlets in Australia and New Zealand.

They have accounted for more than half of ST Group revenues over the last 4 years, inclusive of sales derived from sub-franchisees, renovation fees, and fitting outs of new outlets.

| Year |

2016 |

2017 | 2018 |

31/12/18 |

| ST’s PappaRich Outlets / Total Revenues (%) |

78.1% |

68.3% | 54.8% |

50.8% |

Any factors which are detrimental to the relationship between ST Group and its Master Franchisor, Roti Roti International Sdn Bhd, would negatively impact the group’s financial performance in the future.

2. Subject to Rental Costs Hikes

All of ST Group’s premises for its Central Kitchen and Outlets are leased for the long term with lease tenures ranging from 3-10 years. They have accounted for around 10% of ST Group’s total revenues.

| Year |

2016 |

2017 | 2018 |

31/12/18 |

| ST’s Rental Expenses / Total Revenues (%) |

7.8% |

8.0% | 10.6% |

9.9% |

It faces the possibility of not being able to renew its leases at good rates, thus, may face disruptions in operations if ST Group needs to relocate its operations to a new location.

#7: Valuation

At current price of S$ 0.27 per share, it is trading at P/E Ratio of 23.48 based on its EPS of S$ 0.0115 in 2018. Its net assets a share is S$ 0.077. Hence, its current P/B Ratio is 3.51.

According to its IPO Prospectus, ST Group Food does not have a fixed dividend policy presently. In my opinion, it is unlikely for the company to dish out any dividends as it is on a ramping up growth phase.

Conclusion:

ST Group has achieved growth in sales and profits for the last three years. It has an exciting growth plan where it intends to add 28 outlets into its portfolio.

The management team, most of them, are in their end-30s and early-40s and own a fair share of the company. Their interests are also more in line with shareholders for the company’s performance has an effect to their personal wealth.

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve found 7 exciting companies that are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!