Read this (!) -> DRB-Hicom (Majority shareholder of Proton at 51%) and Zhejiang Geely Holding Group (Geely, 49% stake in Proton) are planning to spearhead and attract RM32 billion in investments for the Automotive High-Tech Valley in Tanjung Malim, Malaysia.

The overall objective for both sides would be to develop an integrated automotive city centered on electric vehicles and parts manufacturing and research. It has ambitions to supply the ASEAN and global markets.

What are the implications for stocks in Malaysia then?

Let’s find out which Malaysian firms could stand to gain from their extensive linkages with Proton!

#1 DRB-Hicom

The first one to benefit is, of course, DRB-Hicom being the majority shareholder of Proton Holdings Berhad (Proton).

DRB-Hicom itself is a conglomerate that is involved in the businesses of automotive, aerospace & defense, postal, banking services, and properties.

That said, automotive sales and production is DRB-Hicom’s core business, encompassing about 71.5% of revenue in 2022.

Proton already has a big manufacturing plant in Tanjung Malim called Proton City. The high-tech valley will probably be an extension of Proton City and could increase the research and development (R&D) activities of DRB-Hicom.

In particular, this will be a big positive for the move by DRB-Hicom to introduce two Proton electric vehicle models this year and another 6 models in the medium term.

Currently, DRB-Hicom is also the distributor of motor vehicles made by Honda, Mitsubishi, Isuzu, Citroen, Kawasaki, Iveco, Tata, Optare, and Setyr.

While most people think that Proton will be the main beneficiary of the high-tech valley, let’s not forget that DRB-Hicom also has extensive relationships with other international car makers.

A quick one on the financial performance of DRB-Hicom. It returned to a profit of RM291 million in 2022 after registering a loss of RM349 million in 2021 during the pandemic and lockdown restrictions.

Revenue has also grown by 25.3% to RM15.5 billion in 2022, marking the continued success of DRB-Hicom’s partnership with Geely on Proton.

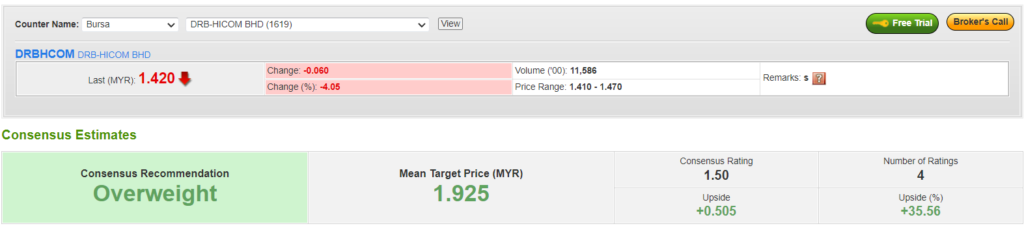

In the market now, DRB-Hicom has an OVERWEIGHT call by analysts with a target price of RM1.93. This implies an upside of 35.6% with current dividend yield at 1.4%.

Furthermore, DRB-Hicom is trading at a price-to-earnings ratio of 14.6 times compared to the industry’s average of 11.3 times.

#2 Greatech Technology Berhad

You might be wondering. What is Greatech Technology Berhad (GTB) doing here? It’s straightforward.

GTB has just obtained pioneer status incentive application (approval-in-principle) for the robotic and factory automation system and related modules and components for electric vehicle and energy storage industries from Malaysian Investment Development Authority (MIDA).

It also has extensive experience in offering battery assembly and handling systems for lithium-ion battery cells, modules and packs.

Lithium-ion is crucial as it is the rechargeable battery component for electric vehicles. GTB’s services will be crucial for any companies investing in the high-tech valley in Tanjung Malim, Malaysia.

GTB provides automation solutions for factory automation and is focused on the sectors of e-mobility (electric vehicles), solar, life science, semiconductors, and consumer electronics.

Its main revenue sources are from the United States, consisting of 60.1% of total revenue in 2022 while Malaysia consists of about 2.5%.

It is here where GTB might benefit. In 2021, Malaysia clients actually generated about 12.7% of its revenue.

The commitment by DRB-Hicom and Geely in the high-tech valley for electric vehicles market, could prompt GTB to bid for some projects in the high-tech valley and enable it to penetrate more clients in China specifically through the Geely link.

In terms of financial performance, GTB’s revenue has been growing at a strong rate of 25.8% to RM546 million in 2022, where it is recording a strong profit margin of about 31% in the past 3 years.

