First REIT is one of the few healthcare REITs listed in Singapore with an asset size of S$1.15 Billion as at 31 Dec 2022.

Its portfolio comprises of 32 properties with the following:

- 11 hospitals

- 2 integrated hospital & malls

- 1 integrated hospital & hotel

- 1 hotel & country club in Indonesia

- 3 nursing homes in Singapore and

- 14 nursing homes in Japan

First REIT has released its FY 2022 results on 13 Feb 2023 and here’s some key highlights that you should know.

First REIT FY2022 Results’ Key Highlights

Rental and Other Income increased 8.7% Y-o-Y to S$111.3 million due to the maiden contribution from 14 Japan Nursing Homes acquired in March and September 2022.

This crucial move also shifted their ‘developed markets’ portfolio allocation to 27.9% of AUM, putting them on track to meet its target of 50% by 2027.

On the flip side, First REIT’s NAV fell to 30.7 cents from 36.65 cents mainly due to the issuance of 431.1 million new units to OUELH and the drop in valuation for Indonesia hospitals.

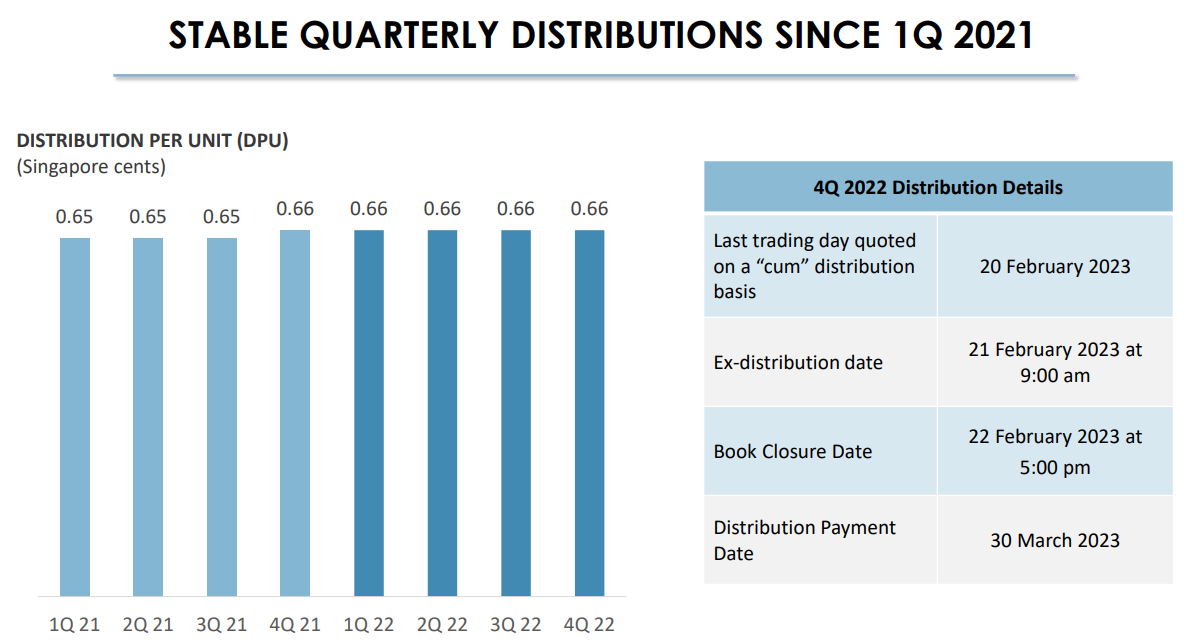

That being said, we noticed that the DPU is stabilizing and looks pretty sustainable at this point in time…

Stable DPU since 2021

I get you. The harrowing experience of First REIT’s falling DPU and share price plunge is still etched in many REIT investors’ minds.

That said, we can take comfort that it seems to have reached a bottom as the quarterly DPU has been stable for 2 years since 1Q2021.

