Excerpts from Maybank report

Genting Singapore (SGX: G13)

Genting Singapore is riding on travel recovery

- With borders reopening earlier than expected, we raise our FY22E/FY23E earnings by 163%/123%. Yet, our FY24E earnings are barely changed (-2%) as we doubt gaming operations will recover to 100% of pre-COVID-19 levels.

- We have also introduced an expanded ESG tear sheet for GENS and assigned it an above average overall score of 80, based on its aggregated quantitative/qualitative/target-based metrics.

Maintain HOLD call and tweak TP to SGD0.86 (+2%)

South East Asia has reopened for travel

As Singapore (SG), Malaysia (MY) and Indonesia (ID) reopened their borders (SG & MY: 1 Apr 2022, ID: 22 Mar 2022) coupled with SG axing pre- and post-arrival testing on 26 Apr 2022, 2/3 to 3/4 of SG’s FY19A gaming market has returned.

Our channel checks note a discernible rise in tourists in SG since. Thus, we bring forward our forecast that RWS’ VIP volume will recover to 83% of FY19A levels to mid-FY22E from FY24E and RWS’ mass market GGR will recover to 92% of FY19A levels to FY23E from FY24E. These raise our FY22E/FY23E earnings by 163%/123%.

China has changed the Asian gaming landscape

Yet, our FY24E earnings are barely changed (-2%). We doubt SG and RWS’ VIP volume will recover to 100% of FY19A levels due to China (CN) outlawing cross-border gambling punishable by ≤10 years’ imprisonment from Mar 2021.

We also doubt that SG and RWS’ mass market GGR will recover to 100% of FY19A levels as Macanese, Philippine and Cambodian integrated resorts (IR) negatively impacted by the above will try to draw premium mass gamblers that frequent SG IRs to compensate.

Potential Thai IRs raises questions on RWS 2.0

Moreover, Thailand (TH) is mulling legalising IRs. We doubt TH IRs will draw away many MY and ID gamblers due to deep personal and commercial ties to SG but gather that they will draw away many CN mass gamblers (c.1/3 of FY19A SG mass market GGR).

Even without IRs, a whopping 11m Chinese visited TH in 2019 (SG: 3.6m). Should TH IRs materialise, we would wonder how financially viable the SGD4.5b RWS 2.0 expansion will be (SGD929.1m invested as at end-4Q21).

Genting Singapore valuation/recommendation

Owns and operates Resorts World Sentosa, one of two integrated resorts in Singapore. ROE<WACC due to VIP market slowdown driven by Chinese economic slowdown.

Will consider expanding into other markets if projected IRR>15% and group ROEs return to >10%. Redeemed SGD2.3b perpetual securities in 2017.

Balance sheet in a resoundingly net cash position. We gather that GENS may pay special DPS if there are no major expansion opportunities.

Maintain HOLD call and tweak TP to SGD0.86 (+2%)

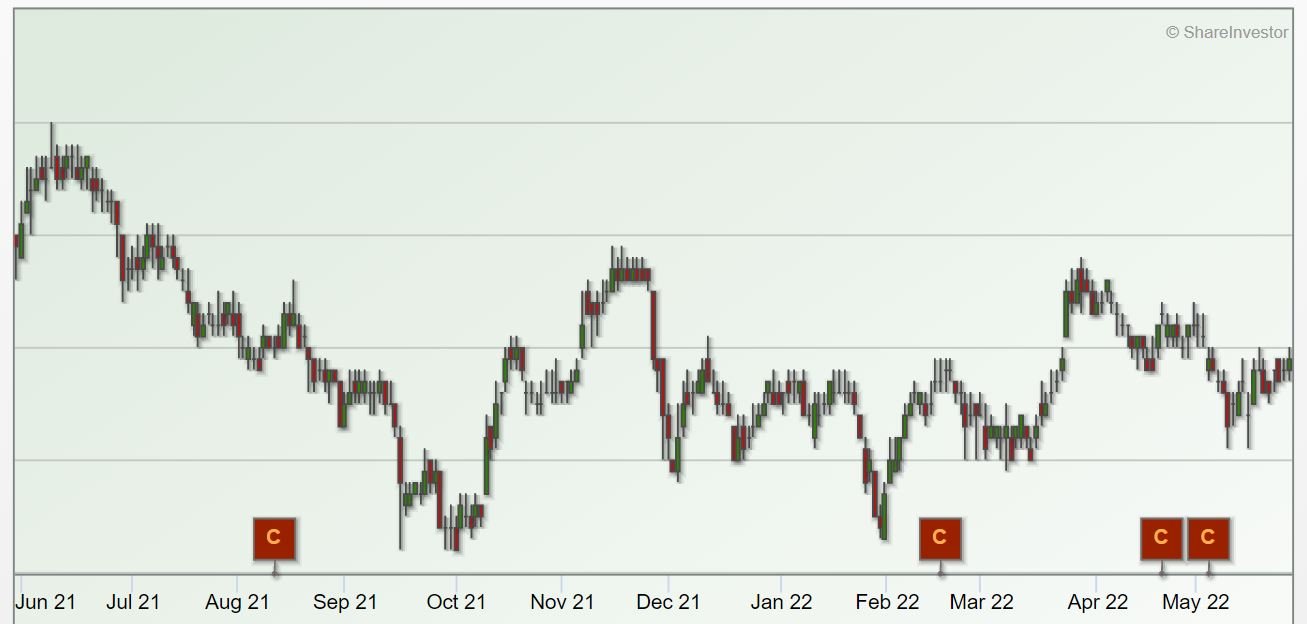

Genting Singapore 1 year price chart

You can find the full report here and the company website here