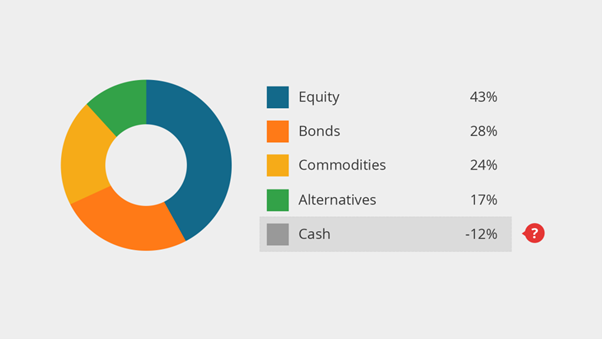

In every portfolio we hold a cash element, used for buying the dips or acting as a buffer for our day-to-day necessities. Cash is a must in every portfolio, but we frequently give up returns on this element, earning way below inflation.

Our hopes are that a cash balance allows us to take a risk elsewhere and earn way above inflation to make up for the difference overall.

What if there was a way to earn high yields on cash, without being exposed to market fluctuations like the S&P500 or other indexes.

Stable High Yield on Cash

It can be even more ideal if this rate of return is floating, allowing market forces to pull it up and compensate when opportunity cost is high / inflation is rampant.

Thankfully, such an investment tool that exists, albeit one in a completely different world. The world of Crypto.

Stablecoin deposits in Crypto is an investment tool that allows Users to generate yields on stablecoins, or tokens that are pegged to the USD.

Stablecoins like USDC & USDT are staples of the crypto world, having 100bil in circulation among the two of them. Let’s talk about using only these two as an investment tool, the risks, the returns and the how.

What are USDC/USDT?

USDC/USDT are centralized stablecoins, backed by a strong company Circle / Tether correspondingly. They are responsible for maintaining the peg (1 USDC/USDT = 1 $USD), and maintain USD reserves in a variety of investment grade assets (Commercial bonds, etc) that correspond to the amount of stables they have in circulation.

Tether allows users to deposit USD and get USDT through their sister firm crypto exchange, BitFinex. BitFinex users can arbitrage Tether, buying below $1 and selling above $1 against USD at BitFinex, helping maintain the peg.

Why can you get returns on Stablecoins?

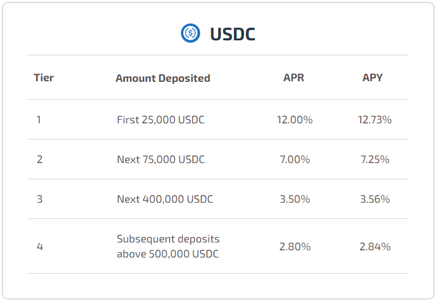

1. Centralized Platforms

There are companies that specialize in borrowing stablecoins from their users, and then invest it for them to earn a yield. They usually offer fixed rates on stablecoins, lower than the prevailing market rate on-chain (in crypto networks like Ethereum), earning the difference.

Some examples of such platforms are Celsius & Hodlnaut. These are the lower risk option for stablecoin deposits, and your only risk is the company your depositing in. However, they have grown to be staples of the cryptoverse, with Celsius having almost US $30Bil in deposits today.

Read more on Hodlnaut here: https://www.smallcapasia.com/hodlnaut-review-earn-up-to-10-5-yield-on-your-crypto-assets/

Other examples of such platforms can be exchange platforms such as FTX. To get higher returns, we must move on-chain, bridging your money into crypto networks like Ethereum or Solana.

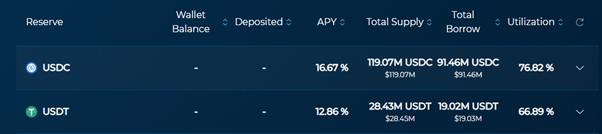

2. DeFi Money Market Platforms

Money market platforms are the simplest stablecoin deposits on-chain. They are lend/borrow platforms, allowing stablecoin holders to deposit their stablecoins to earn a yield. They turn around and lend these stablecoins to people who trade or invest with it and charge them a borrow APY.

