Silver price has gone up more than 36% year to date far outpacing the S&P gain of 20%. At the point of writing this article, the price of silver is USD32.70.

So far there is no bloggers that written articles on silver. Most wrote articles only on silver. Like gold, silver does not produce income and is similar to what Warren Buffet written on Gold. You view my Gold article here.

However, silver is also considered a precious metal. It can be used as both an industrial metal and monetary metal. In this article, I will talk about the reasons for buying silver as part of your investment portfolio and how to invest in silver in Singapore.

Reasons on investing in Silver

- Silver can be used as a monetary metal in times of crisis such as war, food shortage etc.

- Silver is a good investment from rising political tensions in the Middle East and in future China and Taiwan tensions.

- Silver is an alternative to the fiat currency and falling USD. When shit hit the fan and your country currency become worthless like the Turkish lira, silver can be used to buy food. It is cheaper than using gold to purchase goods and services.

- US debt now stands at USD35.9 trillion. US can never pay back its debts. The FED has to lower interest rates so that the interest payments can be reduced or print money to monetise the debt.

- Silver can also be used to preserve your wealth

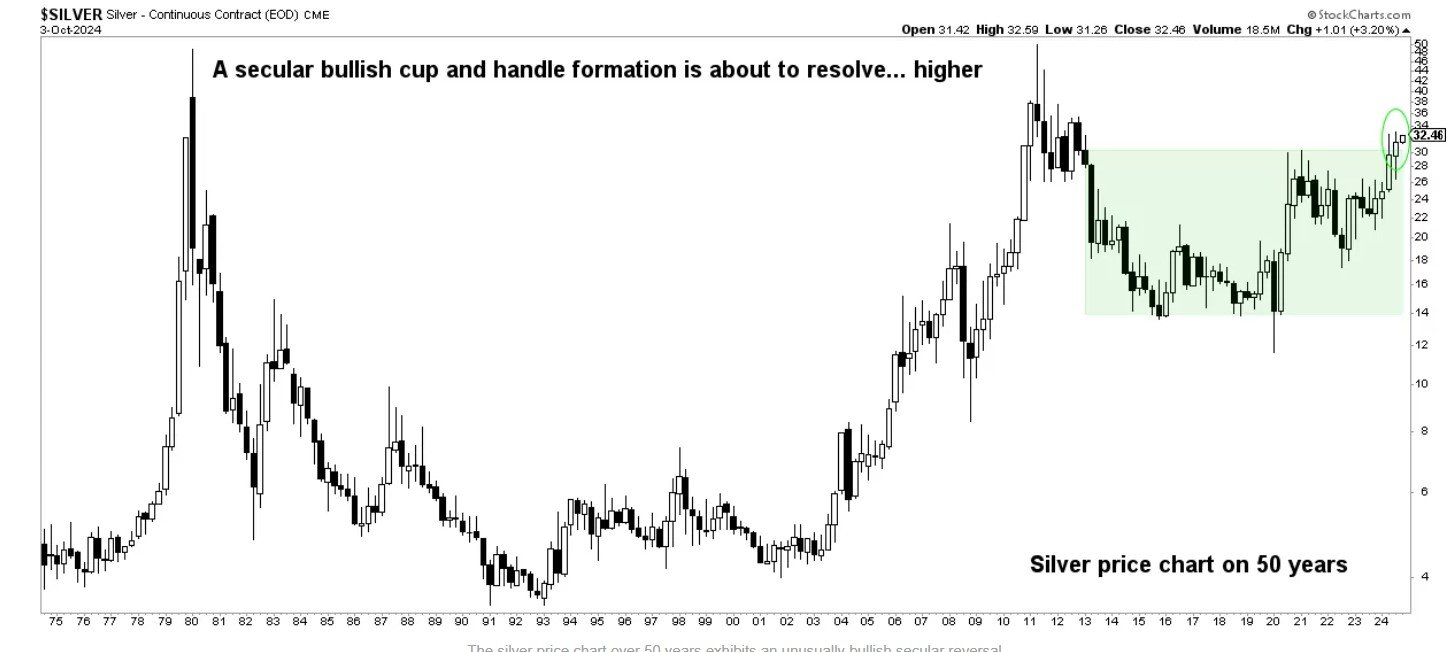

In terms of price appreciation, Silver is poised for a price breakout. It has been stated by many chartists that silver price chart looks like the mother of all cup and handles.

