to download this FREE guide for future reference!

We are all familiar with Initial Public Offerings (“IPO”) because it is the normal route for a private company to ‘become listed’ in the stock market.

But what about existing listed companies which want to raise additional funds by issuing new shares?

There are usually 2 ways to do so – a private placement and rights issues. The former is typically catered for institutional/high net worth individuals through a private offering. On the other hand, a rights issue refers to an offer for existing shareholders to purchase additional shares at a (usually) discounted price.

For the sake of many retail investors who ‘sees stars’ when you see a document letter announcing a rights issue, fret not!

In this article, we will take a deep dive into the nuances of a rights offering using Watches.com Ltd (SGX: WVJ) as an example.

Why do companies issue rights?

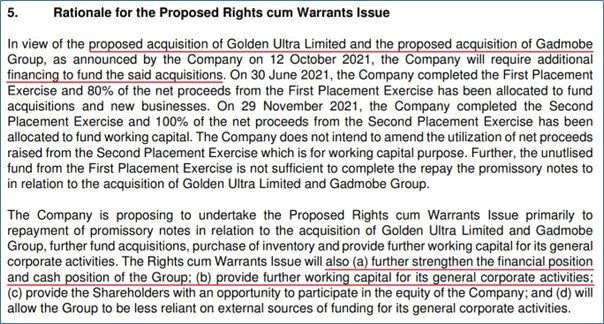

Before we even go into the details, we need to understand the rationale of the rights issues.

In general, the money raised from rights issues is used for corporate expansion or a large takeover of another company aka mergers & acquisitions (M&A). The other common reason is that companies want tap on the rights issues to shore up their financial position.

For Watches.com Limited, it is using the additional funding to acquire 3 new businesses – Watches.com, Golden Ultra Limited and Gadmobe to pivot to the lucrative online watch industry.

Understanding Rights Issues

A rights issue is where a company gives all its existing shareholders the right to subscribe to additional shares.

On top of that, each rights issue comes with a detailed announcement from the company concerned, spelling out how the money raised will be used, the exact process behind how it will work, and a timetable of key dates.

A 15:1 (“fifteen for one”) rights issue means an existing investor can buy fifteen extra shares for every share currently held. The price of the newly issued shares is fixed, and is always set below the prevailing market price at a particular date.

Two types of Rights Issues

This is something that investors may not be aware of – there are two types of rights issues 1) renounceable and 2) non-renounceable.

Renounceable rights mean that you can sell off (tradeable) your entitled rights on the market if you do not want to purchase it. The person who buys your rights will be able to pay for the rights and receive the mother shares.

On the other hand, a non-renounceable rights issue does not allow the rights to be traded and your rights will expire if you do not subscribe to it.

Example of how Rights Issues work

Once again, we will use Watches.com Ltd to work through the flow. Below are 2 screenshots highlighted for Watches.com’s Ltd rights issue exercise:

Say you hold 100,000 shares of Watches.com Ltd. The market price of the shares is S$0.021 and the company then announces a “one for fifteen” rights issue. The subscription price for the rights issue is set at S$0.01.

The value of your holding before the rights issue was:

100,000 shares at S$0.021 = S$2,100

Now it’s up to your discretion to take up 100%, partial or even none of the rights on offer and we will list the scenarios below:

Taking Up the FULL Rights Offer

If you took up all your rights, you would purchase 1,500,000 new shares at a price of S$0.01. The total amount of money summed up is:

1,500,000 shares at S$0.01 = S$15,000

A few weeks after the announcement, the original shares will become what is known as “ex-rights” or showing the “XR” remarks beside the stock code. This means that anyone who subsequently buys the mother share doesn’t have the right to participate in the rights issue.

At this point, the value of the original shares will reflect the discount given for the rights shares. You can estimate it by calculating what is known as the theoretical ex-rights price.

