On 22 February 2023, Oppstar Bhd issued its IPO Prospectus (Part 1 and Part 2) and intends to raise RM 104.25 million in gross proceeds from its IPO exercise.

For the company, its market capitalisation will be lifted up to RM 400.8 million after it is successfully listed on Bursa Malaysia.

Presently, its IPO shares are offered at 63 sen per unit. Below, we will summarize 5 things you need to know about Oppstar Bhd.

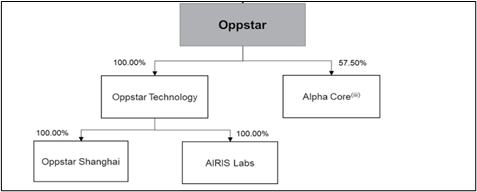

#1 Corporate Structure

Source: Page 6 of Oppstar Bhd’s IPO Prospectus

Oppstar Bhd is an investment holding company. It is established to hold onto its main subsidiaries as stated above in order to facilitate its share listings on Bursa Malaysia.

The details of each subsidiary are stated as follows:

-

Oppstar Technology (OT)

Incorporated in 2014, OT offers integrated circuit (IC) designs to customers such as fabless companies, integrated device manufacturers, fab-lite companies, and electronic system providers.

OT had secured customers that are based in Japan, the United States, Singapore, South Korea and China since it started operations.

-

Oppstar Shanghai (OS)

In 2019, OT set up OS to extend its service offerings in China.

-

Alpha Core (AC)

Established in 2019, AC now offers post-silicon validation services, software and engineering solutions to complement its IC design services.

Then in 2022, it had entered into a strategic partnership agreement with Sophic Automation (SA).

In this agreement, SA subscribed to 42.5% shareholdings of AC and as a result, the amount of Oppstar Bhd’s shareholdings in AC had reduced to 57.5%.

Presently, AC is a MSC status company with MIDA.

Thus, it would enjoy 70% tax exemption on its income made from services through IC design and post-silicon validation services.

The period of tax exemption started on 7 May 2021 and this would end on 6 May 2026.

Of which, its tax exemption period may be extended by another five years, subject to evaluation and compliance of the incentives at that point in time.

-

AIRIS Lab

In 2020, OT formed AIRIS Lab, a joint venture (JV) company with Lee Weng Fook and Lee Weng Fai.

AIRIS Lab conducts Research & Development (R&D) activities on IC and its applications for AI and machine learning capabilities.

In May 2022, OT bought over the remaining 50% of the JV company and hence, AIRIS Lab had become a wholly-owned subsidiary of Oppstar Bhd.

#2 Financial Results

Figures in RM ‘000 unless stated otherwise

| Year | 2020 | 2021 | 2022 |

| Revenues | 15,965 | 29,262 | 50,561 |

| Shareholders’ Earnings | 421 | 7,799 | 16,629 |

| Earnings per Share (EPS) (Sen) | 0.07 | 1.23 | 2.61 |

Source: Page 196 of Oppstar Bhd’s IPO Prospectus

Oppstar Bhd attained substantial growth in revenue and earnings in 2020-2022. This is attributable mainly to the securing of full IC design turnkey projects from Xiamen KirinCore (XK) in 2021.

XK is the single largest contributor of sales today for Oppstar Bhd. XK accounted for 70.73% and 68.43% of Oppstar Bhd’s sales in 2021 and 2022. Hence, it poses concentration risk as Oppstar Bhd is dependent on XK for its sales and profits.

#3 Utilisation of IPO Proceeds

Source: Page 32 of Oppstar Bhd’s IPO Prospectus

From its IPO Prospectus, Oppstar intends to utilise its gross proceeds on:

-

Business expansion (RM 50.0 million)

This refers to the hiring of 280 employees comprising 215 design engineers and 65 post-silicon engineers or technicians.

Most of them would be local engineers while foreign engineers may be recruited from India and Indonesia. For Oppstar Bhd, these employees would be hired over the next 3 years.

-

New Offices (RM 25.0 million)

Today, Oppstar Bhd has offices in Penang, Kuala Lumpur, and Shanghai.

Oppstar Bhd operates 10,500 sq. ft. and 3,000 sq. ft. of Offshore Design Centre (ODC) at its offices in Penang and Kuala Lumpur. It has no ODC for its Shanghai office.

So, for Oppstar Bhd, it intends to set up new offices in Penang, India, Taiwan and as well as in Singapore to expand its market presence.

-

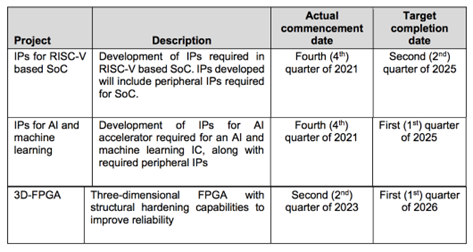

R&D Activities (RM 12.0 million)

The following are some R&D activities that are being carried out presently:

Source: Page 47 & 48 of Oppstar Bhd’s IPO Prospectus

-

Working Capital (RM 12.65 million)

They are as follows:

Source: Page 49 of Oppstar Bhd’s IPO Prospectus

-

Estimated Listing Expenses (RM 4.6 million)

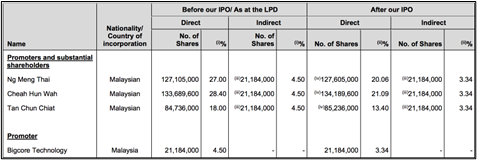

#4 Major Shareholders

Source: Page 56 of Oppstar Bhd’s IPO Prospectus

Upon its listing, Ng Meng Thai, Cheah Hun Wah, and Tan Chun Chiat will remain as substantial shareholders of Oppstar Bhd.

Ng is appointed as its CEO, Cheah is appointed as its CTO while Tan is the COO of Oppstar Bhd.

#5 Valuation

From its IPO Prospectus, Oppstar Bhd revealed that it has a dividend policy of making a payment of at least 25% of its net profits in dividends.

Hence, based on 63 sen per share, its IPO shares are valued at P/E Ratio of 24.14x and will offer a minimum dividend yield of 1.04%.

Conclusion

Oppstar Bhd plans to use its gross IPO proceeds to hire engineers, open up new offices in different nations and fund R&D activities.

While we like how the firm has delivered superb growth in sales and profits, it is mainly due to its 1 major customer – XK; as it accounted for 70.73% and 68.43% of Oppstar Bhd’s sales in 2021 and 2022.

In conjunction with the upcoming semiconductor downturn, investors will need do their due diligence for this Oppstar IPO.