Excerpts from UOBKayHian report

Raffles Medical Group (SGX: BSL)

- 2022 profit margins expanded due to strong performance from the Healthcare Services segment

- Raffles Medical is facing a global shortage of healthcare workers

- TCFs will continue to contribute in the near term

- Increased contributions are expected as China operations pick up steam.

With tailwinds and currently trading at attractive valuations, we maintain BUY. Target price: S$1.90.

Outperformance from Healthcare Services

Despite tapering COVID-19-related activities, Raffles Medical Group (RFMD) noted that the increase in 2022 profit margin for the Healthcare Services segment was led by better operating leverage due to higher volume of operations in 2022.

However, the group expects margins to taper off to historical norms moving forward. This is in line with our expectations. RFMD had an exceptionally high margin of 63.1% in 2022 due to annual cost savings of S$67m yoy.

With domestic inflationary pressures and a shortage of nurses in Singapore, we expect staff costs to inch back up to the historical average of 50% from 45%.

Raffles Medical is coping with inflationary pressure

Facing a global shortage in healthcare personnel coupled with salary inflation, RFMD believes that the group will face inflationary cost push

moving forward.

This is in line with expectations and we believe the implemented price increases in 2022 will help to mitigate the expected increases in manpower costs.

Also, in our view, with the tapering of some lower-margin COVID-19 services, better operating leverage and cost efficiencies, a more favourable revenue mix may help soften the decline in margins.

TCFs still as important

Shareholders raised queries about the growth prospects of RFMD’s transitional care facilities (TCF), with the group stating that TCFs continue to assist the government in freeing up space in public hospitals given the ongoing bed crunch.

With the Singapore government’s renewed focus on TCFs, RFMD mentioned that TCFs could continue to play an important part in Singapore’s healthcare system but also shared that TCFs were not a targeted growth area.

This was expected as, from our standpoint, TCFs still face a regulatory risk whereby the government may deem them redundant.

However, Singapore’s health minister mentioned that TCFs would be retained and become “a medium- or even long-term feature of our healthcare system”, making the redundancy of TCFs unlikely.

Although COVID-19 has become endemic in Singapore, TCFs still function as step-down care facilities which play a vital part in the domestic healthcare system.

Furthermore, with an upcoming TCF tender in the west, winning the tender to operate a second TCF would help boost RFMD’s 2023-24 net profit significantly, given that the current TCF contributes around 35% of 2022 operating profit based on our calculations.

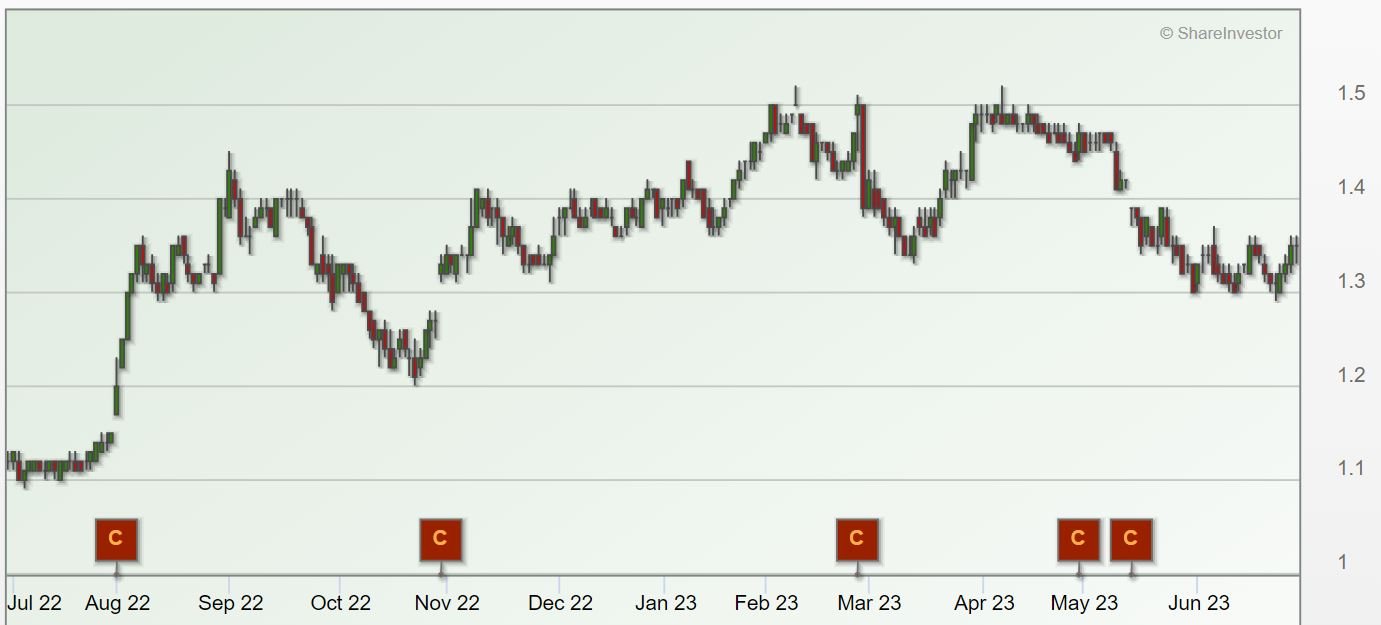

Raffles Medical Valuation

Maintain BUY with an unchanged PE-based target price of S$1.90, pegged to an unchanged 26x 2023F PE, -0.5SD to RFMD’s long-term average mean PE.

Backed by favourable tailwinds, we like RFMD for its cheap 2023F PE valuation (18.2x) compared to regional peers (35.4x).

You can find the full report here and the company website here.