Singapore stocks are known for their dividends. Investors usually buy Singapore stocks for dividend income. Buying dividend stocks helps to cushion investors’ portfolio in times of economic uncertainty.

Dividends also act as a form of passive income that can help to supplement your employment income. Here are 4 Singapore stocks with dividend yields of 5.2% or higher.

DBS Group Holdings

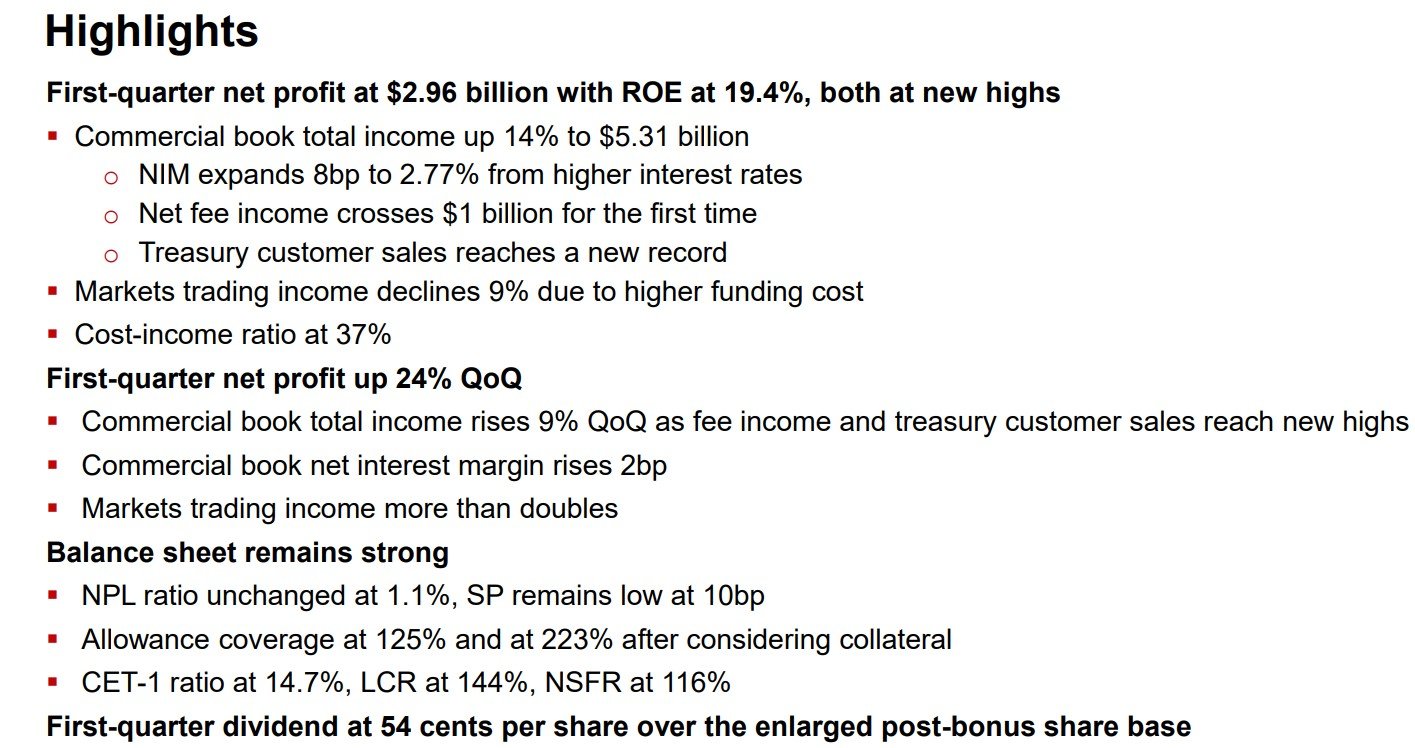

DBS reported record quarterly income and earnings for its 1Q 2024 financial results. First quarter net profit increased by 24% QoQ to S$2.96 billion. ROE is at 19.4%.

Balance sheet remains strong with NPL ratio unchanged at 1.1%. Allowance coverage us at 125% while CET – 1 ratio is at 14.7%. DBS declared first quarter dividend of 54 cents per share which translate to an annual dividend of 216 cents per share.

Based on current share price, DBS has a dividend yield of 5.77% which is more than 5.2% and is one of the 4 Singapore stocks that pay more than 5.2% dividend yield. You can view the bank website here.

Multi-Chem Ltd

I have written about Multi-Chem in my earlier article on 16 April 2024. You can read it here. The share price has since gone up by 33%. Those who have bought the shares is now sitting on good profits!

In its full year ended 31 Dec 2023, Multi-Chem reported revenue increase by 7% to S$658.4 million while net profit increase by 36% to S$27.1 million.

In addition, Multi-Chem has a very strong balance sheet with minimal borrowings and is in net cash position. Multi-Chem declared a final dividend of 15.5 cents per share bringing total full year dividend to 24.30 cents per share.

Multi-Chem will continue to focus on its best-of-breed products and will look out for opportunities for regional expansion. The Group will also promote the M.Tech brand name and intends to work closely with key partners to further promote the products.

This augurs well for Multi-Chem in the future and hence, will be able to maintain in paying increasing dividends. At current price of $2.86, it translates to a dividend yield of 8.4% which is even better than many REITs!

You can view the company website here.

