Prolintas Business Trust (PIBT) issued its IPO Prospectus on 6 March 2024 and thus, extended an invitation to subscribe to its units at RM 0.95 an unit.

So, upon its listing, Prolintas Business Trust’s market capitalisation stands at RM 1.045 billion. The date when it closes its offer is 12 March 2024 and the listing date is 25 March 2024:

Source: Page 24 of PIBT’S IPO

Prolintas Business Trust is a business trust that owns 4 highway concessions in the Klang Valley:

- AKLEH

- GCE

- LKSA

- SILK

Here, I’ll share the details for each highway concession, PIBT’s financials, and as well as its distribution policy. So, here are 8 things investors need to know, prior to subscribing to its units.

1. AKLEH

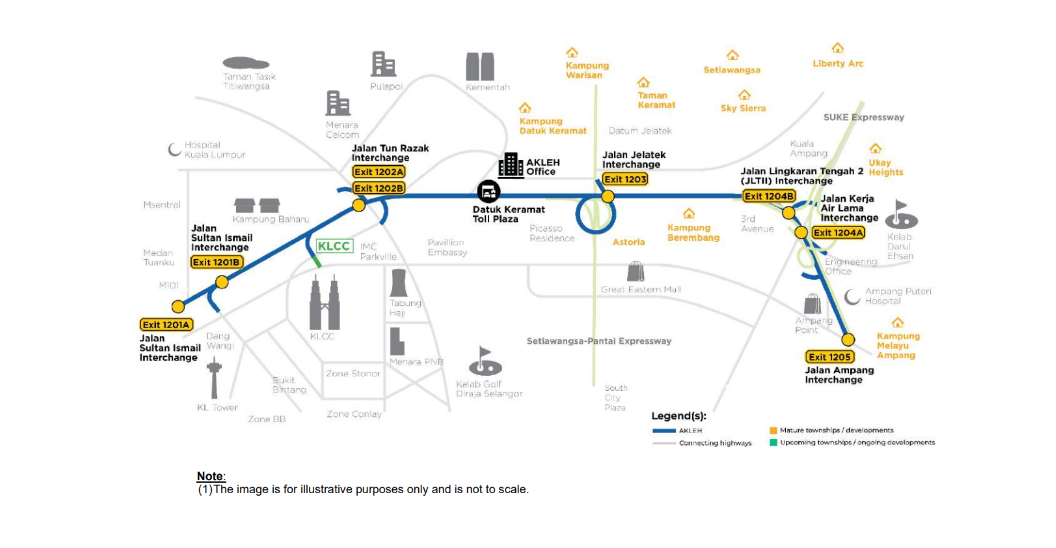

Source: Page 87 of PIBT’S IPO

AKLEH is a 7.4km elevated highway, which connects Ampang to KLCC. Presently, its concession agreement will expire in 13+ years on 15 May 2037. It earns from 1 toll plaza – Datuk Keramat Toll Plaza. AKLEH’s traffic volume had reduced from 18.8 million in 2017 to 9.4 million in 2021 due to the COVID-19 pandemic. Since then, traffic volume had improved to 13.9 million in 2022.

In 2023, AKLEH contributed 11.1% of toll revenues to Prolintas Business Trust.

2. GCE

Source: Page 106 of PIBT’S IPO

GCE is a 25 km highway, which connects Shah Alam to Elmina, Sungai Buloh and eventually the North-South Highway (which leads you all the way to Thailand). Presently, its concession agreement will expire on 31 May 2062 and it earns toll revenues from 3 toll plazas – Bukit Jelutong, Elmina and Lagong. Except for 2021 (COVID-19), GCE’s traffic volume is 30-40 million per annum.

In 2023, GCE contributed 29.8% of toll revenues to Prolintas Business Trust.

3. LKSA

Source: Page 109 of PIBT’S IPO

LKSA is a 14.7km highway that serves the Shah Alam community. It links people from Shah Alam City Centre to Kota Kemuning (another part of Shah Alam). The concession agreement will expire on 31 July 2062 and it generates toll revenues from 1 toll plaza – Sri Muda. Its traffic volume is 25-30 million per annum except in 2020-2021 due to COVID-19.

In 2023, LKSA contributed 14.2% of toll revenues to Prolintas Business Trust.

4. SILK

Source: Page 112 of PIBT’S IPO

SILK is a 37 km highway that connects neighbourhoods located south of KL. This includes Seri Kembangan, Balakong, Kajang & Bangi. The concession agreement will expire on 31 July 2062 and it generates toll revenues from 4 toll plazas:

- Sungai Long

- Bukit Kajang

- Sungai Ramal

- Sungai Balak

SILK’s traffic volume is 68-70 million a year except for 2020-2021 (COVID-19). In 2023, SILK contributed 44.9% of toll revenues to Prolintas Business Trust.

5. Major Unitholders

Source: Page 190 of PIBT’s IPO Prospectus

Prolintas Business Trust’s biggest unitholder is Projek Lintasan Kota Holdings Sdn Bhd (PLKH) with a total of 51% shareholdings (assuming over-allotment is fully exercised). This will make PLKH’s shareholders indirect substantial unitholders of Prolintas Business Trust. They include:

- Permodalan Nasional Bhd (PNB)

Yayasan Pelaburan Bumiputera owns 99.99% of PNB’s shareholdings. - Amanah Saham Bumiputera (ASB)

Apart from PLKH, there are 2 substantial shareholders as follows:

- Lembaga Tabung Haji

- AIIMAN Asset Management Sdn Bhd

6. Financial Results & Distribution Policy

In 2020-2022, Prolintas Business Trustgenerates RM 350-400 million per year in revenues. Most of its costs are finance costs & amortisation of highway development expenses (HDE). HDE is a non-cash expense. In Prolintas Business Trust’s case, its profit after tax (PAT) figures are less meaningful as it plans to distribute at least 90% of its annual income distribution to unitholders, which are calculated as follows:

Source: Page 335 of PIBT’s IPO Prospectus

Prolintas Business Trust plans to make distributions on a semi-annual basis, where its first payment is expected to be paid in September 2024. Itrevealed that it plans to pay out RM 70 million in 2024 or 6.36 sen based on 1.10 billion units. This will work out to be an initial distribution yield of 6.7% per annum.

Source: Page 336 of PIBT’s IPO Prospectus

7. Risks

Prolintas Business Trust has a relatively high gearing ratio. A rise in financing rate shall increase the finance costs and thus, impacting its income distribution.

In addition, for investors based in Singapore, there will be currency risk as the distributions are in Malaysian Ringgit.

8. Toll Revisions

Except for AKLEH, toll revisions for GCE, LKSA & SILK are scheduled for revisions in 2032 and 2042 before expiring in 2062.

Source: Page 90 of PIBT’S IPO

Conclusion

Prolintas Business Trust shall generate long-term recurring income from 4 highway concessions.

Its initial distribution yield is 6.7% a year and this is to be compared with M-REITs / dividend stocks listed in Malaysia.

The main risks would lie in its gearing level as it has RM 2+ billion in financing facilities and negative equity presently. Thus, as investors, we should weigh its pros and cons before investing in it.