As I was searching for the stocks database for Deep Value stocks, MoneyMax popped up in front of me. Given that it has retail outlets populated across Singapore with Mark Lee as their ambassador, I decided to do some in-depth research on it.

Quick Intro on MoneyMax

MoneyMax is a leading pawnbroker, retailer and trader of jewellery, pre-owned luxury bags and watches. Since establishing the first store in year 2008, the Group has evolved and expanded its reach to over 52 stores in the region, making it one of the largest pawnbroking chains with a presence in both Singapore and Malaysia.

However, investors would not be so happy as MoneyMax’s share price has been on a 5-year downtrend from $0.40 on Nov 2013 to $0.146 on 1st November 2018:

MoneyMax seems to have been engulfed in the support area between $0.13 to $0.20. The question now is:

Is MoneyMax undervalued at this price?

To answer your question, we use the Net-Net investment strategies developed by Benjamin Graham. He was of the idea that investors who bought stocks at such low prices would come out ahead, even if the company was shut down and liquidated.

MoneyMax: A Net-Net Stock

A net-net stock is traditionally defined as a company that’s trading below its net current assets (current assets minus total liabilities). Expressed as a formula, it is:

Market Capitalisation < Current Assets – Total Liabilities

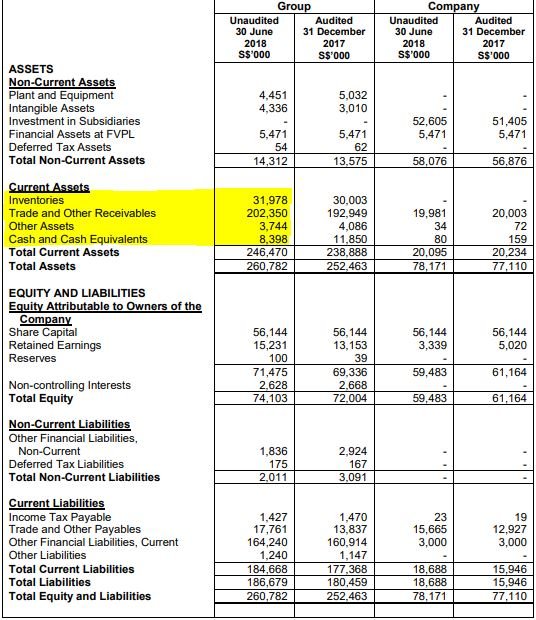

As I go through MoneyMax’s latest 2Q2018 results, the company’s current market capitalization is worth less than its net current assets.

From above, MoneyMax’s current assets are $246.4 million, its total liabilities are $186.6 million, and its current market cap is $51.6 million.

Therefore:

Market Capitalisation < Current Assets – Total Liabilities

$51.6 million < $246.4 million – $186.6 million

$51.6 million < $59.8 million

MoneyMax is currently worth just 0.82 times its net current asset value (NCAV). This means if the company were to hypothetically shut down, liquidate all its current assets and pay off all its liabilities, it’d still be worth more than what you pay for it today.

It’s not every day you see a stock trading below its NCAV and, understandably, net-net stocks are few and far between.

Analysis of Net-net working capital (NNWC)

There is a second definition of net-net which is known as net-net working capital. During his career, Graham realised that only a certain portion of current assets could be readily converted into cash.

For example, a company selling shoes may have $1 million worth of inventories on its balance sheet, but in reality may only be cleared for half that value. Therefore, Graham added a discount to certain assets, and everything else is excluded:

- Cash & cash equivalents x 100%. Cash is always fully valued as it is already… cash.

- Trade receivables x 75%. Trade receivables are marked down for doubtful accounts.

- Inventories x 50%. Inventories, especially those with short shelf lives, are treated as if they are on a fire sale.

The discounted value of these assets minus total liabilities is known as net-net working capital (NNWC). As you can see, this is even more conservative and a company trading below its NNWC is certainly undervalued.

