Geo Energy Resources Limited is setting its sights on an ambitious goal: transforming into a billion-dollar energy company.

With strategic initiatives and robust financial performance, this Indonesian coal producer is charting a path toward significant growth. Geo Energy’s recent moves have captured the attention of investors and market watchers, making it a key player in the evolving energy sector.

In this article, we’ll delve into Geo Energy’s recent robust financial performance, exciting growth initiatives and explore how they’re paving the way for the company to achieve its ambitious goals.

Geo Energy Corporate Profile

Geo Energy Resources Limited, founded in 2008 and listed on the Singapore Stock Exchange in 2012, is one of the major Indonesian coal producers

The company operates five mining concessions in Kalimantan and South Sumatra, focusing on low-cost production of premium coal with low ash and sulfur content. In addition, Geo Energy has a strategic partnership with PT Bukit Asam Tbk, a leading state-owned coal mining company in Indonesia, through a 49% equity stake in PT Internasional Prima Coal.

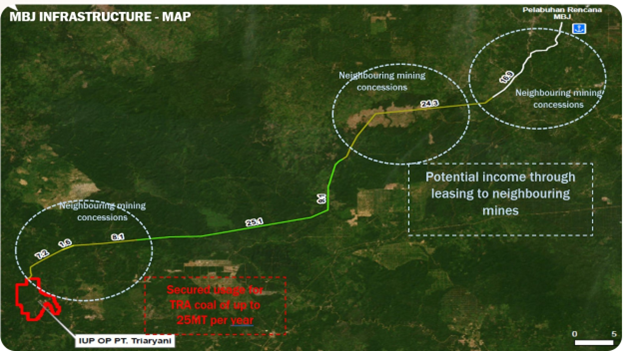

Moreover, the company’s infrastructure arm, PT Marga Bara Jaya, is developing a robust transportation network capable of handling up to 50 million tonnes of coal annually. This infrastructure is designed to support the growth of the company’s TRA coal mine and create new opportunities within the broader energy value chain.

Geo Energy has built a strong reputation for its efficient operations and strategic partnerships, which have positioned it as a leading player in the regional coal industry.

Signs USD150 million Contract For Infrastructure Development

Geo Energy’s growth prospects are driven by its strategic initiatives, which include the development of integrated infrastructure projects and partnerships with industry leaders.

As per the press release, a cornerstone of this strategy is the USD150 million Engineering, Procurement, and Commission (EPC) contract for constructing an integrated infrastructure in South Sumatera and Jambi Province, Indonesia.

This project, in collaboration with CCCC First Harbor Consultants Co. Ltd and Norinco International Cooperation Ltd, is set to enhance transportation efficiency and provide access to international export markets.

Notably, the two partners are among the largest state-owned Chinese enterprises, have established track records and strong capabilities in the construction and development of transportation infrastructure.

The approximately 92-kilometer hauling road and a jetty is designed to support Geo Energy’s production capabilities and market presence.

With a targeted haulage capacity of 40-50 million tonnes per year, the project will significantly bolster the company’s ability to meet growing demand and capitalize on emerging opportunities in the global energy market.

Contract’s Financial Arrangements

Moreover, the Project will primarily be funded by the Contractor, covering more than 85% of the total cost. A deferred payment plan has been implemented for this Project, allowing Geo Energy to only start paying the Contractor two years later.

The deferred payment arrangement provides ample time for the integrated infrastructure to become operational and generate sufficient cash flow to cover these obligations.

Another Growth Catalyst as an Infrastructure Provider

According to a recent news article in July 2024, Singapore sovereign wealth fund GIC announced that it is part of a consortium that will take up a stake worth US$1 billion in a unit of Indonesian toll-road operator as Asia-Pacific sees growing investor interest in infrastructure assets.

For Geo Energy’s integrated infrastructure, it has targeted road haulage capacity has up to 40-50 million tonnes per year, of which at least 25 million tonnes are reserved for the Group’s PT Triaryani (“TRA”) coal mine as TRA scale up the production of up to 25 million tonnes per annum, with logistical cost savings of up to USD10 per tonne.

In addition, the remaining capacity of the road haulage can be leased to neighbouring mines, which can potentially expand its value proposition and diversify its revenue stream as an infrastructure provider.

Furthermore, with Geo Energy business roots in Indonesia, there are potentially opportunities for them to expand their infrastructure business activities, enhancing their business diversification strategy.

Future Growth Plans

Geo Energy has also entered into a non-binding memorandum of understanding (MOU) with the contractors to explore further collaborations in mining services, coal offtake, financing, and operations and maintenance of the integrated infrastructure.

