Excerpts from CGS CIMB report

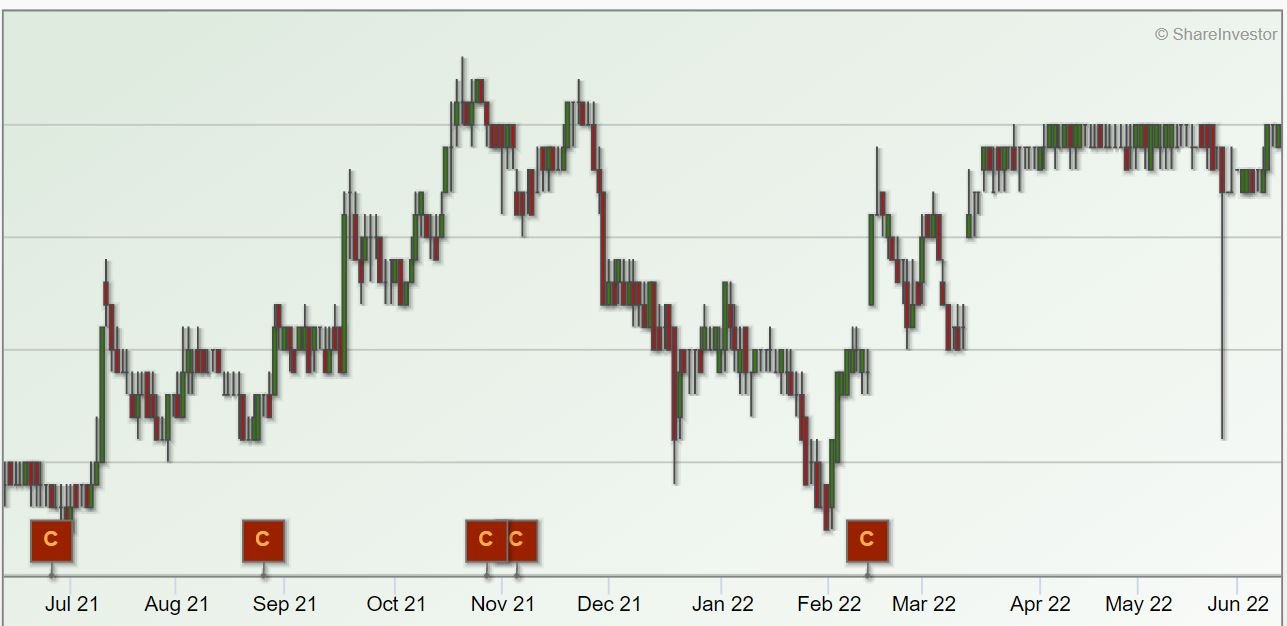

Silverlake Axis Ltd (SGX: 5CP)

- 3QFY6/22 core net profit of RM40m was below expectations due to elevated staff costs and business enhancement opex. GPM stable at c.58% in 9M22.

- Order win momentum sustained at RM97m in 3Q. Robust pipeline of deals of RM1.7bn. Secured backlog of RM450m provides earnings visibility for FY23F.

Reiterate Add with lower TP of S$0.40. We think SILV is poised to benefit from banks’ rising investment appetite as interest rate tailwinds set in.

Silverlake Axis 3QFY6/22 revenues missed expectations on elevated opex

Silverlake Axis’s core net profit of RM40.1m in 3QFY6/22 (-33% qoq, +3% yoy) was below our/consensus estimates by 20%/8% (9M: 69% of FY22F).

This is due to primarily heftier-than expected opex (+24% qoq, +32% yoy) owing to upfront costs related to group initiatives for internal improvement projects (e.g. upgrading finance system), business expansion and staff costs.

Additional staff costs (added c.100-150 headcount in 3QFY6/22 for contract delivery and business development and talent retention).

Nonetheless, revenues rose 22% yoy (-17% qoq) on the back of steady contract win momentum. Siverlake Axis (SILV) registered recurring revenue contribution of c.75% in 9MFY6/22 (FY6/21: c.82%).

It is still a comfortable ratio given that recent contract wins had larger licensing and implementation components. SILV’s gross profit margin was broadly stable at c.58% in 9MFY6/22 (FY6/21: c.60%).

We raise opex estimates from FY6/22F onwards to factor in elevated headcount costs and business expenses.

RM450m secured backlog provides earnings visibility in FY6/23F

SILV’s order win momentum continued into 3QFY6/22 with contract wins totaling RM97m. This brings YTD order wins to RM395m, markedly higher than the RM326m recorded in FY6/21.

This brings SILV’s secured backlog to RM450m – most of which will likely be implemented and recognised as revenue in FY6/23F. SILV has a robust deal pipeline of RM1.7bn, with a high probability of closure for RM157m of deals (final stages of negotiation).

We understand that SILV is also in discussions for a deal to integrate the core banking systems across several countries for a deal recently closed in SG as well.

Rising demand across region and products

While larger deals in recent months were driven by those in TH and ID, overall customer demand is picking up across the region and its other products as well.

For instance, SILV is looking to propose Mobius as an open source solution to its customer in PH. Fermion, its insurtech business, is gaining traction as well as it expands beyond motor claims and into fire, marine, and cargo insurance.

SILV reports that revenues delivered through cloud computing rose to 13% in 9MFY6/22 (from 6% in 9MFY6/21), which is encouraging.

Reiterate Add with slightly lower TP of S$0.40

We see scope for continued order win momentum as transaction volume in the region picks up, spurring appetite for digital solutions amongst banks.

Our TP is still pegged to 16x CY22F P/E (c.0.5 s.d. below mean) as we cut FY6/22-6/24F EPS by c.2% as we factor in higher opex. Downside risks are execution risks in rolling out Mobius on a large scale.

You can find the full report here and the company website here