Here’s a saying about the stock market…

The stocks take forever to climb up and it takes just an instance to wipe out all the gains.

This is probably what’s going with Nanofilm now…

Nanofilm’s share price plunged 28.8% from S$5.97 to S$4.25 in a day as shown above. The red candlestick lies right at the 61.8% mark of the Fibonacci Retracement indicator.

2 Main Reasons behind Nanofilm share price plunge

There are 2 main reasons behind Nanofilm’s share price drop. One is the poor financial results and the other is the sudden departure of 2 key C-suite management within 2 months.

I have digged in deeper below…

1) Nanofilm’s 1H2021 below expectations

1H2021 results missed estimates and retail investors’ expectations by a mile – it feels a lot like US growth stocks where they are punished hard for ‘missing expectations’.

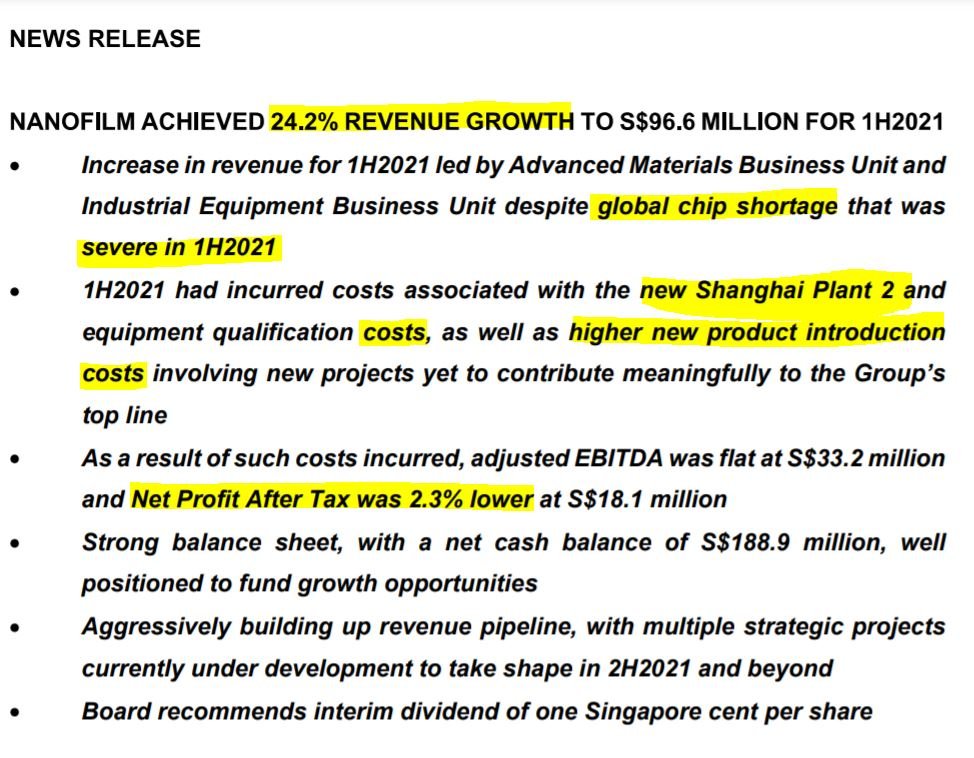

As highlighted above, Group’s top-line grew 24.2% but net profits came in 2.3% lower at S$18.1 million.

The firm’s utilization rate was lower than last time because of a global chip shortage and they also incurred costs associated with the new Shanghai Plant 2 and equipment qualification costs, as well as higher new projects’ costs [yet to contribute meaningfully].

While it doesn’t look ‘so bad’ at 1 glance, investors are already wary of its high valuations (~60x P/E ratio before the plunge) and are now running away when earnings growth cannot keep up with the valuations.

That said, ‘the real kick’ was the sudden announcement that COO Ricky Tan has quit, less than two months after CEO Lee Liang Huang resigned.

2) Nanofilm’s COO quits <2 mths after CEO’s departure

People tend to give a benefit of doubt when the CEO quit due to ‘health reasons’ but when even the COO resigns in quick succession – this will definitely piqued investors’ worries that something is wrong in the company.

This probably exacerbated the situation of the poor showing of results as investors are fearful when they don’t know what they don’t know…

On that note, the Edge’s article has managed to give a clear explanation on that. Extracted below for your reading:

Deputy CEOs Gian Yi Hsen and Gary Ho revealed that while the departure of Lee was “unplanned”, the resignation of Tan was “due to a combination of factors”.

