One big misconception people have is that they think they need tens of thousands of dollars in order to start investing.

The good news is that you do not need a large amount of initial capital and investing isn’t just for the rich. In fact, if you know our motto in SmallCapAsia, we always tout the following: “Start small, Win Big”!

In this article, we have listed a few investment options that require you to kick start your investing with as little as S$100 per month!

1. Exchange-traded Fund (ETF)

An exchange-traded fund (ETF), is a marketable security that tracks an index, such as a stock or bond index. Hence, an ETF typically produces a return that replicates the specific index.

Such index-tracking ETFs are passively managed by ETF managers and do not try to outperform the underlying index. Index-tracking ETFs are best known for having low fees and charges than those of actively managed investment funds.

The Straits Times Index ETF is one of the top ETFs that are listed on SGX. It basically tracks the top 30 companies in the Singapore market which are traded, which include DBS, OCBC, Capitaland etc.

There are 2 methods that you can invest in an ETF. You can either invest all your capital once-off or on a regular basis.

(i) The Lump-Sum Approach

With this method, you will need to create a brokerage account with a broker. There are many Singapore Stock Exchange approved Brokers, a list of which can be found here. The fees are usually between S$10 to S$25 per transaction.

- Step 1: Have a Bank account with either DBS/POSB, OCBC, UOB or FSM/POEMS and a CDP (central depository) securities account (Free to set up)

- Step 2: Apply for a brokerage account with any of the providers as above, such as DBS Vickers or OCBC Securities.

- Step 3: Enter the amount that you are interested to buy for that counter and submit it

- Step 4: Receive a monthly updated report on your investments and dividends quarterly

(ii) Regular Savings Plan (RSP)

This option is actually simpler to setup compared to the above method, primarily due to the idea that you won’t need a CDP account. The bank holds these funds on your behalf. The minimum investment amount for RSP is S$100 per month.

- Step 1: Have a Bank account with either DBS/POSB, OCBC, Maybank or POEMS

- Step 2: Apply through iBanking, the money that you invest will be deducted from your linked bank account

- Step 3: Towards the 15th of the month, you will automatically buy the STI ETF based on your preference amount

- Step 4: Receive a monthly updated report on your investments and dividends quarterly

2. Peer-to-peer Lending

The other alternative that you can invest your little capital is through peer-to-peer (P2P) lending. P2P lending is a method of debt financing that enables individuals to borrow and lend money without the use of an official financial institution as an intermediary.

While it was often judged as a risky investment option, P2P lending on a whole has seen increasingly lower default rates (probably due to more stringent filters).

The return on investments is in the form of repayment of periodic interest along with the principal, based on the amount that investors have put in. The typical tenure for these business loans range between 1-12 months, so unlike fixed deposits or insurances, you don’t need to lock your money in for years to see the returns.

P2P lending is a simple product to invest in that doesn’t require you any technical knowledge. P2P lending is simple and straightforward. It’s easy to understand the factsheet (prepared by the platform) which covers the SME’s business model, track record, financials and purpose of the loan.

In a single loan, there could be hundreds of investors who co-invest and share the risks and returns of investment. You can invest as low as S$50 with P2P platforms such as Funding Societies, MoolahSense and Capital Match.

Click here on how to use Funding Societies!

3. Unit Trusts / Mutual Funds

According to Fundsupermart, a mutual fund is a security that buys into a basket of assets (stocks, bonds, and other investment instruments) actively managed by a fund manager.

The value of each portfolio is the sum of the value of the investments (stocks, bonds) which they hold. You own a portion of the portfolio when you purchase a ‘unit’ of it. That’s it!

Appeal of Mutual Funds

- Diversification benefits – When you buy into a fund, you are getting exposure to the whole portfolio which consists of several instruments at once, thus providing the investor with better diversification through a single investment. This may make forming well-diversified portfolios a more attainable goal given how tedious and time consuming it may be should an investor decide to create a diversified portfolio out of solely individual securities. Aside from time constraints, capital and accessibility constraints may also prevent investors from achieving the same level as ETFs or unit trusts given the number of component securities they can potentially hold.

- Small min. investment amount – As mentioned previously for the ETFs part, you can get started from just $100 a month.