This “borrow APY” would then be distributed to the suppliers as a “Supply APY”, the function is usually Borrow APY * Utilization (how much is borrowed) = Supply APY.

This allows users to deposit stablecoins into their platform and earn a yield, relying on the platform’s smart contracts to automate the borrowing and interest collection process.

Crypto High Yield for your Portfolio

We all have investments like REITs or Bonds that pay out high cashflow with stable price fluctuations. This serves as a good anchor for high-risk portfolios, or an income tool for those with large portfolios aiming to live off the income generated.

The key with this strategy is that if the stablecoin & platform is safe, capital is guaranteed thanks to the stability of the peg, instead of floating like REITs are. They can both be a high dividend tool, or a way of generating returns above inflation on idle cash.

This allows you to hold more cash without worrying about inflation eating away at it, useful for investors of all walks of life.

For me, due to the high volatility of the crypto world, I control my weightage of stablecoin as a counteracting force to the rest of my portfolio, scaling up its weightage in bull and deploying from it in a bear. This leverages the ease of swapping stables into other crypto assets further.

Risk Premium

You’re probably wondering about why these high returns on stable coins exist, and wondering if its too good to be true.

These returns are mainly high because traditional financial institutions can’t go in and deploy their mountains of cash to depress the rates.

While these rates are attractive, there still involves quite a significant increase of risk compared to SGD in a DBS bank account, and USDC in Tulip’s platform.

So before you get too excited, let’s talk abit about these risks.

1. Regulatory Risk

The largest risk involved with these stablescoins are the risk of the stablecoin itself, mainly coming from regulatory sources.

The Securities Exchange Commission isnt a fan of stablecoins, as they see it as a tickling timebomb or a threat to the US Dollar.

There exists a small threat that the SEC will clampdown on stables, but that hasn’t happened yet, and with 100bil in circualtion, USDC/USDT is as safe as investment tools can get.

2. Stablecoin Risk

There will always be a threat that the stablecoin uses its peg to the USD, we once saw Tether fall to as low as $0.94.

Centralised stablecoins with their strong respective backers like Circle and Tether are less prone to failure, as they have billions of reserves to defend the peg if necessary, allowing users to withdraw with them at $1, in the situation that it falls below $1.

However, many smaller stablecoins like IRON has fallen in the past. It might be a good reading experience to read the history of these stablecoins and be aware of any high risk stablecoin project like Iron.finance, promising 1% a day but eventually depegging to $0.75 and staying there.

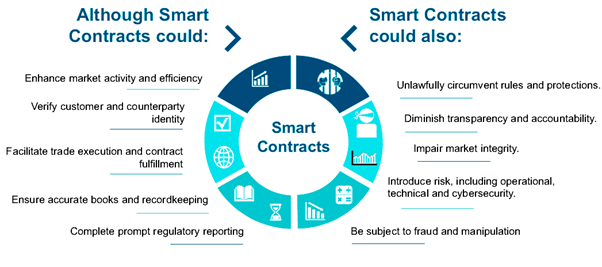

3. Smart Contract Risk

When depositing into DeFi platforms like Tulip or Anchor protocol, there exists an additional risk known as smart contracts risk. These platforms rely on smart contracts to govern and automate their functions.

There have been many cases in the past where a bug in a smart contract allowed hackers to drain the entire vault.

We can manage this by investing in protocols with large Total Value Locked, like Tulip at 1bil TVL, or using platforms that are audited. These aren’t failproof methods though, there have been audited platforms that was still drained.

Interested to get US$20 signup bonus from Hodlnaut? Just use my referral link here to get started!

This article is written by Soju from Metafrens, a community discord of like-minded Crypto users, whether it is DeFi or Play2Earn players. Learn more and participate at: https://discord.gg/PVe7p8MAZT