[*Update after Prime US REIT confirmed the IPO]

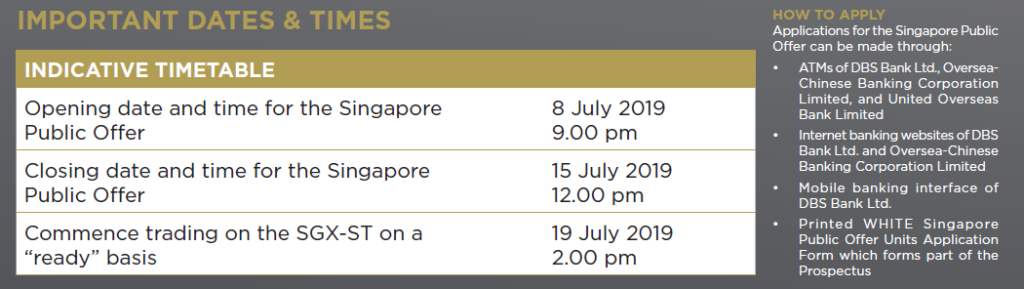

On 28 June 2019, KBS Asia Partners Pte Ltd (KAP) filed in the IPO Prospectus of Prime US REIT IPO – marking the fifth U.S.-based REIT to list in Singapore to date. [Update: it has now filed its IPO Prospectus on 8th July. You can download Prime US REIT IPO prospectus here. ]

Its units are offered at US$ 0.88 each with its distribution yield forecasted to be 7.4% in 2019 and 7.6% in 2020. The timing of the offering has not been finalised [Update below].

With that said, we will highlight 7 key things you need to know about Prime US REIT.

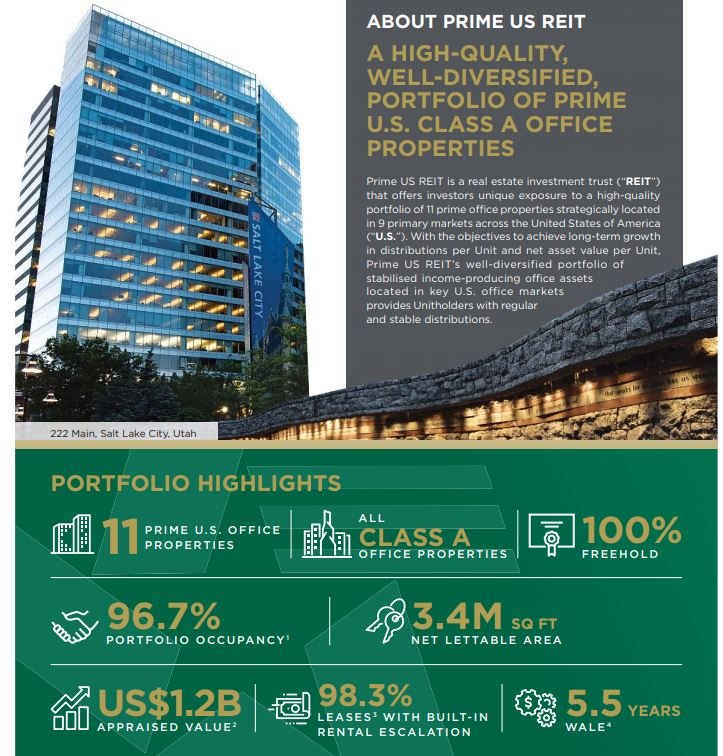

#1: Portfolio

Prime US REIT has 11 Freehold Class-A office properties located in cities all over the United States. In total, they have net lettable area (NLA) of 3.4 million sq. ft. and more than 10,000 parking stalls.

In 2018, Prime US REIT’s portfolio is worth US$ 1.23 billion and they are as follows:

#2: Financial Results

For the last 3 years, Prime US REIT has achieved higher revenues, up from US$ 107.6 million in 2016 to US$ 118.5 million in 2018.

It is attributed to growth in revenues from Village Centre Station 1 & 2, 101 South Hanley, CrossPoint, One Washington Centre, and 171 17th Street during the 3-year period.

As such, the REIT has recorded higher net property income and profits after tax for the past 3 years as recorded below.

