With all the hype surround 5G and tech, semiconductor companies have been on the craze lately. AEM’s year to date returns hit an all time high of +105% and the hype surrounding AEM carried the other semiconductor stocks up as well during the rally.

Amongst the semiconductor picks in the market, Frencken has been receiving quite a lot of attention lately. Could Frencken be the next AEM in the making?

1. Introduction of Frencken Group

Frencken Group Limited is a Global Integrated Technology Solutions Company that provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the automotive, healthcare, industrial, analytical & life sciences and semiconductor industries.

They offer end-to-end solutions to customers across the entire value chain – from product conceptualization, integrated design, prototyping and new product introductions, to supply chain design and management, state-of-the-art value and volume manufacturing and logistics services.

2. Frencken Group’s Financial Performance

(i) Revenue

[visualizer id=”9176″ lazy=”no” class=””]

Note : Chart figures are in S$’000

Frencken has been able to consistently grow its top and bottom line for the past 5 years. Knowing this, it shows that the management has been actively growing the company to bring shareholders increased value as time passes.

For a company to not only grow its revenue but also its net profit, the management has to be innovative and efficient, increasing overall revenue whilst lowering cost of goods and services.

(ii) Financial Ratios

[visualizer id=”9178″ lazy=”no” class=””]

Note : Per share data is in S$ cents

We can also see that Frencken has been able to healthily grow in terms of its profitably in the past 5 years. We can see that its return on equity has steadily grown to a remarkable 15.1% in FY2019.

It has also managed to grow its Earnings Per Share, Dividends Per Share as well as Net Asset Value per share consistently over the past 5 years.

3. Management Team

Frencken Group Limited’s Chairman, Dato’ Gooi Soon Chai, has over 30 years of experience in the global tech industry.

He is presently Senior Vice President of Keysight Technologies and President of Keysight’s Electronic Industrial Solutions Group, driving Keysight’s business across a broad set of electronic industrial end markets, focusing on high-growth applications in automotive and energy, consumer electronics, education and semiconductor industries. He is currently the 9th largest shareholder with 6,365,023 shares or 1.49% to his name.

It is also good to note that he serves as a director in Micro Compact and Precico Holdings, thus increasing his indirect deemed interest in Frencken. His total deemed interest in Frencken comes up to about 92,752,668 shares or about 21.8% interest.

Frencken Group Limited’s President and Executive Director, Dennis Au, has over 30 years of experience in the high tech industry for aerospace & defense, automotive, communications and semiconductor markets.

He is also the CEO of the Mechatronics Division and oversees the division’s business development and expansion plans in Europe, Asia and the USA. He is currently the 17th largest shareholder with 3,487,000 shares or 0.818% stake to his name.

Frencken Group Limited’s Vice President of Operations, Wang Liang Horng, is responsible for providing operational leadership for all the Group’s key programs, enhancing the relationships with customers worldwide and overseeing the implementation of strategic initiatives at both our business divisions.

Mr Wang has over 20 years of experience in the semiconductor equipment and high technology industries.

4. Potential Growth Catalysts

(i) Growth in Industry Demand

Based on PWC Global’s publication in 2019, we can expect the semiconductor industry to grow in view given today’s rapid technological innovation.

The demand for chips related to the rapidly growing use of AI will contribute significantly to the industry’s overall growth.

Of the 7 component types analyzed in the report, memory chips are expected to continue to maintain the largest market share through 2022.

Every application market is likely to grow through 2022, led by the automotive and data processing markets. Lifting these segments will likely be the demand for chips related to AI.

Frencken is a key beneficiary from the rising demand in the semiconductor industry as Frencken has good exposure of 30% revenue to the growing semiconductor segment.

Frencken also has business with companies across a few industries such as healthcare, industrial, automotive and life sciences. As such, the increase in demand for these industries will also be beneficial for Frencken’s growth.

(ii) Consistent Performance

Even though the past should never be used to predict the future, Frencken’s 5 year performance shows that the management is doing a good job growing the top and bottom line, bringing increased value to shareholders.

With the right management team, shareholders can take comfort knowing that the management’s interests are aligned with shareholders.

Final Thoughts

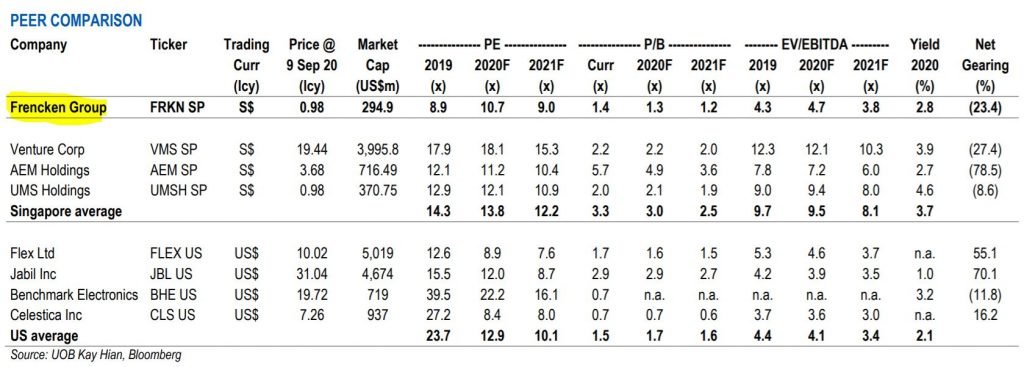

Lastly, we take a peek at its peer comparison from a UOB Kay Hian analyst report.

A quick comparison indicates that Frencken Group’s valuation metrics (be it P/E, P/B or EV/EBITDA) are lower than that of its bigger peers.

If Frencken Group continues to ride on the tailwinds of the growing semiconductor field, the company will still have a long runway of growth.

Want more of such top ideas and exclusive content? Subscribe to our FREE newsletter here and get our “36 Timeless Investment Principles & Checklists” guide as an instant download.