Thus, GTB now has an OVERWEIGHT investment call with a target price of RM5.50. This implies an upside of 22.2%, while it currently does not have any dividends.

GTB is trading at a lofty P/E ratio of 42.7x compared to its peers’ average of 38.5x.

#3 APM Automotive

APM Automotive (APM) designs, assembles, manufactures and distribute automotive parts and components such as vehicle seat systems, air conditioners, electrical components, metal component parts, and others.

It is in an interesting position here based on the list of its reputable customers below:

The brands circled are DRB-Hicom’s distributed models, and APM supplies motor parts to them. The increased investment in the high-tech valley could benefit APM if it has more clients to serve amid the higher manufacturing and R&D developments activities.

Furthermore, its electrical and heat exchange systems are an important part of the electric vehicle.

Moving forward, APM is focusing on the design and development of the batter management system for EV buses in ASEAN.

In 2022, APM’s financial performance has recovered back to its pre-pandemic levels. Revenue grew by 42.1% to RM1.7 billion in 2022, breaching its pre-pandemic level of RM1.5 billion in 2019.

On the other hand, profits have also rebounded to RM41.7 million in 2022, comparable to 2019’s level of RM48.4 million.

There is one thing to note about APM’s business model which could benefit from the high-tech valley. It is a scalable business, which means its profit margins increase in tandem with higher revenue.

When revenue declined to RM1.1 billion in 2020 during the pandemic, its profit margin drastically declined to only 0.5% from 3.2% in 2019.

However, when revenue recovered to RM1.7 billion in 2022, profit margins improved to 2.4%.

At the current juncture, APM is currently trading at a low price-to-book ratio of 0.3 times compared to its peers’ average of 0.5 times.

#4 Betamek Berhad

Betamek Berhad (BB) designs, develops and manufactures electronic products and components for the automotive sectors.

It produces automotive products such as CD changers, car clocks, air purifiers, switches, lighter/power sockets, roof-mounted monitors, speakers, USB chargers, digital air-conditioning controllers and other electronic accessories.

The rise of electric vehicles research and development will increase the demand for electronic products and components supply and design services.

Betamek is well-positioned in this regard considering that it is well-established in the market since 1989, and has intentions to increase R&D into electric vehicles components.

On this front, the RM33.8 million in IPO proceeds were channeled towards mostly to R&D activities.

About RM7 million are allocated to expand the range of their product offerings which includes vehicle visual and sensor features, safety features, infotainment and smartphone integration, telematics and e-call solutions, and could and IoT connected mobility applications.

Another RM6.5 million are allocated to expand their existing R&D office space, raw material storage and ancillary facilities.

Betamek was just listed in 2022, and have recorded a growth in revenue of 2.5% to RM133 million. Its profits have also increased by 10.4% to RM13.5 million in 2022.

In terms of valuation, Betamek is currently trading at a P/E ratio of 15.5 times compared to the industry’s average of 31.7 times.

Since it’s newly listed, it is not distributing dividends yet and do not have any formal dividend policy yet.

#5 KESM Industries Berhad

If there are new products due to R&D activities, they would need to be tested. That’s where KESM Industries Berhad (KESM) comes in.

It is one of the largest provider of semiconductor burn-in services and assembly of electronic components.

KESM’s new test platforms for its automotive business is awaiting certification currently, and will handle updated chips for the advanced driver assistance systems and tyre pressure monitoring system for electric vehicles.

The higher investments into the high-tech valley in Tanjung Malim could potentially increase the demand for testing and manufacturing services by KESM.

KESM is in the midst of transitioning to the electric vehicle uptrend and has invested about RM140 million into its testing equipment for electric vehicles components.

Hence, its financial performance are currently depressed, with profit losses of RM7.1 million for 2022.

Maybe a better gauge of KESM’s prospects would be to look at its capital expenditure trend to determine whether it is committed to transitioning to electric vehicles testing.

Capital expenditure has increased to about RM102 million in 2022 compared to the historical average of RM51.2 million annually from 2014 to 2021.

KESM is currently trading at a P/B ratio of 0.9 times compared to the industry’s average of 1.4x.

Conclusion

The Automotive High-Tech Valley is re-igniting interest in the automotive industry in Malaysia.

The increase in investments into electric vehicle worldwide could also be happening in Malaysia as DRB-Hicom and Geely ramps up its commitment in the project in Tanjung Malim.

These Malaysian companies could be a net beneficiary of the continued growth in the automotive industry.

I am looking forward to the electric models and hope that Proton also works with regular outlets for charging stations. Let’s go green!