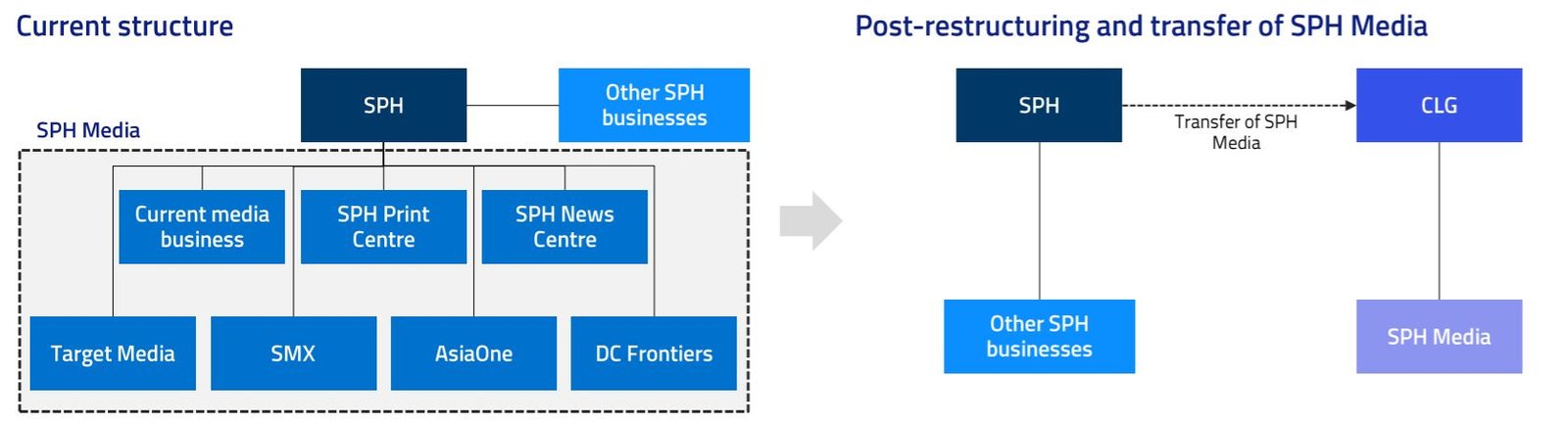

By now, you would already have heard of the news – SPH has proposed to hive off the SPH Media business into a not-for-profit organization.

This is due to the consistent revenue decline and earnings drag of the media business and SPH’s inclination to focus on the property business.

Although this deal makes sense on a business footing, it has garnered HUGE amount of attention with the wrong funny reasons… and i have tabulated some of the interesting links below:

- Mr Brown’s Encik production video

- SPH and The Economist‘s pay & expertise comparison

- Cute Comics

- A well-articulated poem where you can learn even more cheem words!

There are also many financial bloggers coming out with their own articles on this ‘never-before-seen’ deal in Singapore.

With that said, we would also provide our own take – specifically on the total package injected into SPH media and how to value SPH going forward.

Impact of SPH Media Deal

As part of the deal, SPH will provide a one-off consideration of S$351.3 million in the form of cash, shares, issued capital and property leases to the new entity.

This package includes around liquid assets of S$110m comprising of:

