Investors who love REITs and invest them for income are definitely not having an easy time year to date. The REIT sector is facing with higher borrowing costs that affect their DPU and persistently high 10 year US treasury yield.

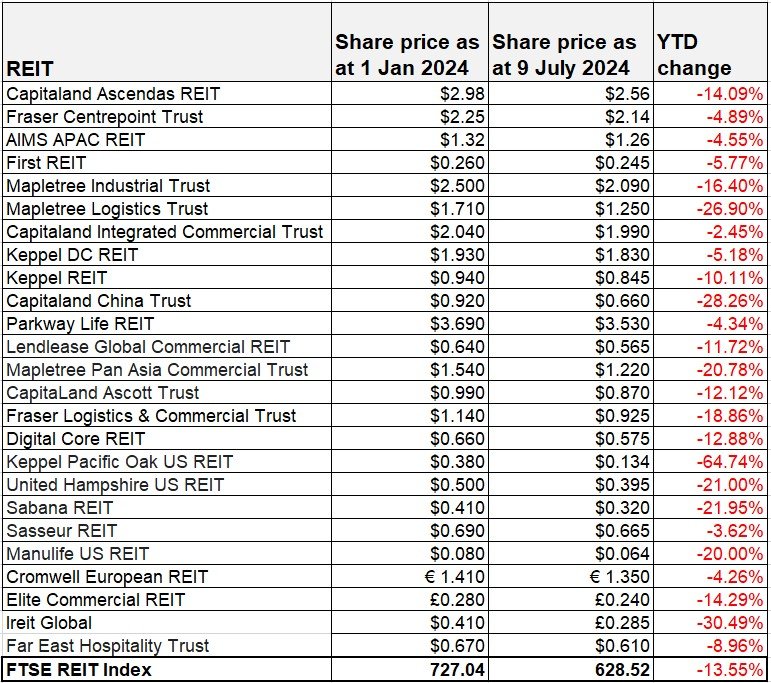

This cause the FTSE REIT index to fall by 13.55% year to date and as such many REITs and even the strong sponsor REITs have seen their share price plunge new lows.

In this article, I will talk about mid-year review of S-REITs and see whether the worst is over for this sector.

At the beginning of this year, one yahoo finance article, mentioned that S-REITs will be net outperformers in 2024. How wrong those analysts are!

These analyst recommended Mapletree Pan Asia Commercial Trust but it turn out that MPACT share price fell by more than 20% year to date.

In this mid-year review of S-REITs, we can see that from the above table, it is a sea of red for the REIT sector. The strong sponsor REITs which many bloggers and analysts advocate buying got it wrong.

Excluding the overseas REITs, the strong sponsor REITs are among the worse performers year to date. Mapletree Logistics Trust is down 26.90% year to date, Mapletree Industrial Trust is down 16.40% and Mapletree Pan Asia Commercial Trust is down 20.78%.

These big name REITs perform far worse than the FTSE REIT index. Even the biggest cap REIT, Capitaland Ascendas REIT is not spared too. The share price is down 14.09%.

The only exception is Capitaland Integrated and Commercial Trust which is the best performer year to date. The share price is down only 2.45%.

This further prove those bloggers wrong who keep harping on buying strong sponsor REITs. These REITs do not save you from falling share price.

Instead, the smaller name REITs which investors shun perform much better. First REIT which many investors avoid is down only 5.77% year to date. AIMS APAC REIT is down 4.89%. These REITs share price performance is much better than the FTSE REIT Index.

Even Sasseur REIT is down only 3.62%. Hence, as shared in my previous article here, strong sponsor REITs is definitely not a criteria for investing in REITs.

Mid-Year Review of S-REITs – Are the worst over?

Many investors are scratching their heads now wondering is the worst over now for the REIT sector. Three scenarios we have to consider:

- Though inflation has moderated in the US and is now closer to the Fed target of 2%, inflation may rear its ugly head again just like the 70s. If this scenario were to play out, then it is very likely that REITs prices will remain depressed.

- Inflation has indeed fallen and couple with moderating job gains, Fed may lower its interest rates and once the 10 year treasury yield fall below 4%, the REIT sector will be revived and REITs will see their share price increase.

- The US economy falls into a deep recession and the FED has to start its money printing, REITs may enjoy gains for a short while only as once the US economy fall into a deep recession, Singapore will be affected. This will then affect the tenants ability to pay rent.

Hence, whether the worst is over for the S-REIT sector really depends on the above scenarios. Of course, the best outcome will be scenario 2. However, in my view, the most likely scenario is scenario 3.

Next year and 2026, we may see the US falling into a deep recession. On surface, we see that US inflation has moderated and employment rate is still very low.

However, deep inside, we can see that there are cracks surfacing such as high credit card debts due to consumers living beyond their means, the commercial real estate sector is having problems now and housing affordability is at its lowest.

These will implode soon and most likely will be towards 3rd quarter next year and 2026.

Conclusion

Many investors may feel that REITs prices are now very low and the valuations are very attractive now. For example, Mapletree Logistics Trust is trading near its Covid low of $1.20 and the dividend yield is also very attractive at more than 7%.

Of course, it is very tempting to buy at such low prices as this kind of valuations does not come often. However, investors need to consider whether they are catching a falling knife or will it be better to see things turn around before buying?

[…] of Singapore REITs Shot Up Sharply Last Week: Is the Worst Over? by The Smart Investor 5) Mid-Year Review of S-REITs – Are the worst over? by SmallCapAsia 6) Data Center REIT Showdown: Keppel DC REIT vs. The Established Peers (My July 2024 Analysis) […]