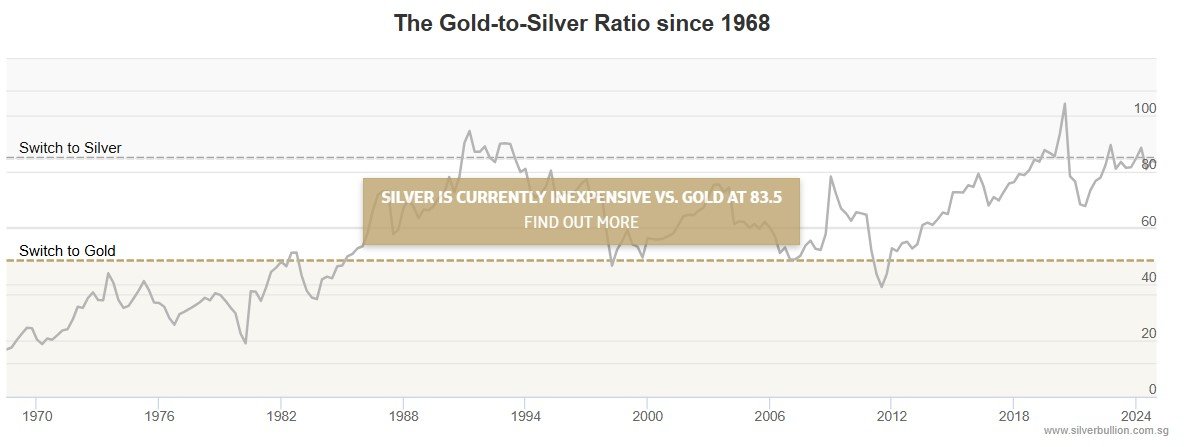

In addition, the current Gold to Silver ratio is at 80. The mean is about 50. Hence, Silver has more price upside than gold when reversion to the mean take place.

How to invest in Silver in Singapore

Once you have decided on buying silver as part of your investment portfolio, you can invest in silver in Singapore through various methods, each with different levels of risks and storage considerations. Here’s a guide on how to invest in silver in Singapore:

Physical Silver

You can buy silver bars or coins in Singapore from reputable dealers such as:

- BullionStar, Silver Bullion and GoldSilver Central. They are the more popular dealers in Singapore and has more varieties of Silver bars and coins to choose from.

Please note that United Overseas Bank (UOB) does not sell physical Silver. You can only buy from coin dealers.

However, if you buy from dealers, you need to check the premium over the spot price. Some dealers charge higher premiums than others. Also, you need to ensure that the Mint is a accredited by The London Bullion Market Association (LBMA).

The popular Mints will be the Royal Canadian Mint, Perth Mint, PAMP, Argor-Heraeus, etc. In addition, when you buy silver from dealers, it is advised to ask them to test for you the purity of silver. It should only be 9999 fine silver.

If you buy physical silver, the disadvantage is the storage cost. You can store the silver in your home or in a secure storage area that is offered by UOB, Bullionstar and Silver Bullion.

Silver Savings Account

You can open a Silver savings account at UOB. This account allows you to buy and sell silver without holding physical silver and thereby incurring storage cost. You can then profit from silver from the price appreciation. Bullionstar also offers the bullion savings program.

You need to be aware of the buy/sell spread and other fees that may apply.

Silver ETF

The 2 main ETFs are iShares Silver Trust (SLV) or Sprott Physical Silver Trust (PSLV) both of which are listed in the US. Though SLV is the more popular of the 2 ETFs, PSLV is preferred as PSLV is backed by 100% physical silver.

Silver crypto

For cryptocurrency backed by physical silver, you can check out Kinesis Silver (KAG). You can buy in centralized exchange such as Kucoin.

Silver Mining Stocks

Investors can also invest in Silver mining companies. In Singapore, there is no silver mining stocks listed in SGX. However, there are several silver mining companies listed in US. The companies are:

| First Majestic Silver (NYSE:AG) | A precious metals mining company that gets the majority of its revenue from silver. |

|---|---|

| Pan American Silver (NASDAQ:PAAS) | A mining company with significant silver reserves. |

| Wheaton Precious Metals (NYSE:WPM) | A precious metals streaming company with significant silver exposure |

Please note there is no silver certificate on sale at UOB. UOB only sells gold certificate.

Tips Before Investing

Before you invest in Silver, here are a few tips which might prove useful to you.

- You need to consider your risk appetite. Like stock prices, Silver also see price fluctuations. Unlike stocks where you may invest in the wrong company and cause you to lose money or worse case scenario, the company goes bankrupt. However, Silver investment does not have such problem.

- Always take note of the counter-party risk. If you buy Silver ETF, Silver savings account etc, there is always the counter-party risks. If you buy physical Silver, you do not face such risks.

- It is good to diversify your portfolio. Is not advisable to only have Silver in your portfolio. Have a mix of gold, silver, stocks, etc in your portfolio.

In this article, I describe on why you should consider buying silver and how to invest in silver in Singapore. Investors need to do their due diligence before investing in silver.