Yummy… Finally Ichiban Sushi’s parent company (RE&S Holdings Limited) is going to join the likes of Japan Foods, Sakae Sushi, Katrina Holdings to be listed.

A heads up, you can find its offer document here and product highlight sheet here.

Is RE&S IPO a delicious one for investors? Let’s check out 5 things you need to know about RE&S IPO below:

1. RE&S IPO Profile

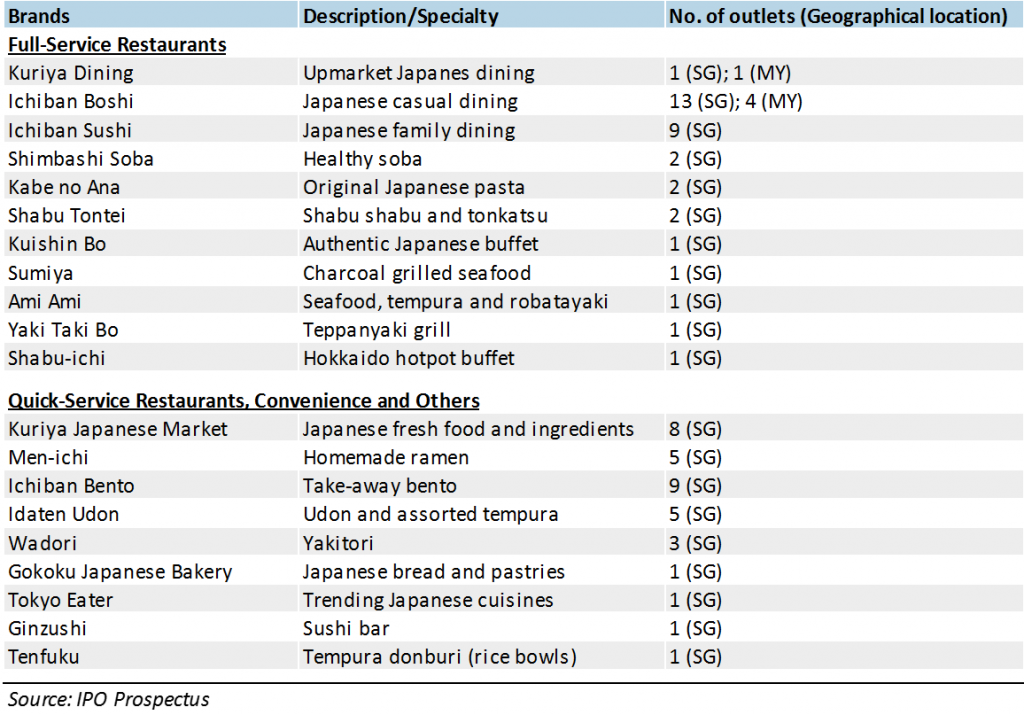

Check out their brands for Full | Quick Services restaurants…

What’s

The allure of a free $20 voucher is so much despite you spending $200 for it. Joking

2. IPO Details

So back to business: RE&S is offering 38m shares at $0.22 each and this is split into

- 3 million shares offered to the public

- 35 million shares will be for institutional investors.

With that, the market cap based on the IPO price is around $78m.

Investors should note that Orchid 2 Investments (under Temasek Holdings) is the sole cornerstone investor. It has subscribed for another placement of 6m shares at 22 cents a piece and will have a 4.5% stake in RE&S’ post-IPO capital.

Application for the subscription of shares will close on 20 Nov 2017 at 12pm, and trading of shares will commerce on 22 Nov 2017, 9am.

