1. Influence Chain ICO Details

Influence chain creates a token based Ecosystem that exploits the advantages of private blockchain by building up a token exchange where influential power (individualized intellectual property) can be monetized into digital assets for the token holders.

People with influential power (influencers) can be celebrities, sports icons, artists, authors, and talented individuals, each of the vertical has its unique supporters. Influence Chain aspires to create value flows and uses cases between influencers and supporters.

In short, Influence chain is looking to give a “value” to the influencers and this “value” will be visible on their “Influence Exchange”. Influencers are required to tokenize themselves in order to be listed on Influence Exchange.

On top of that, Influence Chain holds hand in hand with 3rd parties to develop an array of applications for further interaction and promoting of talents and generating more sponsorships via:

• Personal item auction

• Video greeting

• Private meeting

2. Influence Chain ICO Token Terms

The tokens have all been taken up by 3 rounds of Private sales! I believe thats why the project has stay hidden because the public is not really aware of it.

The allocation means fair too and equally distributed.

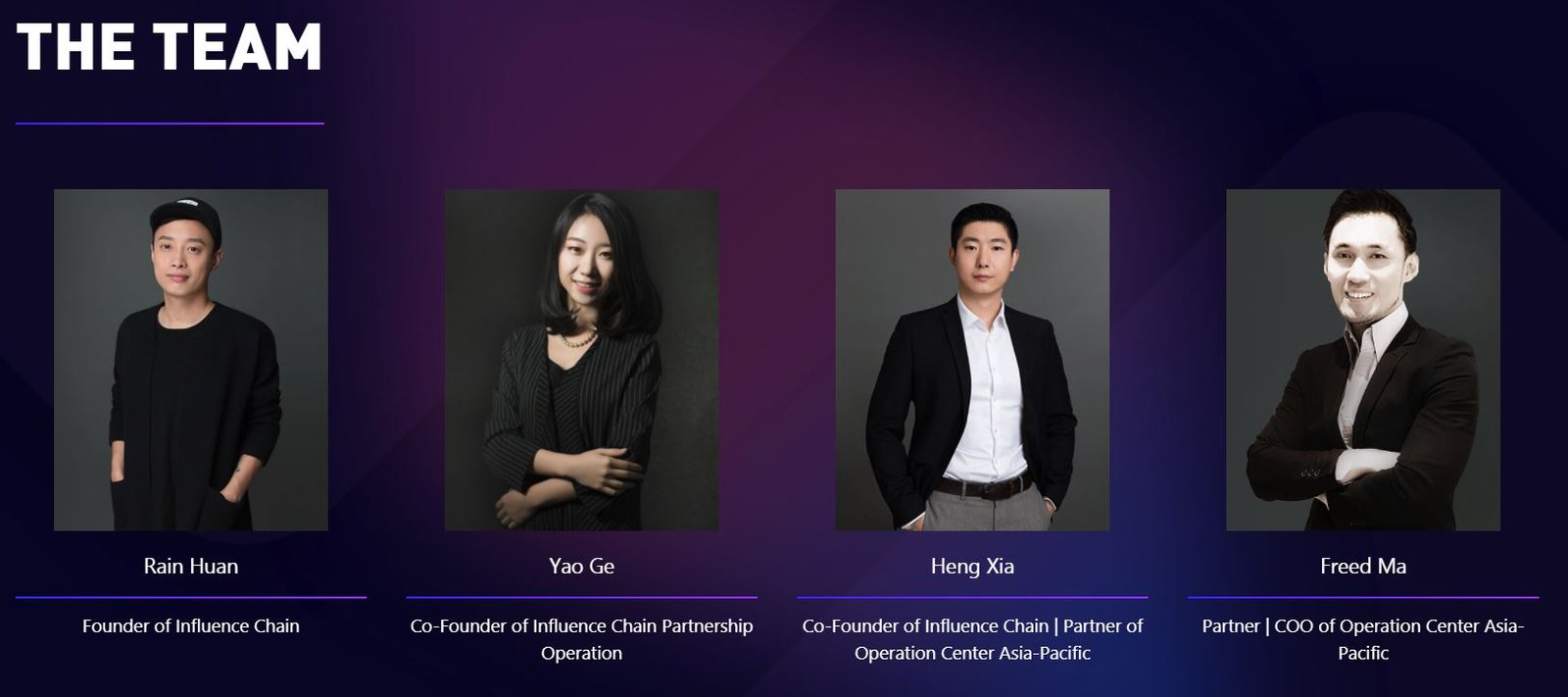

3. Influence Chain’s Team

To keep things simple, i will only cover the top row (there are 16 team members as stated in the website).

Rain Huan

- Founder of Influence Chain

- Senior practitioner in the field of Internet and innovation, and system architect.