- Professional Management – For investors who are unsure of how to select individual securities or simply don’t have the luxury of time, you get a team of investment professionals to do it on your behalf for a small fee. *Do note that returns vary widely*

4. Small Cap Stocks

Small-cap stocks are generally defined as stocks that have a market capitalization ranging from $300 million to about $2 billion.

To add on, small cap stocks are generally selling at a cheaper price compared to the blue chips you know like Singtel and DBS Group.

We wrote previously here and here about why we favour small cap stocks. But nonetheless, we will still share 2 key points below:

(i) Smaller Base for Larger Growth

Before a stock becomes a large company, it often starts out as a much smaller base for lots of room to grow.

Think about it.

Is it easier to double or triple your sales/profits when its $1,000 or when its $1million?

Yeah, you got it…

It is no surprise to see explosive growth of >25% year after year esp. at the start.

Thus, they have much bigger potential to expand their business much easier and faster than a multi-billion dollar company that have already achieved maturity stage in their business.

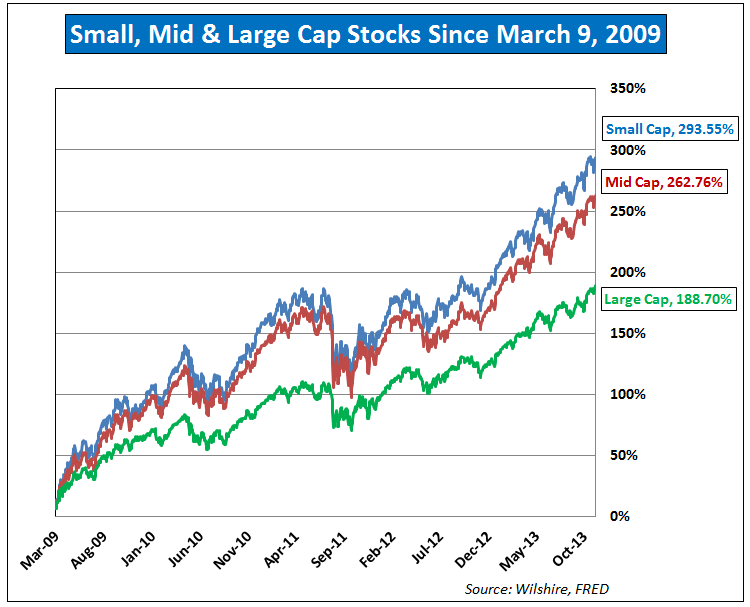

From the graph below, we can see that companies that are in the growth stage (usually small cap companies) have higher upside than companies in the maturity stage (large cap companies).

(ii) Lack of Coverage

Small companies do not get as much attention from the investing community. This has allowed small cap companies to go unnoticed, until the institution buyers started to discover them.

This has led retail investors like us to pose the chance to buy into quality small cap companies before they get noticed by the big players. Hence it is easier for retail investors to invest in small cap companies and outperform the market in the long run than holding large cap companies.

In fact, a lot of academic studies have actually proven that Small Cap stocks are able to outperform the Mid Cap and Large Cap companies over the long term.

To buy a small cap stock, you will need a brokerage account with any investment bank. The procedure for investing in listed small cap companies is the same as investing in exchange traded funds.

The minimum number of shares you need to buy a stock is 100 shares (1 lot). For example, No Signboard Holdings Ltd (SGX :1G6) is trading at S$ 0.15 per share, hence the minimum capital required is S$ 150 (S$ 0.15*100) excluding brokerage fees.

Investors should also take note on the commission fees charged by brokerage firms and trade lesser to minimize transaction cost. The higher the fees, the lower your return on investment (ROI).

Conclusion

We believe the best way to start investing is to do it with little money. This is because you will be able to learn from your investment mistakes when you have much lesser to lose at the start.

To end off, we offer you this quote by Lao Tzu:

Be it securing your comfortable retirement or saving up for your kids’ education, you would need to start off somewhere and get bigger and better in future.

So, what are you waiting for? Get started and make your dreams happen!

Want more insights into how to invest wisely? Join our 400+ strong community in our Telegram Group @ https://t.me/InvestorsExchange today!

That aside, do you know that Master Investors like Warren Buffett has his own Unique Investing System which you can emulate yourself? We have distilled it into a simple 10-Step Checklist for you to decide how or when to buy/sell your stocks.

Simply click to receive your copy today!