- S$80 mil in cash

- ~S$20 mil from 23.4m SPH REIT units

- ~S$10 mil from 6.9m SPH shares

- SPH’s stakes in 4 of its digital media investments

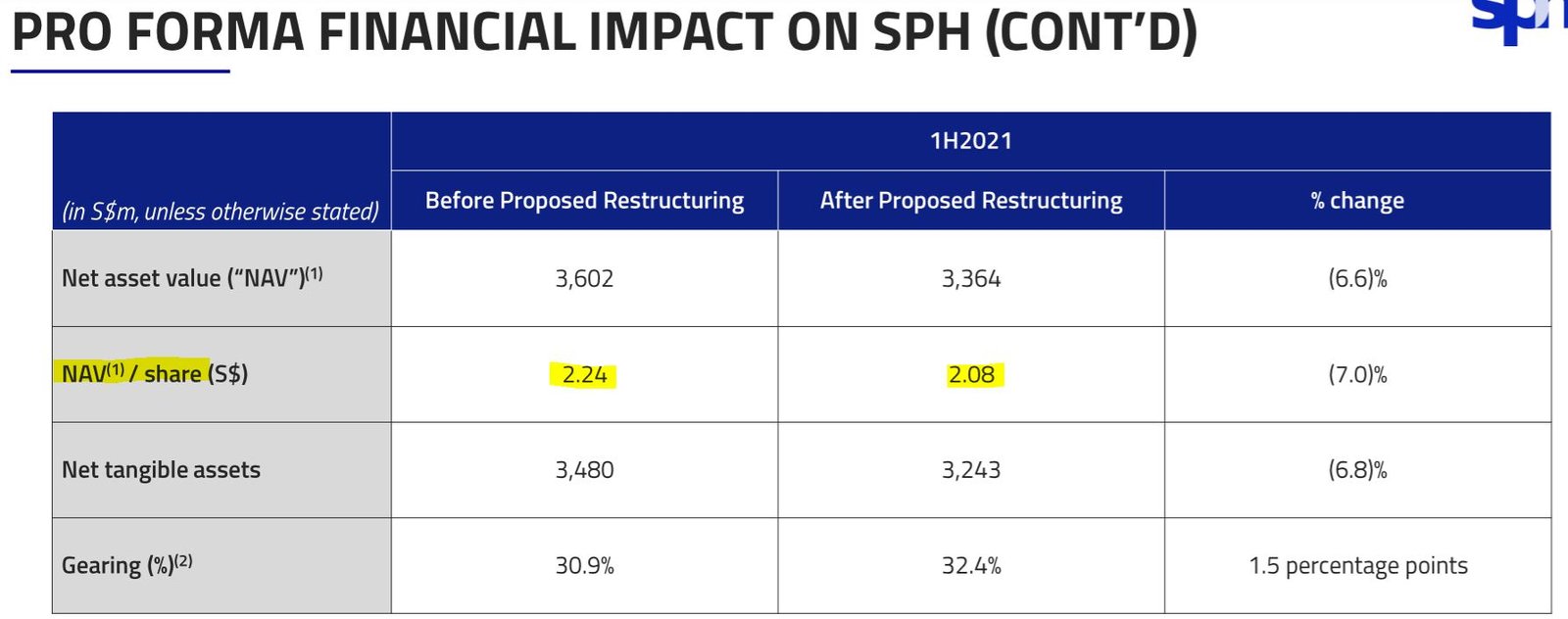

If we consider the NAV instead of market value of the leases, then the contribution from SPH would amount to S$238 million as shown in the presentation slide below.

Correspondingly, its NAV per share will also come to $2.08 after proposed restructuring. Including the one-off restructuring adjustments, SPH’s 1HFY21 net profits will reverse from S$85 mil profit to a loss of S$122 mil.

In addition, 1H2021 operating revenue will fall by 46.3% from S$417 million to just S$224 million. However, operating profit will increase by 9.4% to S$117 million, implying a pretty decent operating profit margins of 52%.

Moreover, investors can expect less volatility in future earnings because it will then be mostly driven by properties, which is more stable in nature.

Long story short, its more of a short-term pain, long-term pain kind of a drastic move. One that many SPH investors are angry of though…

Why Investors are Taking Umbrage at this Deal

The negativity surrounding this deal is so profound and evident in the SPH share price chart…

SPH stock price crashed 15.08% from S$1.79 to S$1.52 on 7 May 2021, the day after the trading halt was lifted.

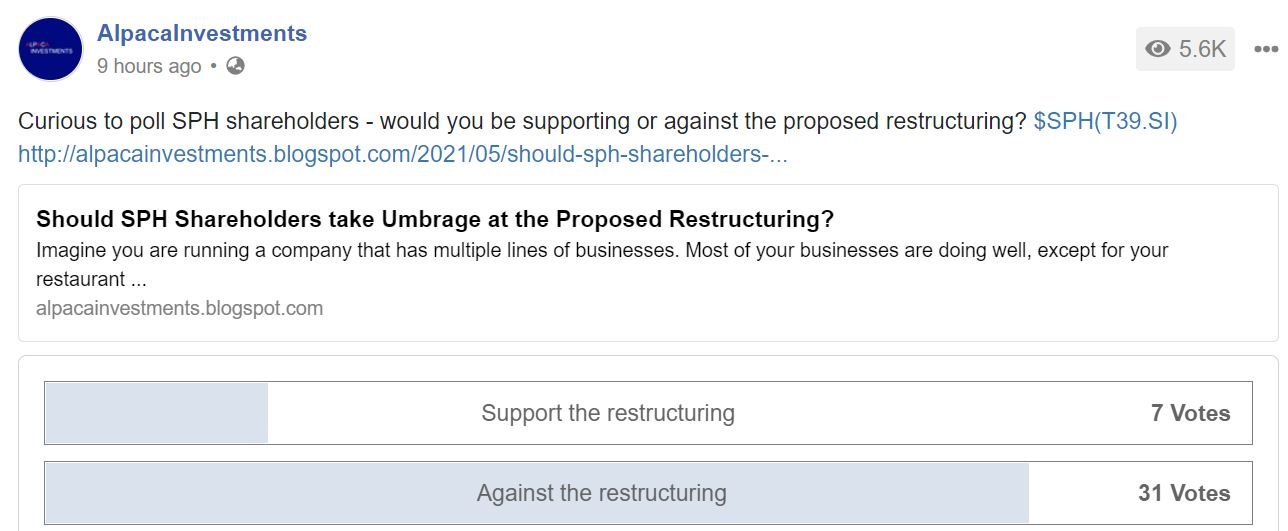

Like what TheGoodInvestors.sg shared, the existing SPH shareholders are losing out in this deal because the company is effectively ‘donating’ a part of it out at a loss.

A quick check on InvestingNote also shows that many readers are against the restructuring deal too…

Despite all the gloom and doom, I do see that analysts covering SPH are quite positive and giving rather high target prices (at least above the closing price of $1.52).