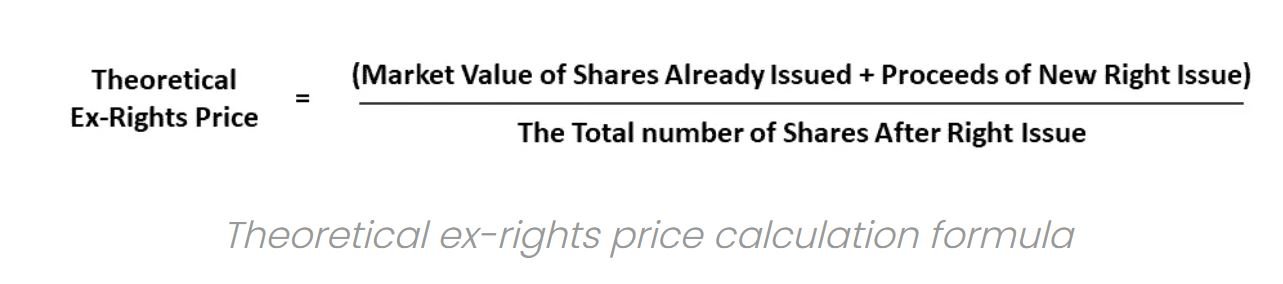

Calculating the Theoretical Ex-Rights price

The theoretical ex-rights price is usually provided in the document but investors typically still want to know how to calculate it themselves.

So, lets go through it how to compute the theoretical ex-rights price (“TERP”), using back the previous numbers:

Woah, it sounds so complicated and a lot to take in!

Do allow me to simplify it further…

TERP = Total value of investment / Total number of shares post rights

= (S$2,100 + S$15,000) / (100,000 + 1,500,000)

= ~S$0.0107

You can see that its just summing up the money you have to fork out at the record date; divided by the total number of shares you will get.

However, as it implies, this is just the theory of what price the rights will trade at.

Rights Timetable

Many people tend to be shocked due to the short time frame to apply for rights shares, typically within 1-2 weeks.

You can check the record date and timetable of key events via the company’s circular/website or the SGX-ST’s website https://www.sgx.com.

Below is the timeline based on the record date (D) – the date by which investors must be on the company’s books to be entitled for the rights issue.

Allow me to further illustrate on the timetable below along with some hypothetical dates:

- (D on 23 May 2022) The Stock Cum Rights (CR) phase is usually around 3 market days where the documents will be despatched to the shareholders.

- (D + 3 on 26 May 2022) Next is the window phase for the trading of Rights. It will last for around 6 working/market days; this is the period where you can trade or buy more Rights and convert to shares

- (D + 9 on 3 Jun 2022) After the last trading day of nil-paid rights, CDP will usually take some time (4 BD) to process the money and application.

- (D + 13 on 9 Jun 2022) Last day for forms acceptance: The converted rights will be debited to CDP account

The listing of warrants (if any) will happen around 2 business days after the whole flow above is executed.

Investors should be mindful of the risk where the mother share will trade below the rights price during the trading of nil-paid rights.

How to Apply and Subscribe for Rights Issue

The process of applying for a Rights Issue is pretty similar to an IPO application and investors should know that time is of the essence too.

Here is a good flow of how to apply for the rights via the local bank ATM (we will use DBS ATM as an example):

(i) Before you start the ATM application process, ensure you have the following:

- Documents from CDP you have received

- CDP account number and bank account number linked to the ATM card.

(i) Head over to any ATMs and perform the below steps:

- Select “More Services” followed by “ESA-IPO / Rights Appln / Bonds / SSB / SGS / Investments and “RIGHTS APPLN”.

- Follow the on-screen instructions to apply for Rights Offerings such as your CDP account number and number of rights you want to apply for.

- If you wish to apply for excess rights, select ‘Yes’.

- If you wish to apply for Rights Share and Rights MBC, you will need to perform 2 separate transactions at the ATM.

Note: If you have bought the mother stock from Supplementary Retirement Scheme (SRS) and CPF Investment Account (CPFIA), you will get notified via hard copy letter which will be mailed to the address registered with the bank.

