Have you ever wanted to invest in UK prime properties but scared to commit a minimum 5-figures at one go?

Fret not! Now you can do so with Shareable Asset – a fintech player which allows investors to fractionally own institutional-grade real estate assets through a blockchain-enabled Real Estate tokenization platform.

After the successful round of fundraising of its first real estate project, more than one week ahead of deadline, the successive deals with high quality assets are expected to accelerate to USD 20 to 30 million in 2020 with several renowned partners in the global real estate field.

What is Shareable Asset?

Shareable Asset is the first-of-its-kind in the market to allow retail investors access to fractional and affordable ownership in institutional-grade real estate which were previously only available to accredited high net worth investors.

The tokenization of assets allows the subdivision of expensive real estate investment into fractional ownership, enabling retail investors to own a portion of an asset, starting from a minimum of GBP100 (SGD174), while earning returns similar to purchasing the full asset.

The above shows the whole ecosystem of how its blockchain technology will facilitate block trading between asset providers and retail/institutional investors, with Shareable Asset in the centre.

With that, Shareable Asset are able to derive 3 main strengths from the blockchain technology:

- Simplicity – making Real Estate Investment as easy as using E-commerce

- Liquidation – Provide exchange tradable security tokens and those tokens can be solely and directly managed by investors

- Granularity – Provide any size of Real Estate assets through fractional ownerships

3 Major Differences Versus REITS

SA aims to tokenize assets worth between US$20 million and US$30 million in 2020 and provide investors with returns similar to or better than what they can get from real estate investment trusts (REITs).

And there are 3 factors that Shareable Asset differs from REITs:

-

Costs

The 1st thing that attracted me to the platform is that all rental income for Shareable Asset would go directly to the investors since it is a direct shared ownership structure.

Investors only have to pay an annual recurring platform fee of between 0.25% – 0.5% depending on the asset value. But for REITs, a part of those rental income goes to management fees, divestment and acquisition fees before trickling down to unitholders.

-

Direct Legal Ownership

While investors only own a fraction of the property — perhaps 1% to 15% of it — they are the legal owners of the asset. This means they have better control over what happens to it such as refurbishments and renovations, compared with ownership via a REIT.

-

Lower Volatility

A share in the Shareable Asset represents physical ownership of property. It is less volatile as the value of the property doesn’t fluctuate on a daily basis, but revalued once annually.

This is in contrast with REITs where prices go up and down every day based on the collective investor sentiment.

Is Shareable Asset Licensed and Trustworthy?

As an investor, it is always better to be careful than sorry when there are so many fintech players like robo-advisors etc.

On that front, Shareable Asset is regulated by the Monetary Authority of Singapore under the Capital Markets Services (CMS) licence awarded in April 2020.

The CMS licence allows for tokenization of real estate and fractional ownership is represented by issuance of security tokens using blockchain technology.

You can check their MAS license details like their office address and number here: https://eservices.mas.gov.sg/fid/institution/detail/231415-SHAREABLE-ASSETS-PTE-LTD.

In addition, Shareable Asset has already successfully closed its first deal from retail investors.

Here are some important highlights of the deal according to PropertyFindsAsia.com:

- Fundraising target was successfully achieved 1 week in advance of the original deadline after positive response from investors from a few countries.

- The successful completion of this investment round paves way for Shareable Asset’s potential to pivot itself further in the global real estate investment market, of which the successive deals are expected to accelerate to USD 20 to 30 million in 2020 with several renowned partners in the global real estate field.

Last but not least, Shareable Asset is backed by robust regulatory standards and the integration of government-enabled service MyInfo. Over 5,000 investors have taken advantage of the ease of opening an account and the ability to invest in global real estate projects through a mobile platform.

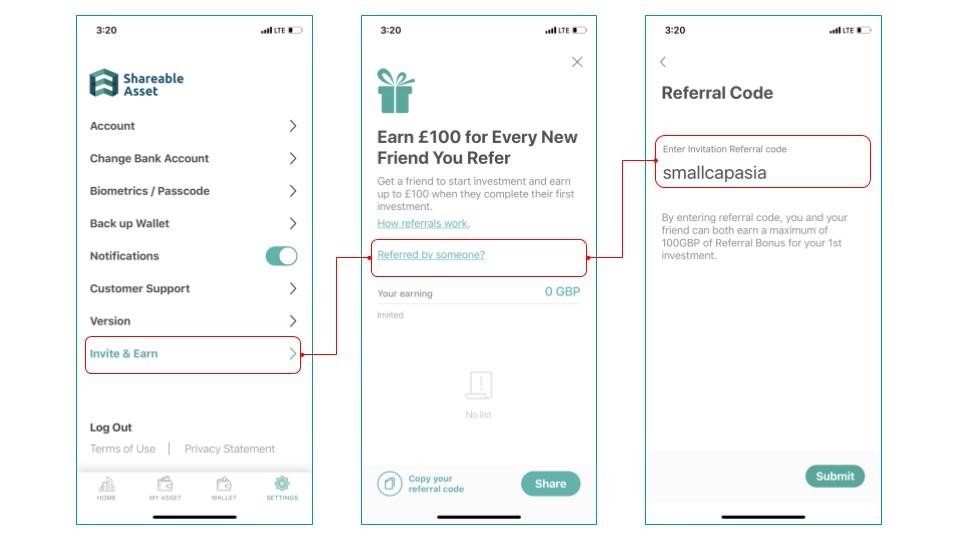

How to Sign Up?

The good part about fintech is that the whole signing up process becomes a breeze.

Here are the steps to follow when you want to get started with Shareable Asset:

- Download the “Shareable Asset” app on your mobile and register to sign up.

- Confirm your email registration address and insert a safe-pin to protect it.

- Before you invest, you would also need to verify your identity. You can do it via MyInfo – a Singaporean initiative. Take a selfie and provide your passport and proof of address, all securely online. The verification of your account takes 1 to 3 business days, and you will receive notification updates about your account status.

- Following which, you will be asked to do a KYC form with 9 straightforward MCQ.

Upon receipt of the KYC clearance, you will be asked to select the properties that you are interested to invest in.

The snapshot will provide detailed information that you need to know as an investor such as the location, tenure, leasehold and net yield rent.

You will then choose how much money you want to invest (can be as little as GBP100) in each of the properties you select.

A Look inside SA App’s User Interface

Want a sneak peek inside Shareable Asset’s app before kickstarting your process?

Check out their App’s sleek interface below:

Any deals would be situated in the “Home” button and your investments will be displayed under “My Asset”. In fact, Shareable Asset has initiated 2 deals as of 14th August 2020 with one of them already receiving 57.8% of the property’s target raise (at the time of writing).

Excited to get started? Check out my Too Long, Didn’t Read conclusion…

TLDR Conclusion: Property Investing with Little Money Down Made Easy

To sum up, Shareable Asset (SA) provides a convenient way for investors to diversify into physical real estate with low starting capital.

If you are keen in UK’s student accommodation and would like to get started with a small amount, Shareable Asset is probably the best and only platform for you right now.

Plus, there is a limited time offer not to be missed! You will receive 5% investment credits when you top up funds in the SA app from 12 – 18 August 2020. Click here to get started!

Read also: https://www.smallcapasia.com/how-to-invest-in-real-estate-for-as-low-as-100gbp/

Disclosure: This post contains affiliate links and is written in collaboration with Shareable Asset. All opinions are that of my own, based on my experience with Shareable Asset.