Figures in US$ ‘000

| Year |

2016 |

2017 |

2018 |

| Revenues |

107,601 |

109,462 |

118,454 |

| Net Property Income |

68,628 |

68,015 |

74,349 |

| Profits after Tax

(Excluding Fair Value Change in Investment Properties) |

37,231 |

35,638 |

41,856 |

#3: Balance Sheet Strength

As at the listing date, Prime US REIT would have total borrowings of US$ 452.2 million, thus, having an aggregate leverage of 37.0%.

Its average debt tenure is approximately 5.6 years and 85.1% of its total borrowings would be hedged or be based on fixed interest rates.

All of its borrowings are denominated in U.S. Dollars and thus, matches with the currency of cash flows received by the REIT.

#4: IPO Proceeds

Prime US REIT intends to raise a gross proceeds of US$ 813.0 million from the issuance of its IPO units, KBS units, and Cornerstone units.

Upon listing, KBS REIT Properties III and its cornerstone investors would emerge as substantial shareholders of Prime US REIT.

One important thing to note is that both their ownership will add up to 63.7% of the total units in issue after the IPO; see below image for reference:

Source: Page 85 & 87 of Prime US REIT’s IPO Prospectus

#5: Lease Profile

As of 1 January 2019, Prime US REIT recorded a 96.7% in occupancy rates for its portfolio. It is occupied by 187 tenants with long-tenured leases that are mostly signed for a term of 5 – 10 years.

Its weighted average lease of expiry (WALE) as of 1 January 2019 is 6.7 years and its 10 largest tenants contributed 43.5% of its total cash rental income for January 2019. These tenants are as follows:

No.

Tenants

WALE (Years)

% of Cash Rental

1

Charter Communications

8.9

7.9

2

Goldman Sachs

6.4

6.0

3

Sodexo Operations

5.0

5.9

4

Wells Fargo Bank

6.2

5.0

5

Holland & Hart

7.4

4.7

6

Arnall Golden Gregory

5.8

3.9

7

Whitney, Bradley, & Brown

3.6

3.1

8

Apache Corporation

5.6

2.6

9

Teleflex

5.8

2.5

10

Rovi Corporation

6.8

2.0

Source: Page 19 of Prime US REIT’s IPO Prospectus

#6: Valuation

Its net asset value per unit is US$ 0.84. Thus, based on its offering unit price of US$ 0.88, its P/B Ratio is 1.05.

From 1 April 2019 to 31 December 2019, it plans to distribute 4.87 U.S. cents to its unitholders. It works out to be an annualised 7.4% in distribution yield in 2019.

#7: Comparison with other U.S.-based SGX-REITs

Prior to Prime US REIT, the SGX has listed four U.S.-based SGX-REIT and they are as follows:

No.

REITs

Type

Date of Listing

Current Unit Price (2 July 2019)

1

Manulife US REIT

Office

18 May 2016

US$ 0.88

2

Keppel-KBS US REIT

Office

7 Nov 2017

US$ 0.77

3

ARA US Hospitality Trust

Hospitality

7 May 2019

US$ 0.89

4

Eagle Hospitality Trust

Hospitality

22 May 2019

US$ 0.70

Based on their current unit price, the current valuation figures for all five REITs, inclusive of Prime US REIT, are as follows:

REITs

Prime

US REIT

Manulife

US REIT

Keppel-KBS

US REIT

ARA US

Hospitality Trust

Eagle

Hospitality Trust

P/B Ratio

1.05

1.10

0.99

1.03

0.80

Distribution

Yield (%)

7.4%

6.9%

6.2%

7.9%

9.2%

In a glance, the valuation of Prime US REIT’s IPO unit offerings would be better compared with Manulife US REIT and Keppel-KBS US REIT as they are of similar class of REITs – U.S. Office REITs.

Presently, it is offering the highest distribution yield than its peers and is second when it comes to P/B Ratio. But, before investing, I reckon that you study through all of the three U.S. REITs in greater detail.

Conclusion:

Prime US REIT’s properties has delivered stable results for the past 3 years. The only exception is Tower 1 at Emeryville, which suffered from a fall in occupancy rates to 50.7% and 62.9% in 2017 and 2018.