Gian and Ho said that as the company was restructured into a “BU model”, (business unit) the need for the COO role was not “as relevant” with the new structure. Gian added that “we’ve been operating without him for a couple of months, [and] the impact has been very minimal.”

He was referring to the period when Tan was on sabbatical leave due to personal reasons. Ho revealed that when Tan returned from his sabbatical leave, the personal issues were resolved, but “that changed his [Tan’s] thinking in terms of what’s the long term, working arrangement. Because he’s 59 years old. I think he’s also wanting to take [more of] a backseat.”

Ho also added Nanofilm respected Tan’s desired requirements and worked with him to explore various roles, but was not successful in coming to an agreement, leading to Tan’s departure.

Nanofilm Investment Merits/Positives

Investors should also not forget the many existing positives of the company as highlighted in the press release:

- Strong balance sheet, with a net cash balance of S$188.9 million, well positioned to fund growth opportunities

- Aggressively building up revenue pipeline, with multiple strategic projects currently under development to take shape in 2H2021 and beyond

- Board recommends interim dividend of one Singapore cent per share

On top of that, Chairman Xu and his wife owns >50% of the firm and Temasek Holdings owns another 5.2%. Strong alignment of interest there.

One last point that I think is crucial is this…

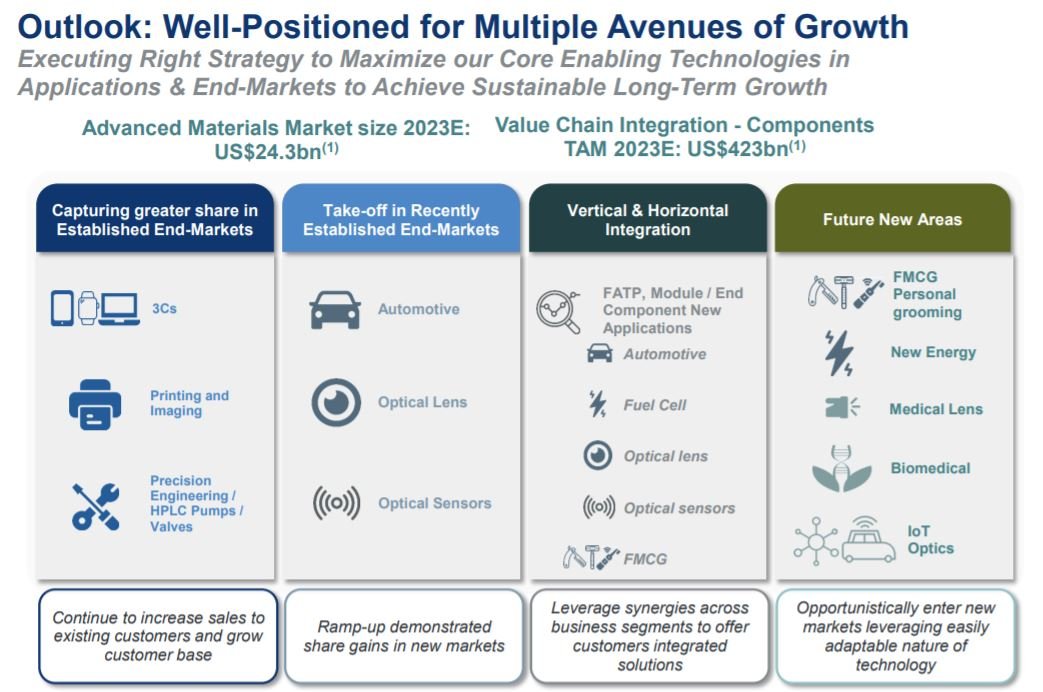

The Target Addressable Market (TAM) is over US$400 Billion come year 2023. All these exciting innovative industries point to sustainable long term growth for the company

Conclusion

According to analysts, Nanofilm’s 2H net profit is usually about ~2x of 1H net profits.

Assuming this year remains constant, then its Fwd FY2021 EPS = 1H’s 2.71 cents + 2H’s 5.42 cents = 8.13 Singapore cents.

Taking the latest share price of $4.25 divided by 0.0813, its FY21 P/E ratio is calculated to be 52.2x.

All in all, this looks like a temporary correction in the grand scheme of things. But investors may need to thread with caution since Nanofilm’s valuation may still be rather elevated in the near term.

To get more stock analysis ideas like the above, join our newsletter here: https://www.smallcapasia.com/free-investing-newsletter/

We will send you a “36 Timeless Investment Principles & Checklists” guide as an instant download too!