KJTS Group Bhd (KJTS), a one-stop integrated building support services provider, is launching its inaugural IPO at 27 sen each.

The IPO has closed on 11 January 2024 and its shares will be listed on 26 January 2024.

For KJTS, upon its listing, its market capitalization would be RM 185.8 million.

In the article here, I’ll share 9 things to know about KJTS:

1. Business Model

KJTS provides building support services: cooling energy, cleaning and repair and maintenance of machinery and equipment to commercial & industrial buildings owners.

These services can be offered on a regular basis over a contract period, ranging between 1-20 years, and on a lump-sum project-basis.

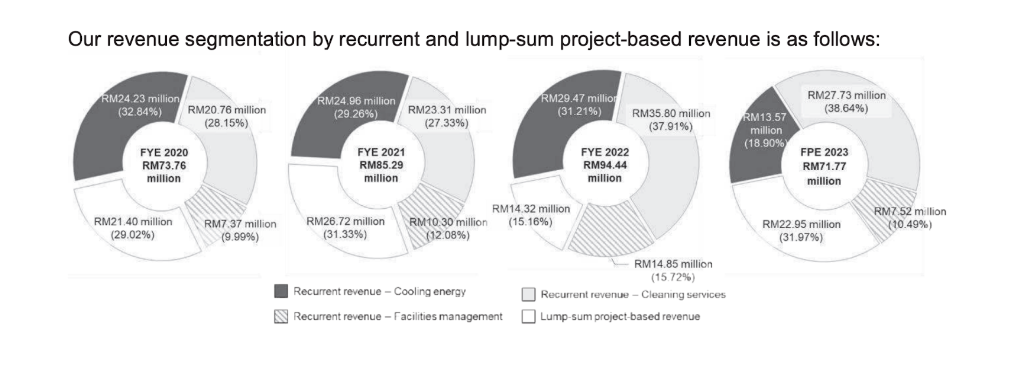

Over the last 3-4 years, 70-85% of its revenues are recurring in nature and the remaining 15-30% are one-off (non-recurring) in nature.

Source: KJTS

2. Financial Results

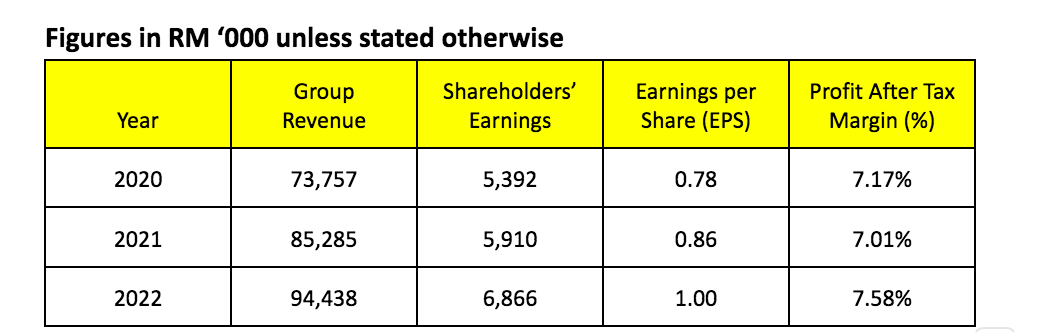

The latest financial results of KJTS for the 3-year period (2020-2022) is:

Source: KJTS

KJTS reported consistent growth in sales and profits in the 3-year period.

Such a growth was attributed to steady sales from its cooling services and as well as an increase from both its cleaning services and facilities management services that are involved in repair & maintenance of machinery & equipment.

Profit margin, for that 3-year period, had been stable at 7-8% per annum.