According to the press release, Mr Charles Antonny Melati, Executive Chairman and Chief Executive Officer of Geo Energy has this to say (summarized):

“Today, we take a decisive step towards unlocking the vast potential of the Group’s TRA coal mine, which has 2P reserves of at least 274 million tonnes of low sulfur and low ash quality coal reserves with a mining life exceeding 20 years. Further, we are also planning for additional drilling and exploration with a targeted increase of 2P reserves to over 300 million tonnes.

Our Integrated Infrastructure is strategically designed to minimise transportation time, achieve substantial cost savings in our logistics operations and provide a captive market for natural resources in that region and diversify the Group’s revenue stream as an infrastructure provider. This development is expected to be completed between late 2025 and early 2026.

The Integrated Infrastructure will allow the Group to ramp up production up to 25 million tonnes per annum, with logistical cost savings of up to USD10 per tonne. Assuming the coal price remains at the current levels, Geo Energy will then be able to generate an estimated USD400-USD500 million EBITDA per annum.”

All in all, this is an important milestone for the company and the strategic partnership can help unlock greater value and reduce capital expenditure investments, aligning with Geo Energy’s vision of becoming a leading coal producer in Indonesia.

Financial Resilience

Geo Energy’s financial performance in recent years has demonstrated its resilience and adaptability in the face of market challenges.

In the first half of 2024, the company reported a net profit of USD 26.8 million, despite fluctuations in coal prices. Geo Energy maintained stable coal sales of 3.2 million tonnes, achieving a cash profit per tonne of USD 11.94.

This underscores the company’s robust cost model and efficient operations, enabling it to navigate market volatility effectively.

Geo Energy’s commitment to shareholder value is reflected in its interim dividend declaration of 0.2 SG cent per share, representing a 11.4% payout ratio.

In response to Geo Energy’s 1H2024 results and future outlook, Executive Chairman & CEO Charles Antonny Melati remains upbeat and said (summarized):

“In anticipation of seasonal heavier rainfall in the first half of the year, we have recalibrated our mining plan in SDJ and TBR coal mines, to open more pits and ramp up our coal production in 2H2024.

As part of our ambitious growth plans, the Group has recently initiated the development of its world-class integrated infrastructure (hauling road and jetty owned by PT Marga Bara Jaya) with the signing of an EPC cooperation contract valued at around USD150 million, with a consortium comprising CCCC-FHC and NORINCO, two of the largest state-owned Chinese enterprises.

Recognising underinvestment in both new and existing coal capacity globally, we have a clear, concise business roadmap that can expand our production capacity yearly, reduce our logistics costs and propel the Group to be one of the top coal producers in Indonesia.

Moving ahead, we will continue to take proactive steps to expand our value proposition within the energy value chain and position our business model towards our vision of becoming a billion-dollar energy group.”

Uncovering Geo Energy’s True Value

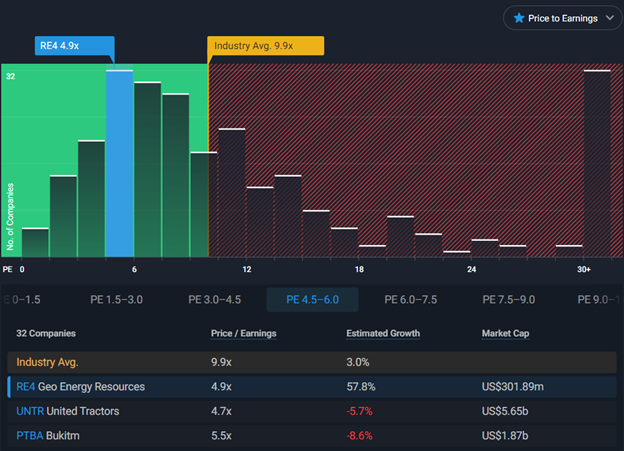

Geo Energy currently trades at a remarkably cheap valuation of 4.9 times its earnings, significantly lower than the industry average of 9.9 times. This stark undervaluation suggests that the market may be overlooking the company’s growth potential.

The company’s impending integrated infrastructure project is also poised to be a game-changer. With the capacity to boost production to 25 million tonnes per annum and reduce logistics costs by USD10 per tonne, Geo Energy is on track to generate an estimated USD400-USD500 million in EBITDA annually.

This translates to an astonishingly low forward EV/EBITDA multiple of ~1x when everything is up and running, making the stock appear exceptionally cheap relative to its growth prospects.

Given its strategic focus on low-cost production and its expanding operations, this discounted valuation presents an intriguing opportunity for investors seeking undervalued gems in the energy sector.

Conclusion

In conclusion, Geo Energy Resources Limited is embarking on a transformative journey toward becoming a billion-dollar energy company.

Through strategic partnerships and growth initiatives such as the integrated infrastructure project, the company is charting a path to significantly enhance its operational capabilities and cash flow generation.

As the company continues to execute its growth strategy, it stands poised to deliver significant value to shareholders in future.