Excerpts from DBS Group Research report

- Data centre REITs’ recent correction presents opportunities to buy “growth at attractive prices”

- Compared against DBS’s metrics, KDCREIT and DCREIT came out on top to ride on the sector’s rapid growth

- Pipelines remain crucial for REITs to tap into, as returns remain compressed due to high competition

- AREIT and MINT provide diversified exposure to a wider “new economy” spectrum but with a more steady but sustainable growth profile

Data centre REITs’ price correction provides opportunity to buy growth at attractive prices

We believe that data centre (DC)-focused S-REITs will remain a key part of investors’ portfolios going forward.

We remain convinced that DCs remain the “oil” for the digital world post COVID, with demand exceeding supply, which translates into a continuously tight transaction market with improving operating metrics.

With the recent share price correction, yields for the four DC-focused S-REITs have expanded to >5.0% on average, and we see attractive re-entry points at the current levels.

The market appears to have “discounted” the superior growth that our DC-focused S-REITs offer to investors, especially when selected S-REITs have significant pipelines that can be acquired from their respective sponsors over time.

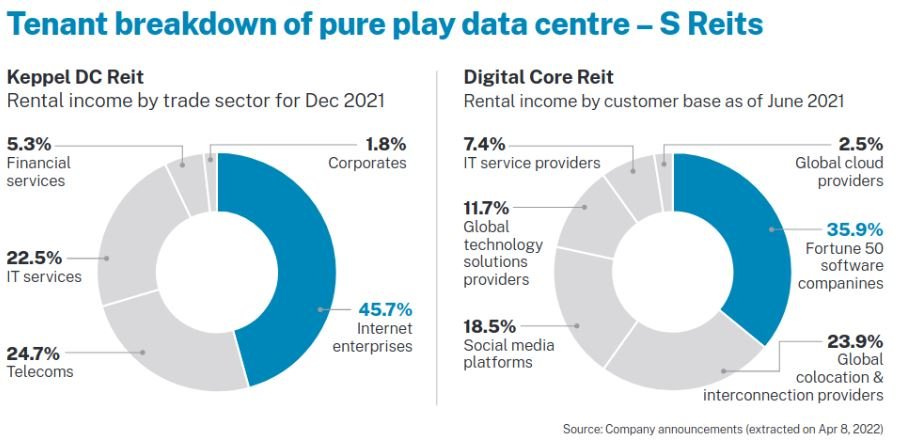

KDCREIT and DCREIT stand out as our preferred plays in our value metrics.

We compare the DC-focused S-REITs over seven holistic metrics covering

- concentration risk and geographical exposure,

- DC type and acquisition pipeline,

- debt headroom, valuations, and growth.

Based on this scoring system we have formulated, KDCREIT and DCREIT stand out.

Amongst the metrics, we believe that having sponsors that are both owners and operators will lead to both REITs acquiring operational data centres (“colocation”), which we believe translate into more sticky tenants and drive stronger earnings growth.

Data centre exposures complement AREIT’s and MINT’s “new economy-focused” portfolios

Although MINT and AREIT started out and recently pivoted into the DC space, their operational scale and diversity should be valued.

We believe that their balanced exposures, including other new economy segments (logistics, IT parks, life science parks), provide myriad growth drivers for the respective REITs.

The rise of data centre-focused S-REITs

First data centre REIT listed in Asia, KDC still the purer play for Singapore. In December 2014, Keppel DC REIT (KDCREIT) was the first data centre REIT to be listed in Asia, with an initial portfolio of eight properties with an AUM of c.S$1.0bn.

Backed by an acquisition pipeline from its sponsor, as well as several third-party acquisitions, KDCREIT embarked on an impressive growth trajectory that saw its AUM grow at a CAGR of c.20% since its listing.

Today, KDCREIT’s AUM of c.S$3.5bn consists of 21 quality data centres across nine countries in Asia Pacific and Europe. In addition to tapping into its sponsor’s acquisition pipeline, KDCREIT leverages on its sponsor’s expertise and track record in developing and managing data centre assets.

Keppel DC Reit stands out

In recent years, KDCREIT undertook AEIs and expansions at several of its properties to increase data centre capacity and drive revenue growth.

With the majority of its portfolio based in Singapore (c.55%), KDCREIT has the largest portfolio of data centres in Singapore compared to its peers.

We believe that the moratorium on new data centre developments in Singapore over the past two years has benefited KDCREIT. While the data centre development moratorium has recently been lifted, we understand that the authorities will be selective in granting approvals for new developments.

Moreover, there may be a cap on the number of approvals for new developments as Singapore works towards more sustainable power to reduce its carbon footprint.

There could even be further moratoriums on new data centre developments until Singapore ramps up its production and import of more renewable energy by FY25-FY27.

The limited availability of new supply could further boost occupancy and rental rates of data centres in Singapore, and we foresee KDCREIT as the major beneficiary among its peers.

You can find the full report here and sgx website on reits watch here

[…] of Mapletree Logistics Trust’s FY2021/22 Annual Report by The Singaporean Investor 3) Data Centre REITs – Fuel for the digital world by Small Cap Asia 4) 3 Singapore REITs That Can Tide You Through a Recession by The Smart Investor 5) What […]