An annualized DPU comes in at $0.0264 and based on its share price of $0.275, the distribution yield of First REIT amounts to an amazing 9.6%!

Is it time for a Turnaround?

As mentioned in our previous post here, we said that First REIT could be one of the REITs that can outperform in 2023.

Here are a few reasons why:

- First REIT has a long wale of 12.5 years with stable revenue streams from its hospitals and nursing homes

- The consistent DPU of 0.66 cents per quarter has instilled a sense of confidence

- All-in cost of debt has decreased from 4.2% to 3.7% – a remarkable feat when other REITs are ‘punished’ with higher rates

Although its gearing ratio has increased from 33.6% to 38.5%, the debt to maturity has increased to 3.38 years with no refinancing requirements till 2025 and the interest cover ratio is at a manageable 5.0x.

It is important to look at the debt maturity profile when investing in REITs especially in a rising interest rates environment.

First REIT 2.0 Growth Strategy

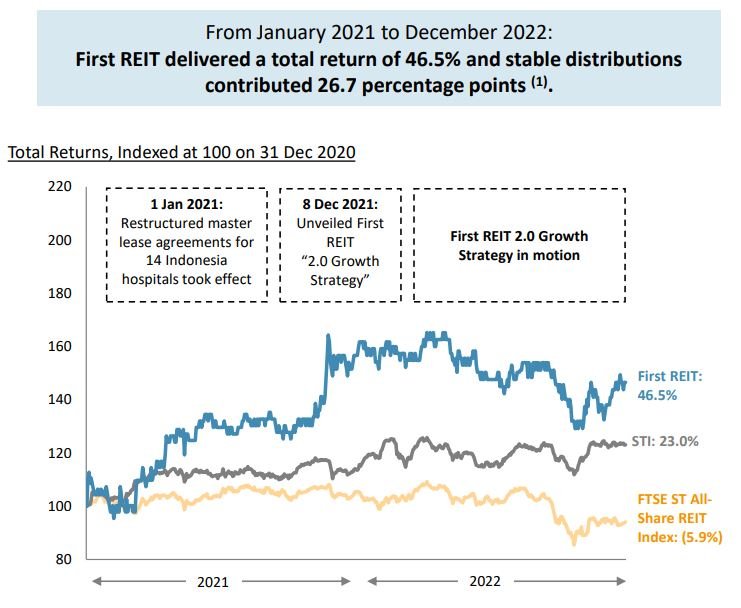

Since the restructured master lease agreements for the Indonesia hospitals took effect on 1 Jan 2021, the total return of 46.5% has outperformed both the FTSE All share-REIT index and the STI Index.

Again, we understand that many investors have lost faith in First REIT given the debacle with OUE sponsor and dilutive rights issues mainly triggered by the SGD/IDR depreciation.

On this note, interested investors can zoom in closer at the restructured lease agreements on how they can provide more assurance to unitholders:

- Rental will be paid in rupiah dollars and hedging will be done.

- Base rent escalation 4.5% fixed annual escalation with performance-based rent 8.0% of preceding financial year hospital gross operating revenue respectively.

- Sponsor no longer need to subsidise the REIT distributions

- Tenure is 15 years with an option to renew for a further 15 years with mutual agreement.

TLDR: The REIT’s pressing issues have been fixed and their balance sheet has been strengthened after the rights issues. More importantly, proactive FX hedging will provide more certainty as the DPU is paid in SGD.

Conclusion – Risk Management is Key

Investing in REITs are no longer that straightforward as compared to the prior years where interest rates are kept artificially low and REITs can continue to just milk the difference of the rental yield and the borrowing costs.

The recent share price collapse of both Manulife US REIT and Prime US REIT and Lippo Mall Trust is a clear indication of the importance on risk management.

That said, looking at how First REIT has tidied up things and is now pursuing a clear ‘developed’ markets’ in the healthcare industry, it may just be the dark horse in 2023.

Check out their latest presentation slides here.