Sheffield Green Ltd, a HR services provider for the renewable energy industry, has unveiled its financial performance for the fiscal year ending June 30, 2023.

For more information on Sheffield Green and its recent IPO, check out: Sheffield Green set to ride on the clean energy wave via a Catalist IPO Listing

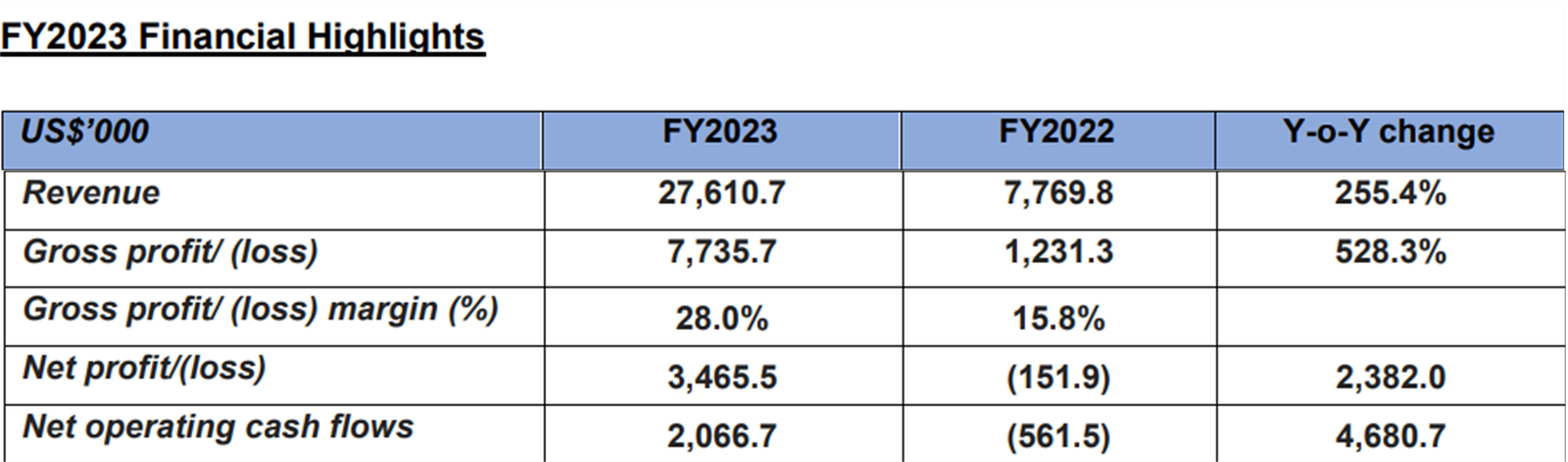

The company achieved a net profit of US$3.5 million, marking a significant turnaround from the loss of US$0.15 million in the preceding year. Gross margins also expanded from 15.8% to 28.0% during the same period – leading to a 528.3% Y-o-Y jump in gross profits to US$7.7 million.

This impressive growth is underpinned by a substantial 255% increase in revenue from US$7.7 million in FY2022 to US$27.6 million in FY2023, attributed to more contracts secured in the offshore wind industry.

The icing on the cake is the proposal of a final dividend of S$0.01 per share, less than 2 months after its IPO on 30 October 2023.

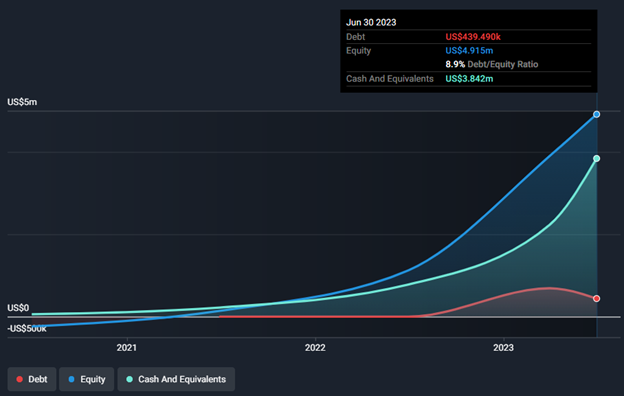

A quick look at its balance sheet shows that its debt/equity ratio stands at a paltry 8.9% so paying a dividend is no issue at all.

Navigating the Winds of Change

The company attributes its robust performance to the escalating demand for renewable energy initiatives, particularly in the offshore wind sector, where Sheffield Green holds a competitive advantage.

