For the past 2 years, the US Federal Reserve hiked interest rates to the present 5.25% to 5.5%, which is the highest since 2007. The sharp increases, coupled with high inflation led to lower DPU for most REITs due to higher financing costs.

With impending interest rate cut by the FED, REIT investors could breathe a sigh of relief as REITs will face lower financing cost and this enable the REITs to increase their DPUs.

In addition, with interest rate reductions, REITs will be able to finance DPU accretive acquisitions to increase their DPU. Hence. REITs could outperform the market when interest rates decrease.

Indeed, with high expectations that the FED will lower interest rate in September, the FTSE REIT index has increase by 9.6% since July 2024.

In this article, I will highlight a few points how REITs can outperform the market with the interest rate cut.

REITs with high gearing

REITs with a high gearing of above 40% will stand to benefit more with lower interest rates. This is due to the fact that in general a REIT with higher gearing ratio has more debt and higher interest expenses.

With the interest rate cut, the REIT will have much lower financing costs and this increase their DPU and thus share price.

For example, with expectation of a FED interest rate cut in September, PRIME US REIT with a very high gearing of 48.9% has seen its share price increase by a whopping 73.64% for the past 6 months. You can view the REIT website here.

Another example is Suntec REIT. Suntec REIT has a high gearing of 42.2%. Its share price has increase by more than 6% for the past 6 months.

REITs with lower fixed rate debts

REITs with a high percentage of their debts in fixed rates, could still suffer even with interest rate cut.

These REITs could have re-financed their debts at a much higher interest rates earlier and if majority of their debts are in fixed rates and in fixed duration, they may not be able to take advantage of the interest rate reductions.

One REIT that could benefit from the interest rate reduction is Fraser Centrepoint Trust (FCT). FCT has 67.2% of debt hedged to fixed rate interest which is relatively low.

The REIT will be able to take advantage of the lower interest rate environment to re-financed their debts and thus resulting in lower financing costs. You can view the REIT website here.

Average debt to maturity

A lower average debt to maturity will benefit REITs when the interest rate is cut in September. This is because, a REIT with lower average debt to maturity, is in a better position to re-finance their debts in a lower interest environment when the debt maturity is earlier.

For example, FCT has an average debt to maturity of 2.78 years compared to Capitaland Ascendas REIT (CLAR) of 3.7 years. Hence, FCT will be able to benefit more when they re-finance their debt at lower rates compared to CLAR.

Underperformance of REIT from interest rate cut

Many investors, bloggers and analysts have mentioned that REITs will benefit from interest rate cut and thus resulting in higher DPU and share price. I will like to play the devils advocate here and show that an interest rate cut may not benefit REITs at all.

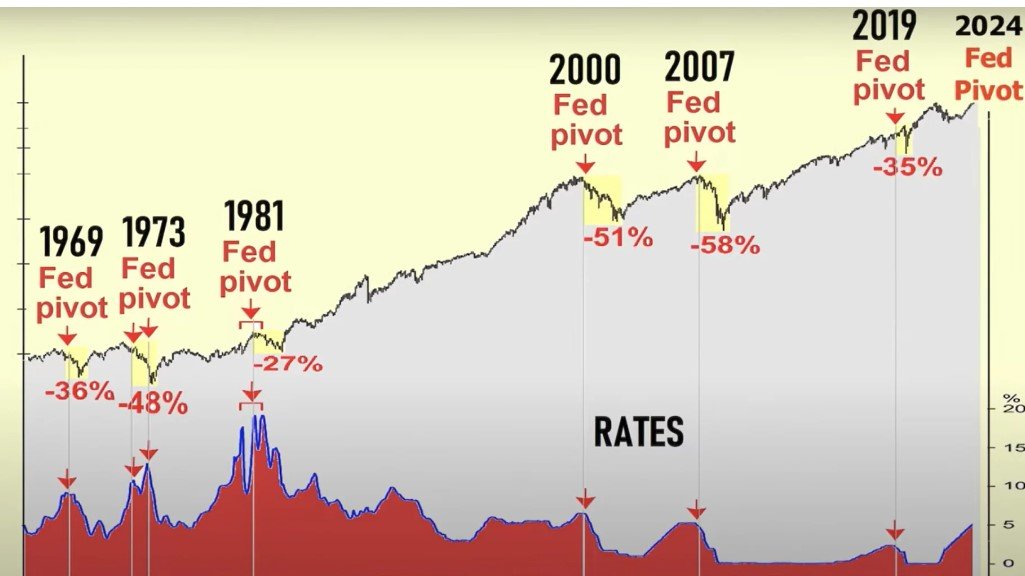

From the above picture, you can see that since 1969 after the FED pivot, the stock market actually crash and this will definitely result in lower share price of REITs. History may not repeat exactly but it certainly rhymes.

Hence, investors must not be misled by bloggers and analysts who keeping saying that REITs will benefit when FED cut interest rates.

To further prove my point, here is another chart to prove that REITs may not benefit with interest rate cut.

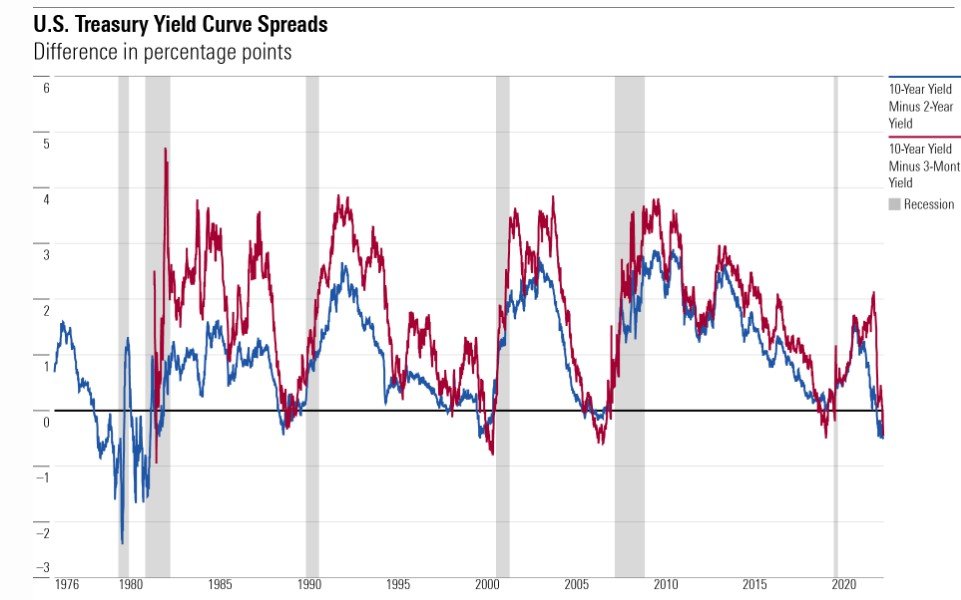

From the picture above, you can see that we have an inverted yield curve for more than 2 years. An inverted yield curve usually results in a recession.

More importantly, when the yield curve actually un-invert, it means a recession is looming as shown from past history. At the point of writing this article, the yield curve is about to un-invert very soon when the FED cut rates. Please see picture below.

Once recession hit the US next year, it will affect Singapore as well. In this instance, REITs may not benefit from lower rates as there could be negative rental reversion and lower portfolio occupancy.

Hence, even with lower financing costs, the DPU could be impacted negatively.

Conclusion

I have given 2 sides of views on the effect of interest rate cut on REITs. Investors should not be blindsided by opinions from analysts and bloggers that REITs will benefit from interest rate cut. Instead, they should dive deeper and do their own research.