Breaking news!

Our 3 local banks DBS, UOB and OCBC are raising fixed rate home loans to as high as 3.85%.

In this article, we are gonna try to dig into the past home loan interest rate history and answer the question on everyone’s minds – How much will mortgage rates go up in 2022 in Singapore?

If you would like to watch a video instead, you can click on the Youtube video below.

Trajectory of mortgage rates

First of all, lets digest the news a bit.

Due to the rising interest rate environment, our 3 local banks are reviewing their fixed rate packages.

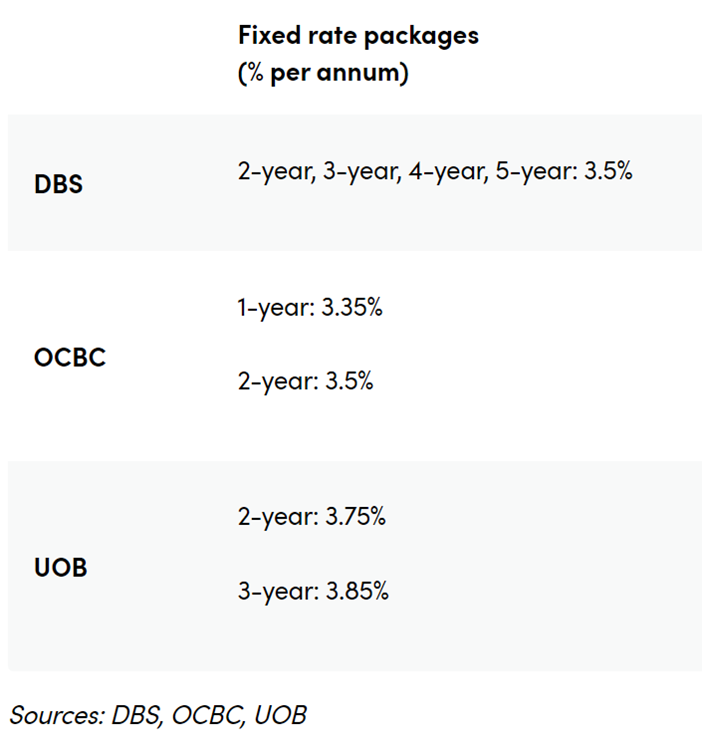

DBS is offering four fixed rate packages available, ranging from two to five years. All four are set at 3.5% per annum.

https://www.dbs.com.sg/personal/rates-online/home-loans.page

This is a steep increase from the 1.8% 5-year fixed rate in 2020. So we are looking at around a 1.7 percentage point increase in just 2 years time.

OCBC also announced that it would be adjusting its two-year fixed rate package to a 3.5. UOB’s rate is slightly higher at 3.75% for a 2-year fixed rate and 3.85% for a 3-year fixed rate home loan packages.