With that, the question begets… is SPH a good buy at this price?

My Take on SPH’s Valuation

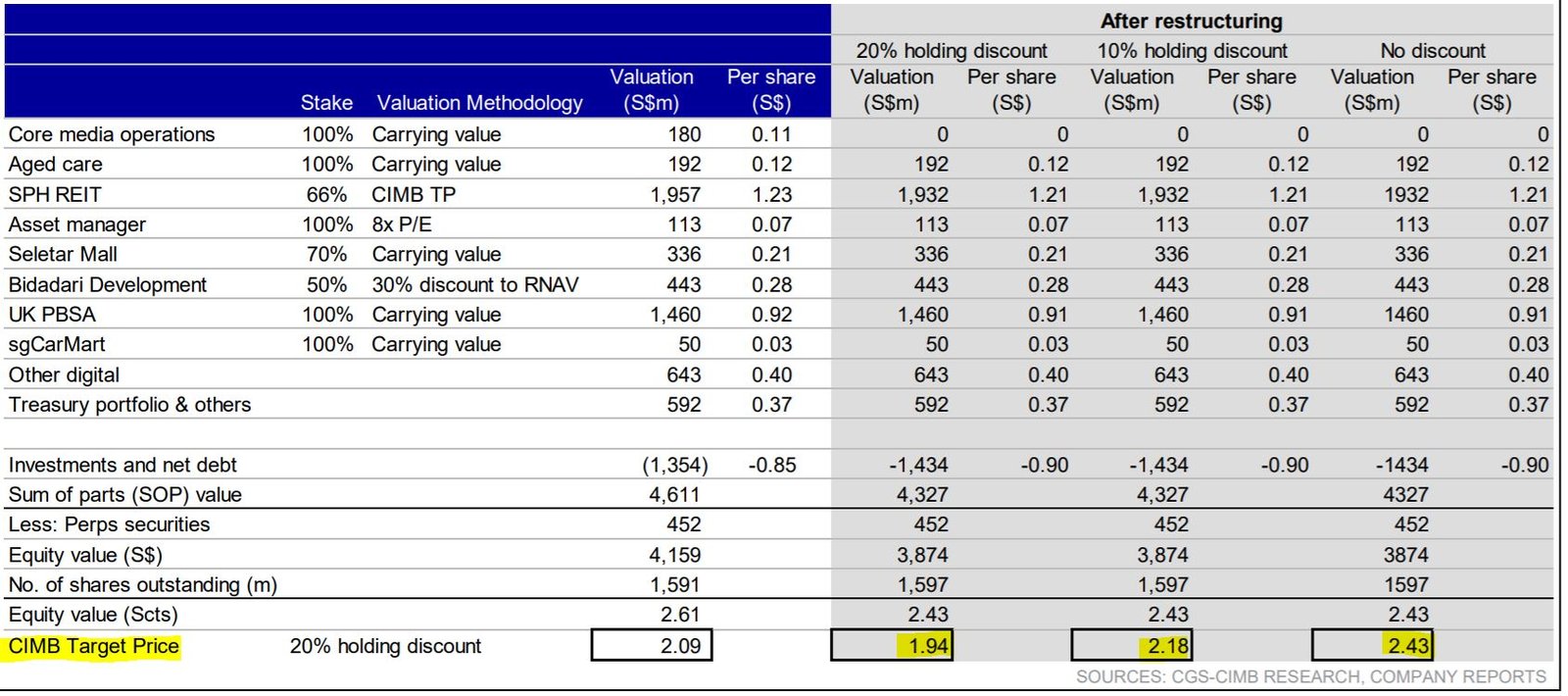

Over the years, SPH has done many acquisitions and venture/startup investment deals so its hard to pen down what are left after the SPH media ‘divorce’.

By taking reference from CIMB’s analyst report, I can see that majority of the assets left are property-based such as Aged care, SPH REIT, Seletar Mall, Students’ accommodation etc.

Here it is:

With that, it would make sense to compare SPH to other SG-listed property peers going forward.

Sourced from Shareinvestor.com

And looking at the above, SPH should trade at a lower Price/Nav compared to the 3 property giants with market caps bigger than SPH.

That said, if we take SPH’s NAV of $2.08 at face value (post-restructuring) and attribute a P/NAV of 0.7x, I am getting a price of S$1.46 for SPH. Even if we use a P/NAV ratio of 0.8x, it would be S$1.64.

Coupled with a near term earnings loss in FY2022F, the upside seems to be pretty limited. On the other end, SPH also mentioned that this carving out of SPH media is only the 1st step of the strategic review exercise and there may be more value-unlocking announcements going forward.

In conclusion, the options are rather open-ended for SPH right now. It can probably choose to spin-off its UK PBSA into a student accommodation REIT or inject Seletar Mall into its REIT. It may even issue rights or just borrow more to acquire new properties.

Hence, it can go either way – and investors may need to forgo their dividends while this transformation continues to take shape. With a potentially poor risk-reward ratio, SPH’s shares may not be the one many people should ‘bargain hunt’ right now.