3. Balance Sheet

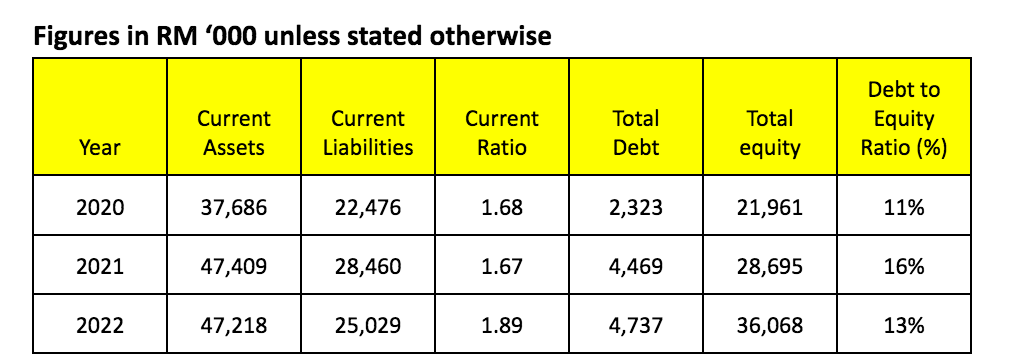

Source: KJTS

In the 3-year period, KJTS had maintained its current ratio at 1.5-2.0 and as well as 10-20% in debt-to-equity ratio. Its balance sheet in that period was solid and thus, showing a healthy past track record for managing its balance sheet.

4. Major Shareholders

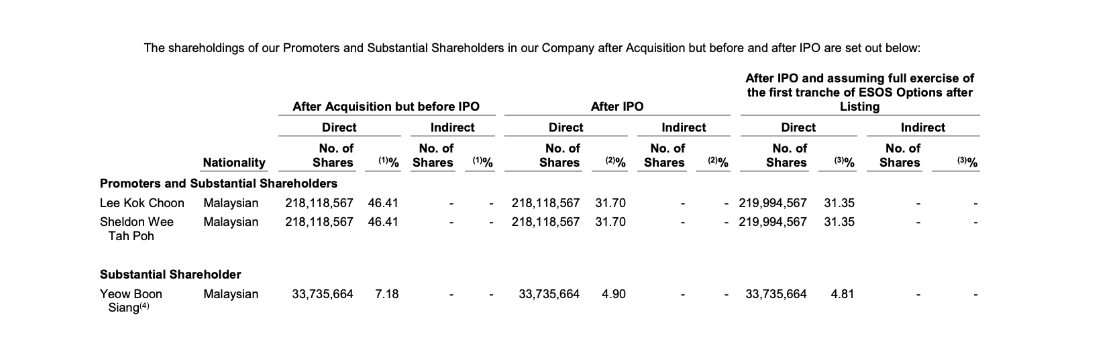

Source: KJTS

Lee Kok Choon and Sheldon Wee would remain as the 2 biggest shareholders of KJTS. Lee is its Managing Director and Sheldon is its Executive Director.