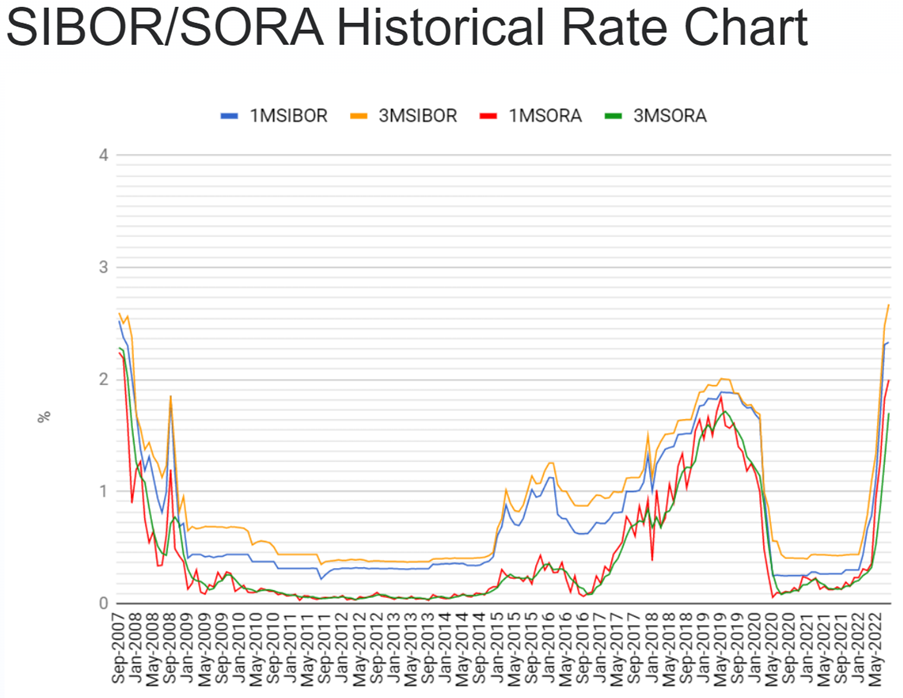

The latest adjustments mean that mortgage rates in Singapore are now at their highest since 2008.

Most mortgage loans are now pegged to SORA since last year’s massive shift from the Swap Offer Rate (SOR) to SORA as announced by MAS.

The most important question here for many property owners or prospective buyers would be:

How much will interest rates go up in 2022 in Singapore?

In order to understand that question, we need to look at the US Federal Funds Rate which is directly correlated to the SORA benchmark we use for mortgage loans in Singapore.

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

If we look back at the US Fed Funds Rate Historical Chart over the past 62 Years, we can see how it has gone crazy to 20% before in year 1980, effectively killing the housing market back then.

The 3 main reasons that drove the interest rates so high were sky-high inflation brought on by rising oil prices, government overspending and rising wages – very similar to what we are seeing now.

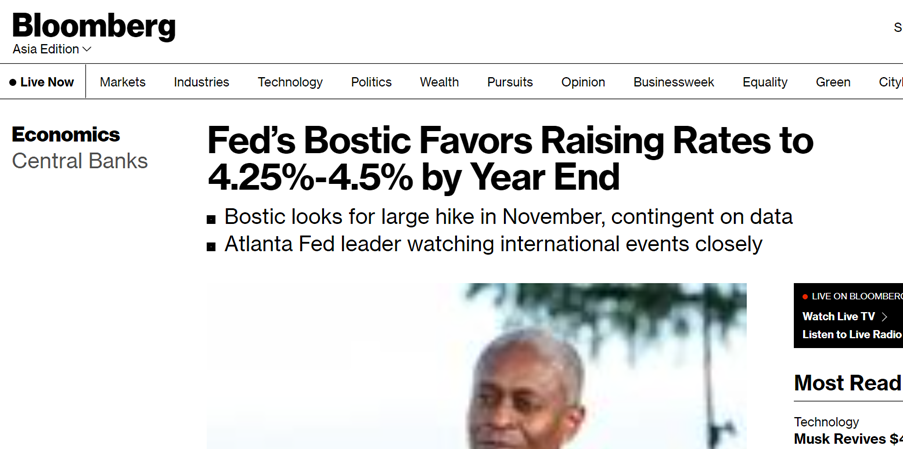

The U.S. central bank has officially increased the benchmark interest rate from near-zero in March to as high as 3.25% in September.

What’s more shocking is that, the Fed isn’t done yet.

In updated projections, the Fed signaled plans to lift rates by another 1.25 percentage points before year 2022 is over. This will bring the interests rate to another high of 4.25-4.5 percent.

With inflation showing no signs of slowing down yet, we can expect that our Singapore’s interest rates will rise in tandem as well.

And to answer the question of how much will interest rates go up in Singapore – I am not sure but in my opinion, interest rates will break through 4% in the next few months and likely to stay elevated until inflation comes down – which means we are seeing a recession forming right now.

Impact of New Mortgage Rates

Finally, this fast and furious home loan rates must be pretty scary for property owners. I have taken the liberty to guage the impact of the new rates by doing 2 calculations.