- Established the Internet technology solutions company “DLAB” in 2010.

- Set up the first domestic designers crowd-funding platform (Jue.so) in 2011.

- Established YUN Space presently the largest platform of commercial property short-term rent, in China

Yao Ge

- Co-Founder of Influence Chain

- 10 years experences in investment and M&A industry, managed a VC fund with 1billion RMB fund size.

- 10 M&A deals and invested in more than 20 companies such as Douyu(China biggest live streaming

platform); Bilibili (China largest young generation multiculturalism video platform); Unity(the world largest 3D mobile game engine)etc. - Also worked for the world largest management counslting firm – McKinsey & Company.

Heng Xia

- Co-Founder of Influence Chain

- Partner of Operation Center Asia-Pacific

- Co-founder and chief architect of United Valley, a partner of Atlas Capital partners , and a co-founder of the Global Investor Hub on the Bund.

- Works as Legal Executive as well as the Partner of Operation Center Asia-Pacific in Singapore.

Freed Ma

- Bachelor’s degree of LSE of London University.

- He is the cofounder of AIC Fintech Singapore where is an online payment and blockchain solution provider.

- A regional partner of Lufax back in 2013, worked with Dell at SME Sales Op for nearly 7 years, was a researcher at Frost & Sullivan.

Also Read: https://www.smallcapasia.com/should-you-invest-in-cryptocurrencies/

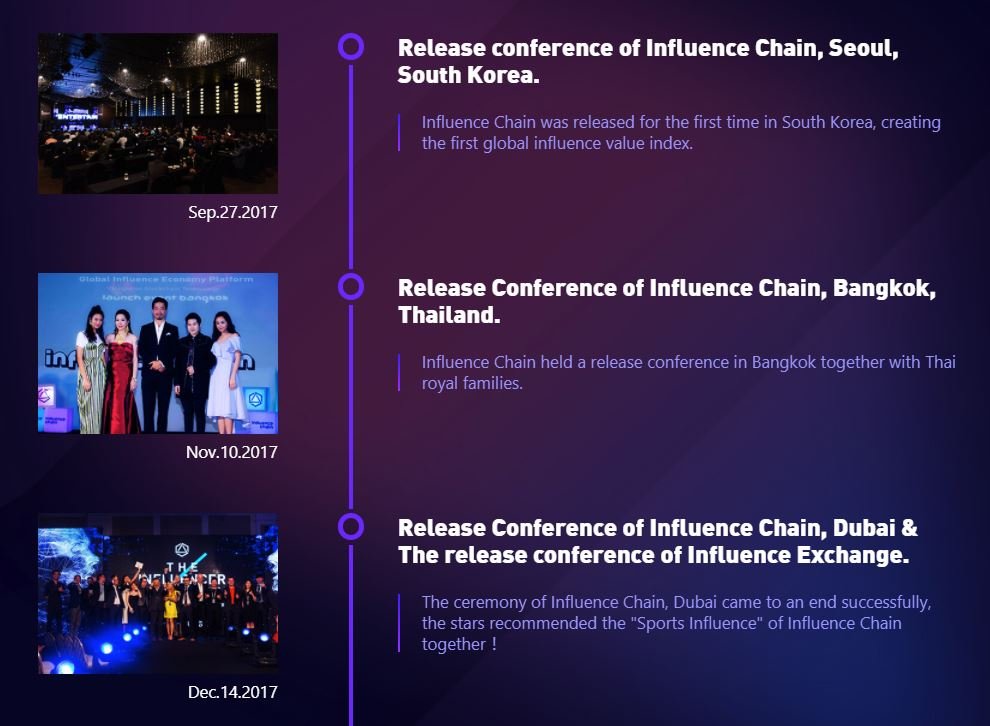

4. Influence Chain Roadmap

Their Roadmap on the website is not updated. I found the below in the whitepaper:

It seems that they have already successfully roped in different stars to come on board. If everything goes well in the beginning, i would foresee many artistes or superstars eager to jump on board.

5. Influence Chain Hype/Community

Based on the private sales’ allocation, it seems that Influence Chain is looking to sell this concept to big investors or businesses. As such, there is not much awareness in the public space.

That said, you should go to their events to gauge on their performance etc. And lucky you, sign up >> http://influencechain.club/rsvp/ to find out more about the company and even meet with Michael Owen (Soccer Star) and Fann Wong (beautiful Ah Jie)!

Want to learn how to make 1000% in Crypto-currencies like Bitcoin, Ethereum and more??

Sign up here to be part of the FREE membership (Limited Time Offer)!

Don’t forget to be part of our Crypto-Investing Facebook Group too as you can learn about the different types of crypto-coins, the platforms, the price charts and many more!