Dyna-Mac Holdings is making BIG headlines these days, a far cry from the turbulent times in year 2020 and before.

From the recent acquisition of Exterran Offshore for US$8.25 million, securing a JTC Lease to boost fabrication capacity, and winning the LowCarbonSG award, it is now even offering a bonus warrants issue to reward shareholders.

So what makes Dyna-Mac tick? We shall now take a ‘deep’ look at Dyna-Mac in this article and see if it deserves a spot on your radar.

Business Model

For a quick background, Dyna-Mac mainly constructs floating, production, storage, and offloading (FSPO) structures and ships and sells them to clients in the oil & gas, marine construction and other heavy industries.

In general, these huge structures are used to (in chronological order):

- extract crude oil or natural gas from deep sea wells

- process these fossil fuels

- store them in tankers

- transport them to ports

These FPSO structures require big investments in fixed assets, a big space in shipping yards to construct them, deploying high-tech equipment and machinery in the process.

Source: Dyna-Mac Annual Report 2022

According to the Annual Report 2022 above, FSPOs or Topside Modules are essentially Dyna-Mac’s main business segment, making up about 93% of its revenue.

In other words, Dyna-Mac is closely intertwined with the fortunes of the oil & gas industry.

Pivot to New Strategy

According to a BT interview, Dyna-Mac’s CEO Mr. Lim Ah Cheng faced significant challenges when he assumed leadership at Dyna-Mac while the firm was reeling from the recent demise of its founder and poor financial results.

The company had experienced a net loss of S$23.8 million in FY2019, prompting Mr. Lim to re-assess its strategy. Departing from the traditional tendering approach, Dyna-Mac focused on building relationships and adding value for customers, offering advice on cost reduction and collaborating on module design.

Despite deeper losses in FY2020, this shift in strategy paid off, with the company turning profitable again in FY2021 and more than doubling earnings to S$13.1 million in FY2022.

Strong Foundation for Financial Recovery

The robust financial results achieved by Dyna-Mac over the last two years, marked by a nearly fourfold increase in revenue to S$291 million in 2022, serve as evidence that the company’s strategy pivot has worked well to establish a solid foundation for future growth.

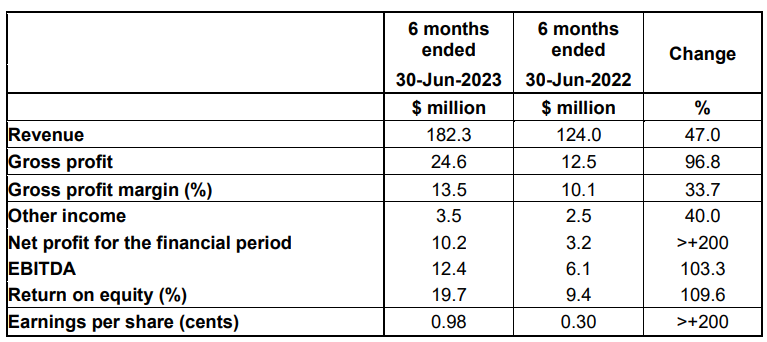

Source: Dyna-Mac 1H 2023 Results

In its latest half-yearly results, the revenue increased by a further 47% from S$124 million in 1H 2022 to S$182 million in 1H 2023. Likewise, its net profits shot up over 200% to S$10.2 million during the same period.

Bonus Warrants to Reward Shareholders

As a show of appreciation to its shareholders, it has recently announced an exercise to offer 207,384,840 warrants to existing shareholders. This means that for every 5 Dyna-Mac shares owned, shareholders have the opportunity to purchase 1 warrant.

Assuming that the Bonus Warrants are fully exercised and converted into New Shares, the issued share capital of the Company would increase to 1,244,309,040 Shares.

Important: Any person who wants to participate in the Bonus Warrants Issue has to own shares of Dyna-Mac before 15 January 2024.

This development is particularly positive, as the warrant grants the holder the option to acquire Dyna-Mac shares at a favourable price of S$0.15. Furthermore, Dyna-Mac expects to get about S$31.1 million in proceeds to reinvest in yard development and for working capital purposes.

To account for the dilution from the bonus warrants, assuming a conversion rate of 100%, Maybank Research’s target price has been lowered to 38 cents from 51 cents, pegged to 16.5 times Dyna-Mac’s FY2024 P/E.

This still implies a potential upside of around 27% from the existing share price of S$0.30.

Bright Outlook

The oil & gas sector is anticipated to remain stable in 2024, according to Deloitte, which forecasts an estimated US$580 billion of hydrocarbon investments bolstered by the whole industry’s free cash flow of US$800 billion.

In addition, Reuters projects that crude oil prices will remain above US$80 per barrel throughout 2024, surpassing the December 2023 figure of US$77.

Similarly, Dyna-Mac’s FSPO business is expected to demonstrate stability in 2024, supported by its healthy order book. The company’s total order book has seen a noteworthy increase, rising from S$412 million in 2022 to S$543 million in the first half of 2023. Maybank further anticipates that Dyna-Mac will secure additional orders ranging from S$200-S$350 million by the first half of 2024.

Looking forward, Mr. Lim envisions diversifying Dyna-Mac’s portfolio beyond the oil and gas sector, exploring opportunities in pharmaceuticals and green energy. Furthermore, the company is contemplating potential acquisitions to drive further growth i.e. Exterran Offshore.

Through the acquisition, Dyna-Mac will gain access to Exterran’s Offshore yard facilities spanning approximately 4.5 hectares along Gul Road. This strategic move will augment the group’s fabrication capacity, enabling it to undertake more extensive projects.

Conclusion

In summary, Dyna-Mac stands out as a robust player in the FSPO sector, showcasing a resilient financial rebound.

With a positive outlook for the Oil & Gas sector in 2024, Dyna-Mac is poised for another year of strong performance, supported by a healthy order book and strategic initiatives for diversification and potential acquisitions.