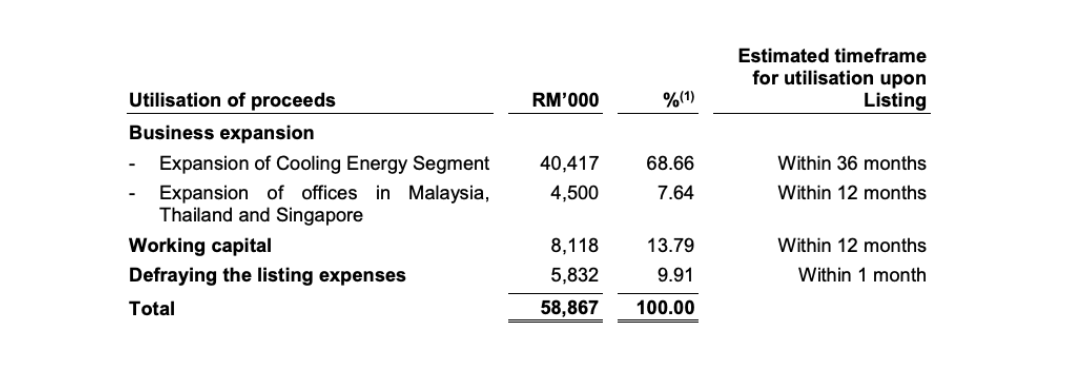

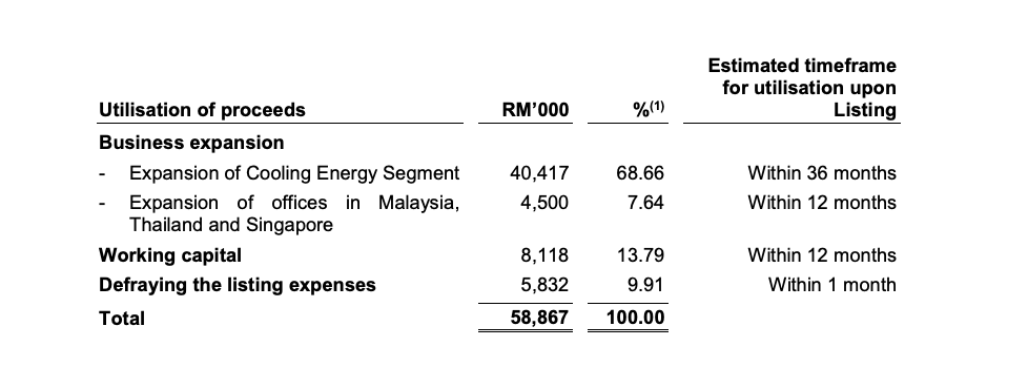

5. Utilization of IPO Proceeds

Source: KJTS

KJTS intends to raise RM 58.9 million in IPO Proceeds. Of which, it allocates:

- RM 40.4 million in Expansion of Cooling Energy System

This refers to its purchase of equipment, components & materials as well as the hiring of subcontractors & specialists to support possible new cooling contracts. The equipment, components & materials will be installed at its clients’ sites and eventually be owned by its clients after KJTS bills its clients.

Source: KJTS

Presently, KJTS has 7 contracts in tender that are worth RM 121.4 million which are related to EPCC of cooling energy systems.

- RM 4.50 million in Office Expansions

It is to enhance its market presence in Kuala Lumpur, Bangkok and Singapore.

- RM 8.12 million in Working Capital

It refers to salaries, staff welfare, allowances, administrative & operating costs.

- RM 5.83 million in Listing Expenses

6. Recurring Contracts

Presently, KJTS has 7 contracts where they’ll account in excess of RM 1 million a year in revenues. 2 contracts would expire between 2028-2032. 5 contracts will expire in 2033-2038.

7. Risks

KJTS revealed that its business operations are subjected to the risks as follows:

- Its business needs to secure new contracts to grow its revenue & profit. If it fails to do so, KJTS would risk being unable to maintain its growth in its revenue and profit.

- Its long-term recurring contracts could be terminated early.

- Its business is impacted by electricity tariff as it is energy-intensive.

8. Dividend Policy

It adopts a policy to pay out at least 20% of its yearly shareholders’ earnings. As of 2022, its earnings per share is 1 sen. The minimum dividends per share (DPS) would be 0.2 sen. Thus, its minimum initial dividend yield is 0.74% per annum.

9. Valuation

The IPO Offer at 27 sen is currently valued at P/E Ratio of 27.0, based on its EPS of 1 sen in 2022.

Conclusion

KJTS is an established building support services provider. It has delivered a solid set of financial results and balance sheet in 2020-2022. But do note that KJTS in that 3-year period has reported declining operating cash flows.

Its IPO proceeds are allocated to cater to potential new contracts secured for its cooling services and expansion plans in Malaysia, Singapore and Thailand.

Presently, the offer of 27 sen is valued at P/E Ratio of 27 and minimum initial dividend yields of 0.74% a year. As investors, it is ideal to compare with other stocks with a similar P/E to see if KJTS is suitable as an investment.