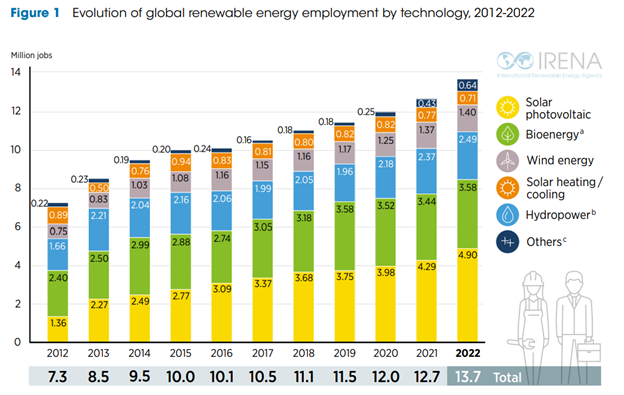

According to IRENA, employment in the renewable energy sector is expected to surge from 12.7 million in 2021 to 38.2 million by 2030.

After experiencing relatively flat spending between 2015 and 2020, investments in renewable energy, encompassing both private capital and public expenditure, increased significantly from USD 348 billion in 2020 to USD 499 billion in 2022, marking a substantial 43% growth. The majority of these funds were allocated to the solar and wind industries, with their collective share of total renewable energy investments escalating from 82% in 2013 to an impressive 97% in 2022.

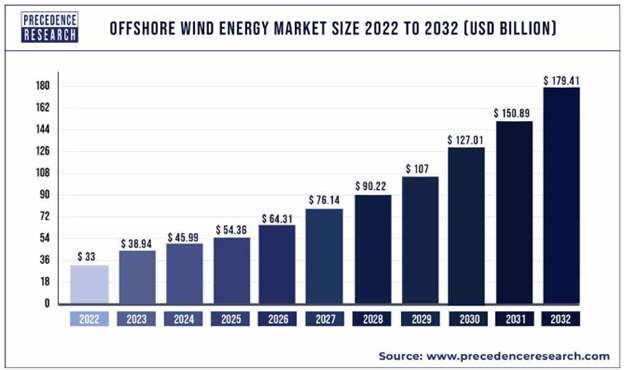

In addition, Precedence Research estimates that the offshore wind sector is projected to grow from USD 33.0 billion in 2022 to USD 179.4 billion by 2032.

Hence, the company’s primary focus on offshore wind projects is well-timed, as the sector’s expansion is anticipated to catalyse substantial job opportunities in the renewable energy industry in the long run.

Company’s Growth Momentum

In its press release, the Group shared several initiatives to capitalise on these thriving industry trends namely:

- Offering comprehensive human resource solutions

- Sourcing for diverse roles from C-suite to technical and offshore crew positions

- Provision of ancillary services such as meticulous handling of visa and work permit applications

To further strengthen its regional presence, the Group is strategically expanding into other international markets by establishing local offices. Notably, the Poland office commenced operations in November 2023, and plans are underway for the establishment of a US regional office in Boston.

Building on the success of its training centres in Taiwan, the Group envisions opening more training centres in markets like Japan and Poland to meet the escalating global demand for renewable energy personnel.

Bryan Kee, CEO of Sheffield Green, conveyed confidence in the FY2023 results with these comments:

“Reflecting on this transformative year, I am immensely proud of our team’s achievements. Our success in FY2023 is a direct result of the team’s relentless commitment, adaptability, and innovative strategies in the renewable energy sector.

Despite the challenging economic environment, we have not only managed to achieve significant growth but also enhanced our operational efficiencies and strengthened our market position. This success is a testament to our dedicated team and the solid partnerships we have fostered. We are excited to continue this momentum and further our mission of powering sustainable energy solutions.”

Peer Valuations

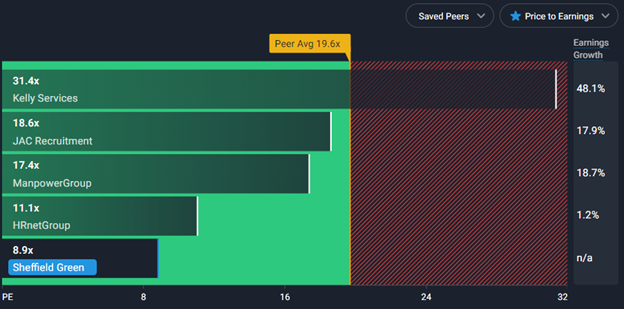

Based on the peer valuations chart above, Sheffield Green is trading at a relatively cheaper valuation compared to its global listed peers. The company has a price-to-earnings ratio of 8.9x, which is significantly lower than the industry average of 19x.

Some of the more renowned staffing players such as Manpower Group, Kelly Services and Singapore’s own HRnet Group have much higher P/E ratios of 17.4x, 31.4x and 11.1x respectively.

On top of that, Sheffield Green’s competitive edge in the renewable energy sector may be a stronger growth driver for its earnings going forward. This means that the company may be an attractive investment opportunity in the renewable energy staffing industry.

Conclusion

The Group’s strategic penetration into flourishing offshore wind markets in Taiwan, Japan, and Poland, coupled with its emphasis on workforce development, underscores its strong investment potential amid the burgeoning opportunities in the renewable (offshore wind) energy sector.

Be sure to ‘catch the wind’ as the Group navigates and capitalises on the rising momentum of renewable energy staffing solutions!