MM2 Asia has been hit badly during the Covid-19 pandemic given the nature of all its businesses.

Unsurprisingly, its share price also tumbled, falling from S$0.30 at Jan 2020 to merely S$0.083 on 19 Feb 2021.

Given the sharp fall in its share price and a potential recovery post-Covid19, is there merit in MM2 Asia? We take a deep dive into its recent developments below.

MM2 Asia Profile

mm2 Asia is a leading producer of films and TV/online content in Asia. As a producer, mm2 provides services over the entire film-making process – from financing and production to marketing and distribution, and thus has diversified revenue streams. mm2 also owns entertainment company, UnUsUaL, and cinemas in Malaysia and Singapore.

Since its IPO listing on year 2014, mm2 Asia has strengthened its competitive advantage through its acquisitions of a majority stake in an award-winning virtual reality, visual effects and computer-generated imagery studio, Vividthree Holdings Ltd. (SGX: OMK), and an event production and concert promotion company, UnUsUaL Limited (SGX: 1D1).

With the establishment of mmCineplexes and the acquisition of Cathay Cineplexes Pte. Ltd., mm2 Asia is currently one of the key cinema operators in Malaysia and Singapore.

The Group’s primary business activities are:

- Core Business – Content Production, Distribution and Sponsorship

- Post-Production and Content Production

- Cinema Operations

- Event Production and Concert Promotion

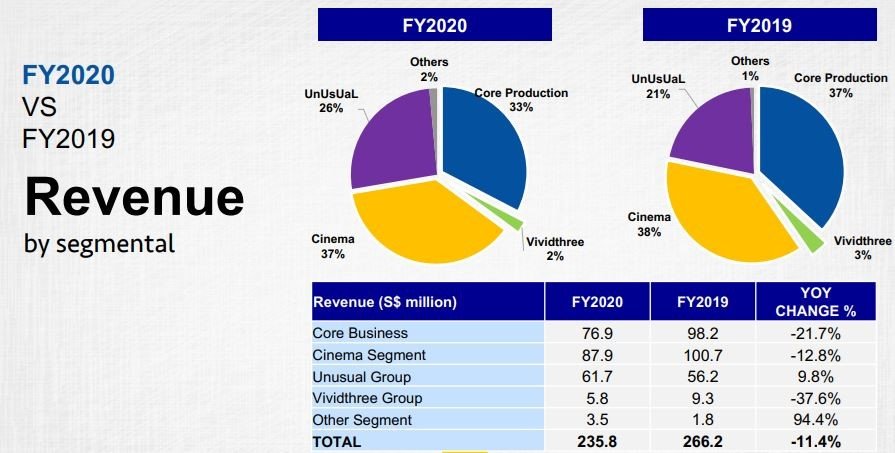

According to its FY2020 results presentation, mm2 Asia’s revenue largely stems from its core content production/distribution business, the Cathay Cinema segment and their subsidiary Unusual Group.

3 Key Corporate Developments to Take Note

There has been a slew of developments surrounding the entertainment group recently. Below, we will go through 3 key corporate developments investors should know about the company.

1) 1 for 1 Rights Issue and Extension of Convertible Bonds

According to a press release, MM2 Asia launched a rights issue to shore up its financial position.

The rights issue aims to raise net proceeds of about S$52.2 million, to be used to pay off the medium-term note due on April 27, 2021, and for general working capital and operations.

The issue price of S$0.047 for each rights share represents a 60.8% discount to the counter’s share price of S$0.12 on 1st Feb, the last trading day prior to this filing.

Based on the closing price of S$0.083 on 19 Feb, the theoretical ex-rights price (TERP) is S$0.065.

Under the terms of the Underwriting Agreement, the extension of the maturity date of the S$47.85 million convertible notes and convertible bonds issued on 7 February 2018 by the Company’s subsidiary, mm Connect Pte Ltd (the “mm Connect Notes and Bonds”) to 31 December 2021, is a condition to the underwriting by the Manager and Underwriter.

