Sinostar PEC Holdings Limited (SGX: C9Q) (“Sinostar”), one of the largest producers and suppliers of downstream petrochemical products within the Shandong Dongming Petrochemical Industrial Zone, announced an impressive set of 3QFY2020 financial results on 13 Nov 2020.

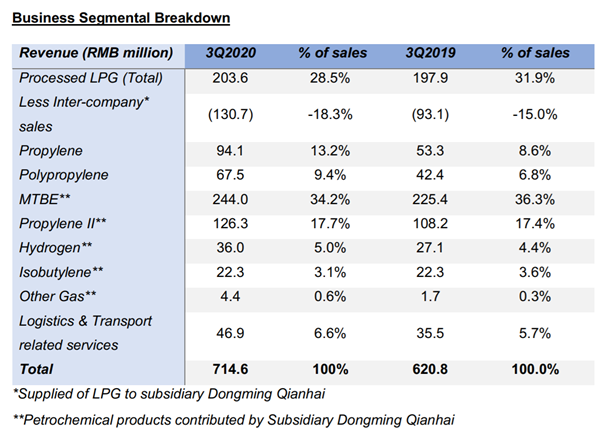

The Group’s 3Q2020 revenue increased 15% year-on-year from RMB 620.8 million to RMB 714.6 million. Gross profit rose 54% year-on-year to RMB 84.3 million mainly due to an increase in sales volume of the petrochemical products and an expansion in gross profit margins by 300bps to 11.8% in 3Q2020.

The breakdown of the different petrochemical products can be seen as per below:

Coupled with a drop in admin and finance expenses, the firm’s 3Q2020 net profits skyrocketed 99% from RMB 26.0 million to RMB 52 million. The Group also registered a 42% jump in net profits for 9M2020 on a year-to-year basis.

Business Outlook

According to its press release, Sinostar stands to benefit from the forecasted 8.2% GDP growth in China come year 2021. In addition, the rebound in economic activity and continual demand for protective surgical masks and related products have helped to drive the demand for individual products such as polypropylene (pp) fibre which is used in the manufacturing of these protective equipment.

Mr Zhang Liucheng, Chief Executive Officer and Executive Director of Sinostar PEC, commented,

“The Group is pleased with our third quarter performance, especially during such challenging times. China’s fast recovery is a boosted confidence for us. Nonetheless, we remain to be prudent in the management of our finances and investments.

We are excited for the completion of our new polypropylene production plant that will add on to the Group’s production capabilities. The team is not resting on our laurels, we hold onto our commitment of providing long-term value to our shareholders.”

Higher Capacity and Lower Costs

The firm is set to benefit from higher production capacity and lower production costs going forward.

The construction of the new polypropylene production plant, which has an annual production capacity of 200,000 tons/year, is in the final completion phase, and the Group is currently preparing for trial productions.

In conjunction with a combination of good cost control on construction and centralised bulk purchase of equipment for the new plant installations through working with its strategic partner Dongming Petrochem Group, the Group has been able to enjoy cost savings from the construction of the new polypropylene plant as it now expects the cost of construction to be much lower than the original budget of RMB 1.2 billion.

Based on its latest results, its trailing earnings per share comes up to around 4.29 Singapore cents. With that, Sinostar is only trading at a 3.26x ttm P/E ratio based on its share price of S$0.14.