Below we dive into MoneyMax’s NNWC:

Cash & cash equivalents = $8.4 million x 100% = $8.4 million

Trade receivables = $202.3 million x 75% = $151.73 million

Inventories = $31.9 million x 50% = $16 million

Total liabilities = $186.7 million

NNWC = $8.4 million + $151.73 million + $16 million – $186.7 million = -$10.6 million

As you can see, NNWC doesn’t really apply to MoneyMax in this case because its ballooning trade receivables comprise >80% of its total current assets.

MoneyMax: A fair business at a wonderful price

Net-net investors typically look for stocks that trade less than 0.66 times their NCAV or below their NNWC. These are usually companies facing highly distressed situations or terrible businesses that the market tends to ignore. Investors are less concerned about the quality of the business than its cheapness.

Because even if the business were to fold and liquidate all its assets, you’d still come out profitable if you have a significant margin of safety.

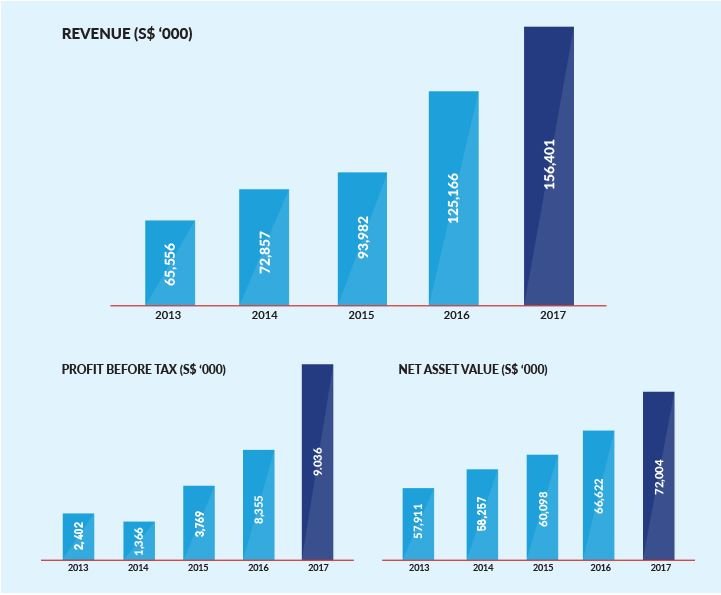

That being said, MoneyMax has been growing its revenue, profits and NAV over the last 5 years:

Source: MoneyMax’s website

Therefore, even though MoneyMax is trading at only 0.8x its NCAV, you’re buying a business with improving earnings and decent 3.4% dividend yield. Not to mention that MoneyMax is spun off from the family behind Soo Kee Jewellery too.

On the other hand, the business faces cut-throat competition from other pawnshop retailers like Maxi-Cash and ValueMax. According to Business Times, they are also facing headwinds like higher labour and rental costs. Maxi-cash also reduced their interest rates to only 1% which the other players have to follow suit, citing a low economic moat to bout.

MoneyMax has been trying hard to set itself apart through offering the trade-in services for luxury bags and accessories in April 2016. They are also embarking on the digital push through their online platform as well as a mobile app for buying, selling and appraising valuables.

MoneyMax’s Mr Lim commented:

“The introduction of online services appeal to the tech-savvy younger generation and allows us to reach out to busy customers who may not have time to visit physical stores. Customers can now perform an online valuation of their valuables any time and anywhere, in the comfort of their homes,”

All in all, MoneyMax is a business that is unlikely to face into any worries even if there’s a downturn because of its pawnbroking business nature. As such, I feel that it’s a fair business trading at a wonderful price right now.

Read also: https://www.smallcapasia.com/why-you-should-consider-investing-in-small-cap-stocks/

Conclusion

Lastly, you should keep in mind that buying deep value stocks is not like buying high quality businesses. Net-net investing is more like buying companies that are extremely cheap today and wait for any catalyst to unlock value for shareholders.

That said, this investment strategy requires a significant amount of diversification and the ability to filter the good from the bad.

To learn how you can consistently bring in 15% to 25% per Annum using the Graham approach,

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve uncovered 7 hidden gems poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!