The maturity date of the mm Connect Notes and Bonds has been extended to 31 December 2021 as announced on 21 January 2021.

Melvin Ang, Founder, Executive Chairman, has expressed his intention to vote for the rights and subscribe to his entitlement, flagging his support for and commitment to mm2.

2) Budding Private Equity Investor

In a bourse filing on 7th February 2021, mm2 Asia said it has received a non-binding term sheet, from a Singapore private-equity investor expressing interest in taking a minority stake in one of the group’s core businesses.

mm2 Asia also noted that confidentiality undertakings prevent it from disclosing the investor’s identity or other proposed terms at this stage.

There is no certainty that the investment transaction would proceed, nor whether the discussions will result in binding agreements. But if the deal goes through, it would also add another source of capital for the company in this tough climate.

3) Proposed Spin-off and Merger of Cinema Business

In December 2020, MM2 Asia has already proposed a spin-off IPO of its cinema business, mm Connect.

For a quick background, mm Connect operates 8 cinemas in Singapore under the “Cathay” brand and 14 cinemas in Malaysia under the “Cathay Cineplexes Malaysia”, “Mega Cinemas” and “Lotus Fivestar” brands, as well as a movie film distribution business and an online streaming business.

Subsequently, mm2 Asia also proposed a merger with Orange Sky Golden Harvest Entertainment (Holdings) Limited (“OSGH”) – the parent company which owns 14 cinemas in Singapore under the “Golden Village” brand.

The benefits of the above are 3-prong:

- The merger would create the biggest cinema operator in Singapore and enjoy improved margins from economies of scale

- Fortify the balance sheet of the combined business to survive through the current pandemic

- Incentivise senior management personnel to deliver the best possible value to shareholders

Mm2 Asia – What to Expect?

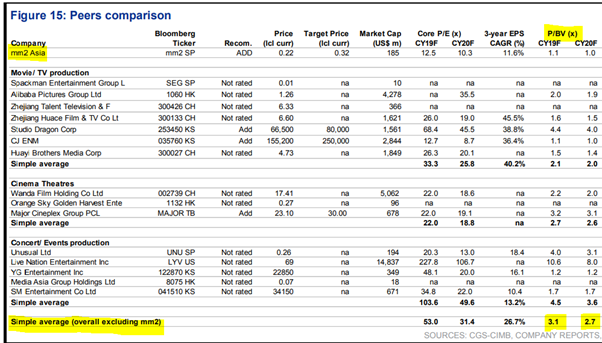

Based on the CIMB analyst report excerpt above, mm2 Asia is trading at ~1x Price/Book at S$0.22 when the average of entertainment peers all trade at ~3x Price/Book.

As of 19 Feb 2021, mm2 Asia’s share price points to a record low of 0.5x P/B. That means it has around 600% upside from current levels if we were to take the idealistic average of 3.1x P/B.

On the other hand, let’s look at the pre-covid19 earnings (before they acquire Cathay Cineplexes on Nov 2017). As of March FY2017, mm2 Asia reported a revenue of S$95.4 million and a net profit of S$18.8 million.

Assuming mm2 Asia can rebound back to S$18.8 mil in time to come (i.e. FY2023 2 years later), and issued # shares of 2,325 million post IPO, the EPS will come to S$0.008. Taking today’s share price of S$0.083, the forward P/E ratio would come up to 10.27x (it will be even lower if we take the ex-rights price of S$0.065).

Conclusion

All in all, mm2 Asia has hit a snag due to the unprecedented pandemic and perhaps a big shift to home entertainment going forward.

Post-conversion of the convertible bond, rights issue and potential PE investor’s investment in one of the Group’s businesses, mm2 Asia’s net gearing will decline significantly. This could then lift the overhang which has been dragging the stock for a long time.

In addition, with countries rolling out vaccination, and the spread of COVID-19 getting more in control, investors may be optimistic that the worst is over for mm2.

Coupled with an asset-light business model and a proven track record (i.e. ‘Ah Boys to Men’ movie series), mm2 Asia could be worth a closer look for investors looking for a cyclical recovery play.