This notification letter is usually sent within 6 business days after the record date. Another important thing to note is that you will have to use the same fund source to apply for rights. This means that if your shares were purchased with SRS, you can only subscribe to a rights issue via your SRS funds.

You can find out more details on how to use CPF to subscribe for the rights here.

Potential Upside from Trading Rights Issues

In the example above, buying the rights is a call option granting us the right to buy the mother shares again.

Sourced from learnbusinessconcepts.com

We can then use another calculation to see where the rights should be trading at all things being equal.

(Premium) Value of the Rights = TERP – Right Issue Subscription Price

= S$0.0107 – S$0.01

= S$0.0007 (~S$0.001)

This would give us an indication that the rights should trade at a premium of S$0.0007 or S$0.001 (because that is the smallest denomination in SGX).

Here’s an example of a P&L calculation assuming the share price goes up to S$0.02.

Going back to our previous example; you own 100,000 shares of Watches.com and subscribe for the 15 rights allotted (1,500,000 shares) for a total investment of S$17,100.

If the share price goes up to $0.02, your profits would be as calculated:

$0.02 * 1.6 mil shares – $17,100 (investment) =

$32,000 – $17,100 = $14,900 (a handsome 87% return!)

By and large, the rights price fluctuates based on Watches.com’s current share price. So traders can simply buy or sell the rights in order to try and profit from a reversion to the mean trade.

Your rights are usually tradeable in the open market under a separate ticker for example Watches.com Ltd R or SGX code WVJR. This indicates that you can buy and sell them through a broker, just like you can with ordinary shares.

Impact to the firm’s Financials after a Rights Issue

With more new shares coming onto the market, the total shares outstanding increases.

This will affect “per share” calculations like earnings per share (EPS) and dividends per share (DPS) because the same profits are now divided by a much larger base of shares now.

During the release of financial results post-rights issue, the previous year earnings and dividends per share data are usually adjusted to reflect the increased number of shares in issue, ensuring the figures are comparable.

Additional things to take note

As rights issues may require you to buy new shares, you need to be able to come up with the additional cash to participate to avoid share dilution.

One other complication that can occur is when the share price in the market drops below the subscription price in the rights issue. In this case, it’s not worth participating as it would be cheaper to buy shares in the market.

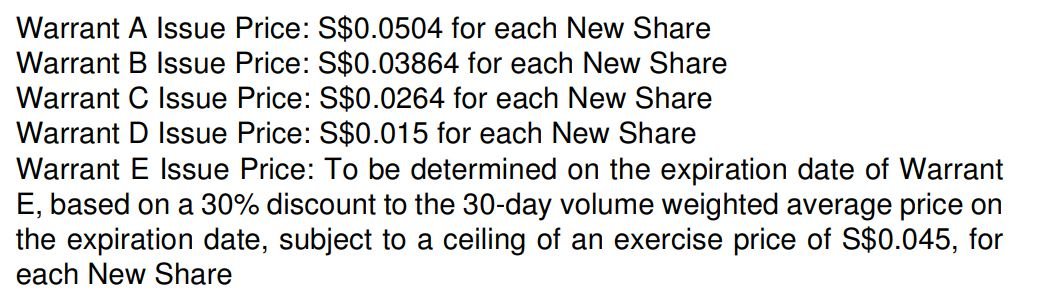

Lastly, companies can sometimes throw in a deal sweetener – free warrants on top of the rights issue.

In the case of Watches.com Ltd, they are offering a total of 10 free warrants (2 warrants each) at various exercise prices as seen above.

For instance, this means that once the mother share price increases above S$0.015, you can then exercise the right to buy the share at S$0.015 and sell it to pocket the difference!

Final words

While rights issues can be a tad confusing, understanding how it works can allow you to see what others can’t and potentially make a handsome profit from the trade.

All in all, investors should weigh up each rights issue on its own merit, as well as their own risk profile.

to download this post for reference esp. when your stocks go on Rights Issue!