3. Use of Proceeds

The Group aims to raise net proceeds of about $10.4 million. The use of proceeds will be as follows:

I like how the company is going to use majority of the proceeds for biz expansion (70%). In actual fact, it seems that the quick-service restaurants segment is what the company is heading for as per below. Another 3 things they can do are:

- Selective opening of restaurants in Malaysia

- Franchise opportunities

- Expansion through acquisitions/JVs/alliances (Jumbo Group has done quite well in this aspect)

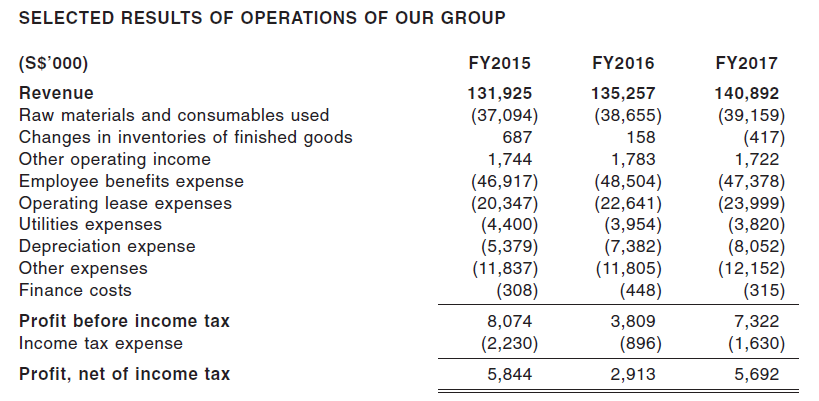

4. Financial Highlights

For its past 3 years, revenue has gained by 6.8% from S$131.92 million in 2015 to S$140.89 million in 2017. However, whatever gain in the top-line has been offset by the increase in the expenses namely:

- Higher raw materials

- Higher operating leases (rental costs)

- Increased Depreciation Expense

- Other expenses (delivery, cleaning, repair costs)

In fact, RE&S is operating in a competitive environment as shown by their consistent 4+% profit margin. It is facing higher furnishing costs, higher rental and even high cleaning costs.

What this means is that the company has to lower their costs dramatically in order for their expansion to bear fruit to the bottomline too.

As for its dividend policy, RE&S intends to distribute dividends of not less than 35% of their net profits to their shareholders in FY2018 & FY2019. With its current earnings, dividend yield will be around 2.5%. Not so shabby, but difficult to grow it if they wish to utilize the cash to expand the biz.

5. Peer Comparison

We are lucky that POEMs came up with a comprehensive report on the RE&S IPO and i found the peer comparison part rather intriguing.

At one glance, we can see that RE&S is under-performing in terms of a few aspects:

- Net margin 4% compared to Japan Foods of 7.1% and Jumbo Group of 11.3%

- Net Debt/Equity of 50+% when most of them are Net Cash

- Sales growth of 4.2%

On the bright side, it will trade at a much cheaper P/E of 13.75x and relatively higher ROE of 18% (if you exclude Kimly Ltd & Jumbo from the average).

Our Take on RE&S IPO

Overall, we are excited about this IPO for its flipping potential but neutral on its long-term potential. Our thoughts are as follows:

For flipping: Good

RE&S Holdings is a brand synonymous with premium Japanese cuisine in Singapore. Its cheap price ($0.22) & low P/E valuation also means that it is likely to jump up on the IPO debut.

Last but not least, there are only 3 mil shares for grabs, equivalent to only $660,000. I think a few retirees can almost snap up everything already!

For long-term holding: Neutral

I feel that Singapore is too saturated for any F&B operator due to the ever-changing tastes of Singaporeans (think the Ah Ma egg cake – no more long queue after 3 months!).

Thus, RE&S may have a bright future if they can expand aggressively in other countries through the franchise model or acquisitions. That said, they may rack up higher costs as there is no central kitchen overseas and also full of other challenges.

We’ve released our 3 HOT growth stock picks which could skyrocket >100% by the end of 2017. History has shown that getting in early on a good idea can often pay big bucks – so don’t miss out on this moment.

Simply click here to receive your copy of our brand-new FREE report, “3 stocks poised for explosive growth”.

Do Like us on Facebook too as we share the latest investing articles and stock ideas for you!