With extra cash from bonuses, investors is able to go shopping for reliable dividend-paying stocks to boost your passive income. In this article, I will introduce my Chinese New Year wish list, 4 dividend stocks to give me fat fat ang bao this year and in future years too.

Here are 4 dividend stocks in my Chinese New Year watchlist to give me more ang bao for 2024.

Sheng Siong

Sheng Siong started as a small provision shop in Ang Mo Kio and has grown to become one of Singapore’s top grocery retailers, with over 60 stores island-wide today.

The supermarket stores are primarily located in the heartlands of Singapore and are designed to provide customers with both “wet and dry” shopping options.

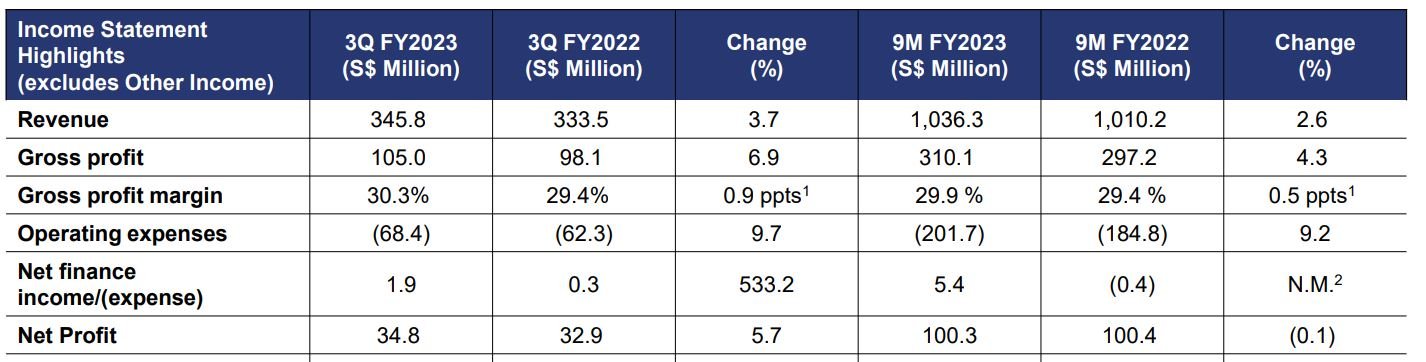

In its 3Q FY2023, Sheng Siong reported revenue increase by 3.7% to S$345.8 million while net profit increase by 5.7% to S$34.8 million. The company did not declare dividend in 3Q FY 2023 as the company pays dividend half yearly.