The good news is – it has improved its occupancy rate to 81.1% in 2019. The rest of its properties are also enjoying well above 95% in occupancy rates, thus, provide income visibility to its unitholders. What’s more, you are getting a nice 7.4% distribution yield from the onset.

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve found 7 exciting companies that are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!

#3: Balance Sheet Strength

As at the listing date, Prime US REIT would have total borrowings of US$ 452.2 million, thus, having an aggregate leverage of 37.0%.

Its average debt tenure is approximately 5.6 years and 85.1% of its total borrowings would be hedged or be based on fixed interest rates.

All of its borrowings are denominated in U.S. Dollars and thus, matches with the currency of cash flows received by the REIT.

#4: IPO Proceeds

Prime US REIT intends to raise a gross proceeds of US$ 813.0 million from the issuance of its IPO units, KBS units, and Cornerstone units.

Upon listing, KBS REIT Properties III and its cornerstone investors would emerge as substantial shareholders of Prime US REIT.

One important thing to note is that both their ownership will add up to 63.7% of the total units in issue after the IPO; see below image for reference:

Source: Page 85 & 87 of Prime US REIT’s IPO Prospectus

#5: Lease Profile

As of 1 January 2019, Prime US REIT recorded a 96.7% in occupancy rates for its portfolio. It is occupied by 187 tenants with long-tenured leases that are mostly signed for a term of 5 – 10 years.

Its weighted average lease of expiry (WALE) as of 1 January 2019 is 6.7 years and its 10 largest tenants contributed 43.5% of its total cash rental income for January 2019. These tenants are as follows:

|

No. |

Tenants |

WALE (Years) |

% of Cash Rental |

|

1 |

Charter Communications |

8.9 |

7.9 |

|

2 |

Goldman Sachs |

6.4 |

6.0 |

|

3 |

Sodexo Operations |

5.0 |

5.9 |

|

4 |

Wells Fargo Bank |

6.2 |

5.0 |

|

5 |

Holland & Hart |

7.4 |

4.7 |

|

6 |

Arnall Golden Gregory |

5.8 |

3.9 |

|

7 |

Whitney, Bradley, & Brown |

3.6 |

3.1 |

|

8 |

Apache Corporation |

5.6 |

2.6 |

|

9 |

Teleflex |

5.8 |

2.5 |

|

10 |

Rovi Corporation |

6.8 |

2.0 |

Source: Page 19 of Prime US REIT’s IPO Prospectus

#6: Valuation

Its net asset value per unit is US$ 0.84. Thus, based on its offering unit price of US$ 0.88, its P/B Ratio is 1.05.

From 1 April 2019 to 31 December 2019, it plans to distribute 4.87 U.S. cents to its unitholders. It works out to be an annualised 7.4% in distribution yield in 2019.

#7: Comparison with other U.S.-based SGX-REITs

Prior to Prime US REIT, the SGX has listed four U.S.-based SGX-REIT and they are as follows:

|

No. |

REITs |

Type |

Date of Listing |

Current Unit Price (2 July 2019) |

|

1 |

Manulife US REIT |

Office |

18 May 2016 |

US$ 0.88 |

|

2 |

Keppel-KBS US REIT |

Office |

7 Nov 2017 |

US$ 0.77 |

|

3 |

ARA US Hospitality Trust |

Hospitality |

7 May 2019 |

US$ 0.89 |

|

4 |

Eagle Hospitality Trust |

Hospitality |

22 May 2019 |

US$ 0.70 |

Based on their current unit price, the current valuation figures for all five REITs, inclusive of Prime US REIT, are as follows:

| REITs |

Prime US REIT |

Manulife US REIT |

Keppel-KBS US REIT |

ARA US Hospitality Trust |

Eagle Hospitality Trust |

| P/B Ratio |

1.05 |

1.10 |

0.99 |

1.03 |

0.80 |

| Distribution

Yield (%) |

7.4% |

6.9% |

6.2% |

7.9% |

9.2% |

In a glance, the valuation of Prime US REIT’s IPO unit offerings would be better compared with Manulife US REIT and Keppel-KBS US REIT as they are of similar class of REITs – U.S. Office REITs.

Presently, it is offering the highest distribution yield than its peers and is second when it comes to P/B Ratio. But, before investing, I reckon that you study through all of the three U.S. REITs in greater detail.