The ASEAN region, like the rest of the world, has seen a significant boom in the digital economy thanks to the rapid adoption of digital technologies and services by consumers and businesses during the COVID-19 pandemic.

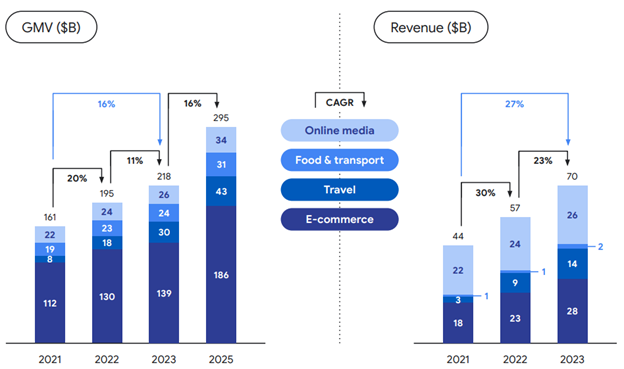

According to the e-Conomy SEA report by Google, Temasek, and Bain & Company, Southeast Asia’s digital economy exceeded US$190 billion in gross merchandise value (GMV) in 2022 and is expected to grow at double digits to reach U295 billion by 2025.

Digital adoption continues to rise post-pandemic, with key sectors such as e-commerce, transportation and food, travel and online media fueling this growth.

On this note, monetization has gained momentum across the region over the last two years where the region’s revenue is expected to grow at a rate 1.7x higher than that of GMV. The emphasis on monetization is motivated by the quest for financial sustainability and improved unit economics across various sectors.

Multiple growth drivers to foster swift adoption

According to the Bloomberg 2021 report, ASEAN possesses the world’s most rapidly expanding mobile wallet market. The upswing in cross-border trade over the past decade has played a pivotal role in driving the adoption of digital payments.

Historically, cross-border transactions were linked to high costs and prolonged processing times. However, digital payments have now emerged as a convenient and efficient solution to overcome these challenges.

In fact, a recent global study, conducted in partnership with Juniper Research, predicts a staggering 311% growth in the number of mobile wallets used across Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam from 2020 to nearly 440 million by 2025.

A PWC report also shared about how “consumers are swiftly embracing digital financial services, signaling a shift away from the era where cash reigned supreme”.

According to a recent report by Google, Temasek, and Bain & Company, digital payments now constitute over 50% of transactions in the region.

In certain areas like Southeast Asia, the prevalence of digital payments through e-wallets has already surpassed physical card payments and is poised to become the predominant method across point-of-sale systems overall,” noted Dan Jones and Alex Walker of OliverWyman.

As technology continues to reshape the financial landscape, ASEAN nations are also embracing innovative solutions to cater to the evolving needs of consumers and businesses alike.

For instance, to support the development and integration of digital payments in the region, 5 ASEAN central banks – Bank Indonesia, Bank Negara Malaysia, Bangko Sentral ng Pilipinas, Monetary Authority of Singapore (MAS), and Bank of Thailand – have signed a cooperation agreement to establish an interoperable cross-border payment system that will allow instant and seamless digital transactions across ASEAN countries.

The system will use QR codes as a common standard for digital payments, enabling users to scan and pay with their preferred mobile wallets or apps. The system will also facilitate remittances and e-commerce transactions, as well as reduce the reliance on cash and the U.S. dollar.

Tapping on the digital payments’ revolution

As the ASEAN digital payments industry continues to flourish, savvy investors are eyeing opportunities to benefit from this upward trajectory.

One way is to invest in the companies who have secured digital banking licenses in Singapore to provide banking services entirely online, without any physical branches.

As of 2023, there are 4 digital banks in Singapore:

· GXS Bank (consortium backed by Grab Holdings and Singtel)

· MariBank (owned by SEA Limited)

· Anext Bank (backed by Ant Group – Alipay)

· Green Link Digital Bank (consortium involving Greenland Financial, Linklogis Hong Kong, and Beijing Co-operative Equity Investment Fund Management)

Digital banks help to streamline tedious financial processes and offer various advantages for customers and merchants, such as convenience, efficiency and cost-effectiveness.

For example, GXS Bank, a consortium backed by Grab Holdings and Singtel, leverages its existing ecosystem of ride-hailing, food delivery, e-commerce, and mobile payments to offer seamless and integrated banking solutions for its users and partners.

Green Link Digital Bank, backed by Greenland Financial Holdings, intends to use its experience in real estate, logistics, and trade finance to offer cross-border payment and lending solutions for SMEs in Singapore and China.

Another direct way that investors can tap on the digital payment revolution is through Oxpay Financial, a payment solutions provider that offers online and offline payment services in Singapore and abroad.

Oxpay Financial operates a payment gateway platform that connects merchants with various payment methods such as credit cards, e-wallets and bank transfers. Given its presence in the 4 ASEAN countries Singapore, Malaysia, Indonesia, and Thailand, Oxpay emerges as an attractive investment option for those seeking exposure to the growing digital finance market in ASEAN.

You can read more about Oxpay Financial’s tie-up with GLDB here.

Conclusion

With the ASEAN digital banking and payment systems industry undergoing a remarkable transformation, Oxpay Financial, with its innovative solutions and strategic approach, stands out. Oxpay Financial is poised to play a pivotal role in shaping the future of digital payments in ASEAN.

The shift towards digital payments in ASEAN is not just a fad; it’s a structural shift fueled by technological advancements and changing consumer behaviors.

As the financial landscape continues to evolve and digitalise, this trend will create many promising investment opportunities for those looking to capitalize on the digital finance boom in the ASEAN region.