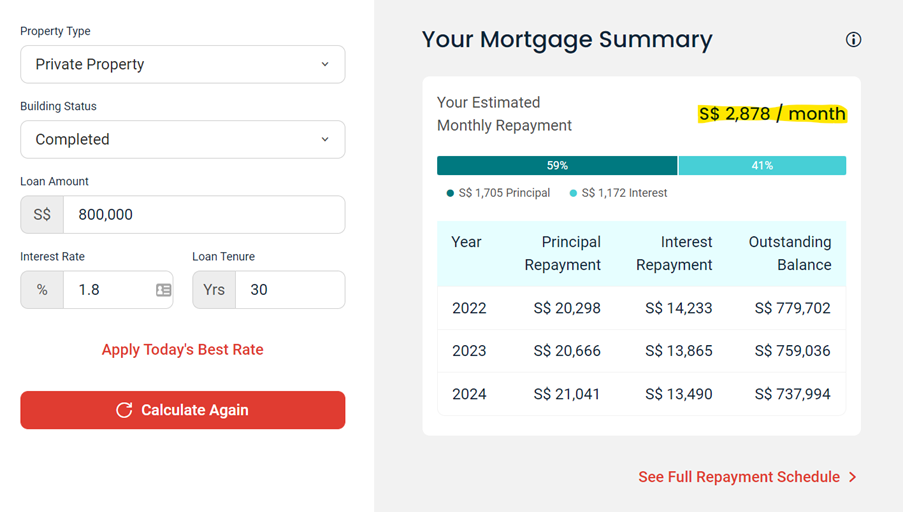

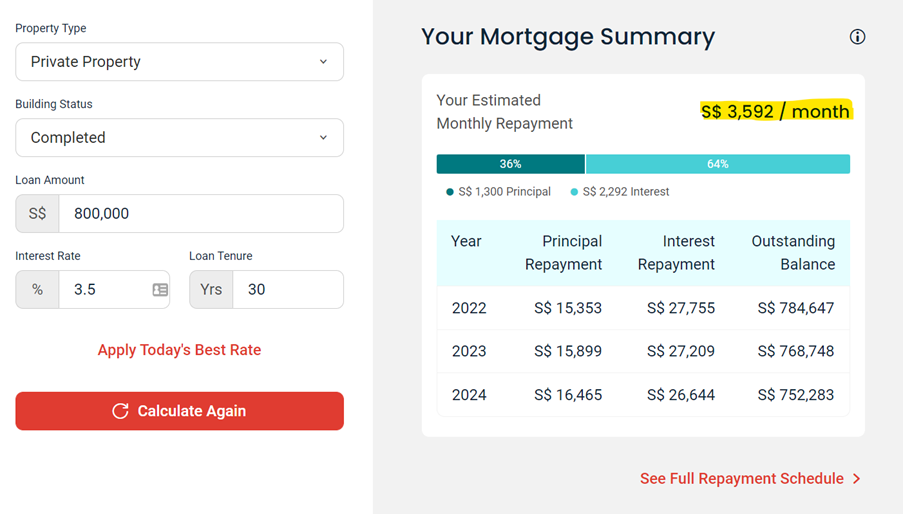

Assuming we are buying a million-dollar condo or HDB, 20% down-payment and 80% loan for 30 years.

The 1st interest rate is 1.8% based on DBS fixed rate in 2020 and the monthly repayment comes up to be S$2,800/mth.

The 2nd interest rate is based on the latest rate of 3.5% in Oct 2022 and the monthly repayment comes up to be around S$3,500/mth.

That is a $700 or 25% increase from the home loan package 2 years back!

My Personal Take

This is not likely to be the last interest rate increase. The U.S. and U.K. mortgage rates have already surpassed 6% and 5% respectively as we speak!

Hence, it makes sense for property owners to be prudent in this current climate and always have a rainy day fund!