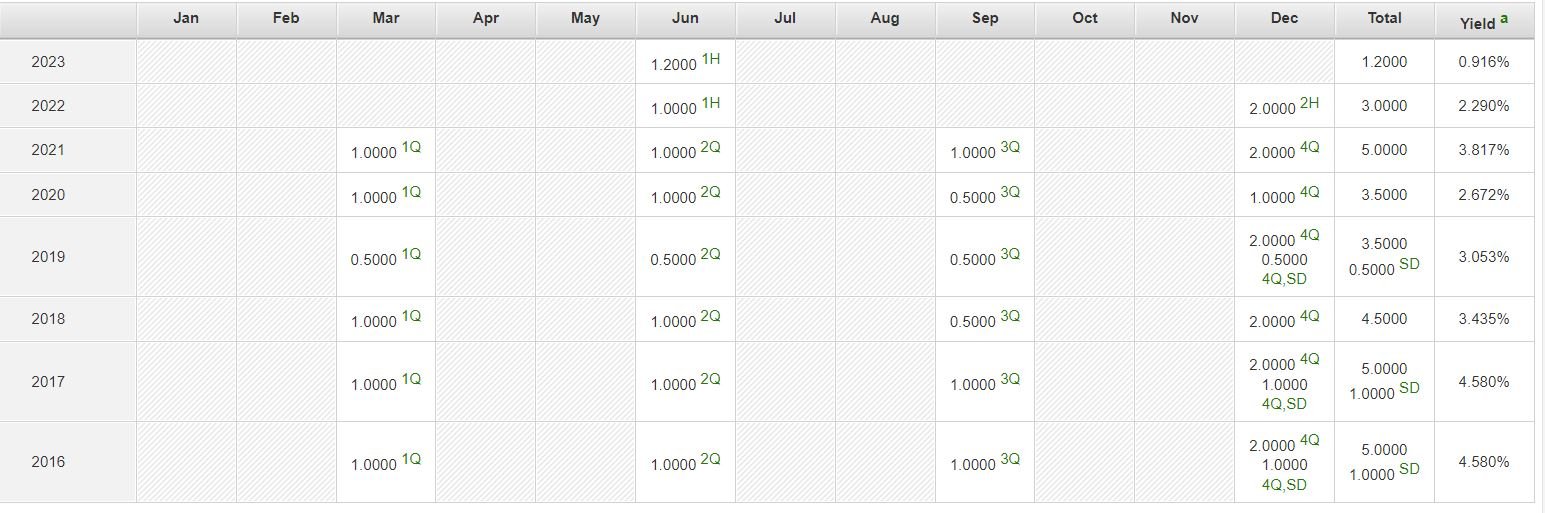

As you can see from the table, Sheng Siong has been giving out consistent and reliable dividends for the past years. Sheng Siong is in the resilient supermarket business. In the event of of an economic downturn, people still have to buy groceries.

Sheng Siong will continue to seek growth through continuous expansion of network of stores in Singapore, especially in areas without presence, supported by the ramp in supply of HDB projects through 2023.

In addition, Sheng Siong will continue to expand in China and will be opening its 6th store in Kunming, China. You can view the company website here.

Singapore Technologies Engineering

ST Engineering is a global technology, defence and engineering group with offices across Asia, Europe, the Middle East and the U.S., serving customers in more than 100 countries.

The Group uses technology and innovation to solve real-world problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence and public security segments.

In its 3Q FY2023 ended 30 Sep 2023 market update, the group reported 9% increase in revenue to S$2.4B with revenue growth across all business segments. Outstanding order book stands at S$27.5B. The company declared an interim of 4 cents per share.

As can be seen from above, ST Engineering has been giving regular and reliable dividends. In fact, the company pays quarterly dividend.

With is strong order book and recovery in air travel, ST Engineering should be able to continue its job in paying regular dividends to shareholders. You can view the company website here.

Hong Leong Finance

Hong Leong Finance is a financial services arm of Hong Leong Group Singapore and has evolved to become Singapore’s largest finance company.

Hong Leong Finance has over 60 years of experience in serving businesses and individuals.

The Company offers an extensive suite of financial products and services spanning from deposits and savings, corporate and consumer loans to government assistance programmes for SMEs, corporate finance and advisory services.

In its half year results ended 30 June 2023, the company reported interest on loans increase by a whopping 120.6% to S$217.2 million while net profit just increase by 3.2% to S$46.5 million due to higher interest paid to depositors.

The company declared an interim of 3.5 cents with higher dividend expected in the second half

As can be seen from the table above, the finance company has been giving consistent dividend over the years with dividend yield ranging from 3.5% to 6.7% based on current price of S$2.51.

With expected elevated interest rates in the near future and if Singapore economy continue to do well, Hong Leong Finance will benefit from this trend of higher rates. You can view the company website here.

UMS Holdings

UMS is a precision engineering group which specializes in manufacturing high precision front-end semiconductor components and perform complex electromechanical assembly and final testing services.

Included in its core business is the production of modular and integration systems for original semiconductor equipment manufacturers.

In its 3Q FY2023 results ended 30 Sep 2023, UMS reported 29% decline in revenue to S$71.2 million while net profit decline by 65% to S$15.4 million. Despite decline in profit, the company declared interim dividend of 1.2 cents.

As can been seen from the table, the company has been giving consistent and reliable dividends. In fact the company has been giving quarterly dividend since 2016!

The company mentioned that its performance in the coming months will be supported by the sanguine guidance of some major semiconductor equipment makers which expect to deliver sustainable outperformance.

With the completion of its new production facilities in Penang, the Group is well poised to capture new growth opportunities on the horizon and is definitely in my Chinese New Year wish list. You can view the company website here.

Conclusion

These are the 4 dividend stocks that pays consistent dividends and is definitely in my Chinese New Year wish list to give me more Ang Bao going forward. Investors need to do their due diligence before buying any stocks.