Once grappling with losses during COVID, Soilbuild Construction Group Ltd (SGX: S7P) (“Soilbuild Construction”) has delivered a stunning financial and operational turnaround in recent years.

On top of that, Soilbuild Construction is leveraging its current momentum to tap into the growing opportunities in Singapore’s thriving construction industry as a sustainable builder with a strengthening growing order book.

In this article, we’ll explore Soilbuild Construction’s recent financial performance for first half of 2024, business model and competitive strengths to evaluate whether it presents a promising opportunity for investors.

About Soilbuild Construction

Based in Singapore, Soilbuild Construction is a leading builder with a long and successful track record of constructing a sterling award-winning portfolio of residential and business space properties.

With over four decades of experience, Soilbuild Construction has solidified its position as a leading construction company. The firm’s A1 ratings from the BCA for general building and civil engineering projects allow it to tender for projects of any scale. In addition, the Group also has BCA ratings that allow them to tender for civil engineering projects with a contract value of up to $105 million.

Precast Concrete Pte Ltd, a subsidiary of the Group, is one of the few licensed manufacturer of prefabricated and precast building components with automated manufacturing facilities in Singapore and manufacturing plant in Malaysia.

Notably, Soilbuild Construction’s multi-property sector approach diversifies its risks as it allows the Group to shift its focus should there be a slowdown in any particular sector of the property market.

Financial Turnaround: First Half Net Profit has Exceeded FY2023’s Net Profit

Soilbuild Construction’s remarkable financial turnaround is a central part of its story.

Revenue for 1HFY2024 grew by 19.5% to S$153.9 million, up from S$128.7 million in 1HFY2023. The Construction division remains a key revenue driver, contributing S$120.4 million, while the Precast and Prefabrication segment saw a phenomenal 114.9% growth to S$33.5 million.

Some of the key projects in the Construction division include:

- DB Schenker Project: Construction of sustainable, energy-efficient logistics facilities at Greenwich Drive.

- Soitec Project: Building of a high-tech manufacturing facility with cleanroom capabilities at Pasir Ris.

- Toa Payoh HDB Project: A public housing development in Toa Payoh.

- New Industrial Road Project: A five-storey industrial building.

In FY2023, the company reversed its fortunes, reporting a net profit of S$7.3 million after enduring losses in previous years due to adverse impact of COVID-19 pandemic on the Group’s construction and precast manufacturing operations, as the Group has had to navigate the challenging environment to deliver and complete projects that were secured before the onset of the pandemic.

Nevertheless, this upward trend has continued into 1HFY2024, where Soilbuild Construction has exceeded its full-year FY2023 profit in just six months, posting a net profit of S$7.4 million, a 444.5% surge compared to 1HFY2023’s S$1.4 million.

These results seemed to highlight the normalisation of the Group’s operating margins, while the Group continue to optimise its operating efficiencies.

Enhanced Financial Strength and Cash Flow

Soilbuild Construction’s financial health is further underscored by its growing cash flow and strengthened balance sheet.

During 1HFY2024, the Group generated S$18.6 million in positive operating cash flow, bolstered by ongoing projects and higher gross margins, which increased to 9.6% from 5.8% in 1HFY2023.

As of June 30, 2024, the Company’s total assets stood at S$267.1 million, with a healthy cash position of S$25.7 million. Additionally, the successful exercise of 179 million warrants by shareholders, including Executive Chairman Lim Chap Huat, injected an additional S$13.1 million into the company, further strengthening its cash reserves.

Expanding Order Book: Building for the Future

The recovery of Soilbuild Construction took place against the backdrop of a steadily growing construction industry in Singapore.

With a projected 2.7% CAGR from 2023 to 2027, the construction sector is driven by the government’s continued focus on infrastructure development and the private sector’s growing demand for commercial and industrial spaces. In fact, the industry has demonstrated a 4.3% year-on-year growth in Q2 2024, supported primarily by public sector output.

As previously mentioned, this positive industry outlook offers a fertile ground for established companies like Soilbuild Construction to thrive. Soilbuild’s A1 classification under the Building and Construction Authority (BCA) allows it to tender for projects of unlimited contract value, positioning it as a key player in public infrastructure and large-scale private developments.

In fact, Soilbuild Construction’s future growth is well supported by a robust order book that reached approximately S$1.25 billion as of August 2024.

This includes the construction project at Tuas Port with a contract value of S$647.5 million, the largest contract secured by the Group in its history, representing Soilbuild Construction’s growing prominence in the public sector.

Moreover, Soilbuild Construction’s increased focus on sustainability also aligns well with broader industry trends, as the demand for green buildings and energy-efficient solutions continues to rise.

The group’s involvement in projects like DB Schenker’s sustainable logistics facility reflects its commitment to environmental stewardship, a critical factor in winning future contracts as Singapore pushes toward a greener future.

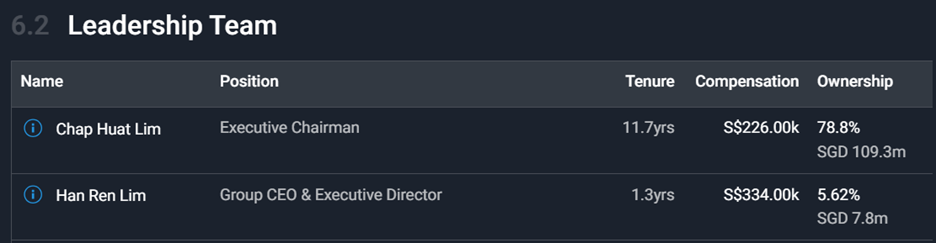

Experienced Leadership: The Engine Behind Success

One of the driving forces behind Soilbuild Construction’s turnaround is its experienced leadership team.

Executive Chairman Mr. Lim Chap Huat and CEO Mr. Lim Han Ren own a controlling 78.8% and 5.6% stakes, pointing to the fact that they are sticking in the company for the long haul. Under their leadership, Soilbuild Construction has strengthened its order book, enhanced project execution, and maintained a disciplined approach to cost management.

CEO Mr. Lim Han Ren expressed confidence in the company’s future and said (summarized) in its press release for 1HFY2024 :

“Our strong set of results reflects our team’s continual focus on operational execution and project delivery, and once again highlight that we are executing on our imperative to drive growth and profitability.

We made significant progress in strengthening our order book and with approximately S$1.18 billion of pipeline projects, it will improve revenue visibility and we aim to continue to drive efficiencies through our operating model and improve margins.

Building on this positive momentum, we will continue to focus on improving the quality of our growth with long-term commitments and larger-scale projects.”

On dividends, the Group seemed inclined to reward shareholders with dividends as well. With a turnaround for its FY2023 results, the Group announced a final dividend of 0.1 cents per share. And with improved financials for 1HFY2024, the Group has declared an interim dividend of 0.1 cents per share for 1HFY2024.

Conclusion: A Solid Investment in the Future

Soilbuild Construction’s turnaround journey is a testament to the company’s resilience, strategic leadership, and strong operational capabilities.

With that in mind, Soilbuild Construction presents a compelling case for delivering long-term value, underpinned by its diversified service offerings, robust financial health, dividend payout and commitment as a sustainable builder.

As Singapore’s construction sector continues its resilient and stable growth, Soilbuild Construction potentially offers shareholders not only attractive returns but also a stake in the future of Singapore’s infrastructure landscape.