Oversea-Chinese Banking Corporation

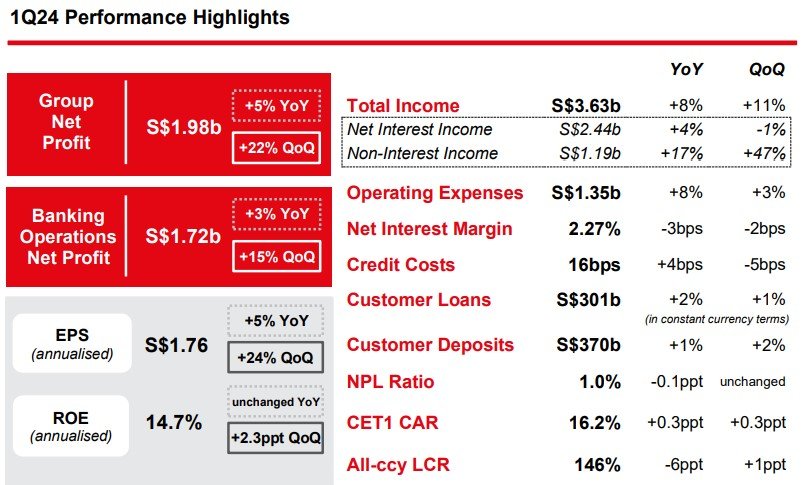

OCBC reported first quarter 2024 net profit rose by 22% from the previous quarter to a record of S$1.98 billion. Total income increase by 8% YoY to S$3.63 billion.

The Group’s resilient performance was driven by strict cost discipline and lower allowances. Income growth outpaced the increase in operating expenses, which drove an improvement in cost-to-income ratio to 37.1%, while credit costs decreased to 16 basis points.

Loans grew 1% and asset quality was sound with non-performing loan (“NPL”) ratio steady at 1.0%. The Group’s capital, funding and liquidity positions remained robust, providing flexibility to support business growth and handle uncertainties.

Return on equity climbed to 14.7% and earnings per share was higher at S$1.76, on an annualised basis. OCBC commented that the bank key markets in Asia are expected to be resilient, benefitting from increasing capital flows and supply chain diversification.

OCBC Group bank healthy balance sheet position provides the flexibility to manage uncertainties, and capacity for growth.

OCBC declared a total dividend of 82 cents per share for the full year ended Dec 2023 which translate to a dividend yield of 5.4% based on current price of $15.00. You can view the bank website here.

Singapore Telecommunications Ltd

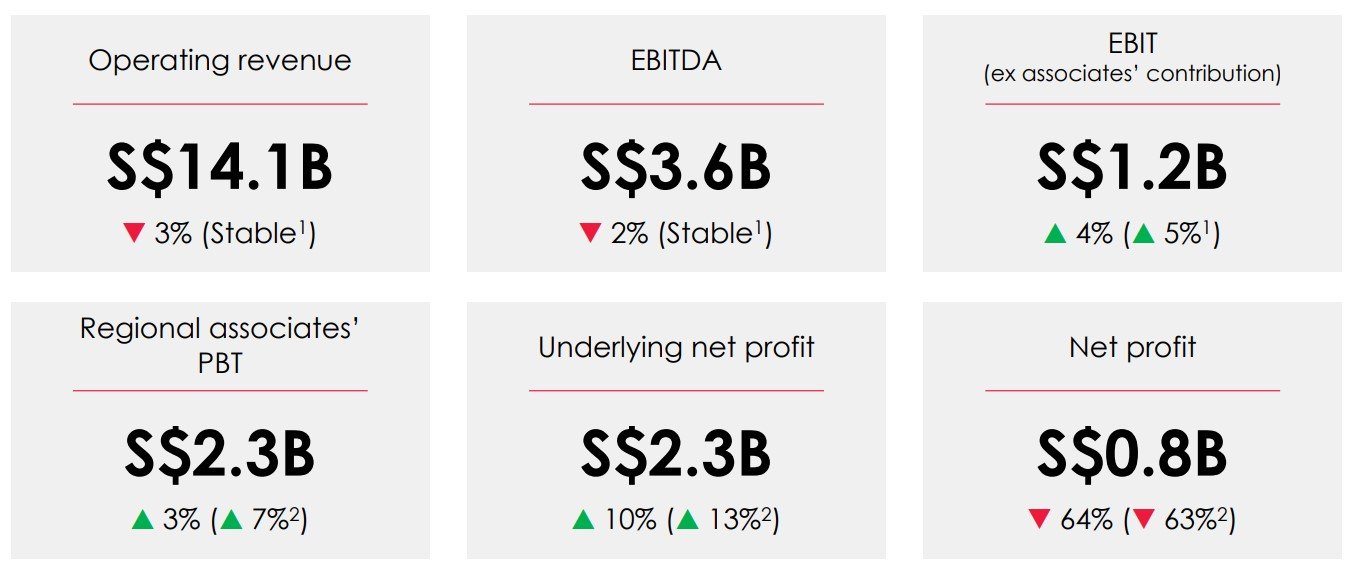

Singtel’s FY24 net profit was down 64% to S$795 million due to exceptional loss from non-cash impairment charges. Operating revenue was down by 3% to $14.1 billion while underlying net profit increased by 10% to $2.3 billion.

Singtel declared a final dividend of 7.9 cents per share including value realisation dividend of 1.9 cents per share. This bring total dividend of 15 cents per share for FY24 which translate to a dividend yield of 5.2%.

Singtel is committed to a dividend policy of 70% to 90% of underlying NPAT. In addition, Singtel introduced a new programmatic value realisation dividend of between 3 to 6 cents per share annually.

Conclusion

These are the 4 Singapore stocks delivering dividend yields of 5.2% or more. Investors need to do their due diligence before investing in any of these stocks.