On 19 December 2021, Daiwa House Logistics Trust (DHLT) issued its official IPO document, thus, opened an invitation to subscribe its units at 80 cents per unit and is set to be listed on 26 November 2021.

Check out the IPO document at this link: DHLT’s IPO Document.

You can also read the 10 key things to know before investing in DHLT below.

#1: Daiwa REIT Portfolio

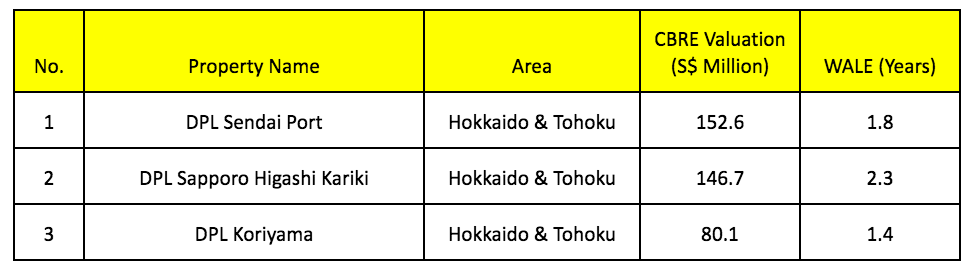

DHLT is a SGX-listed REIT that has 14 logistics properties located across Japan. It has a total net lettable area (NLA) of 423,920 sq. m., where 39.0% and 37.2% of its properties are situated in the Greater Tokyo and Hokkaido & Tohoku area. As of 30 September 2021, its properties are valued at S$ 954.3 million. Overall, the properties are relatively new with a portfolio age of 3.7 years. From its property portfolio, the 5 most valuable properties of DHLT are listed as follow:

#2: Daiwa REIT Lease Profile

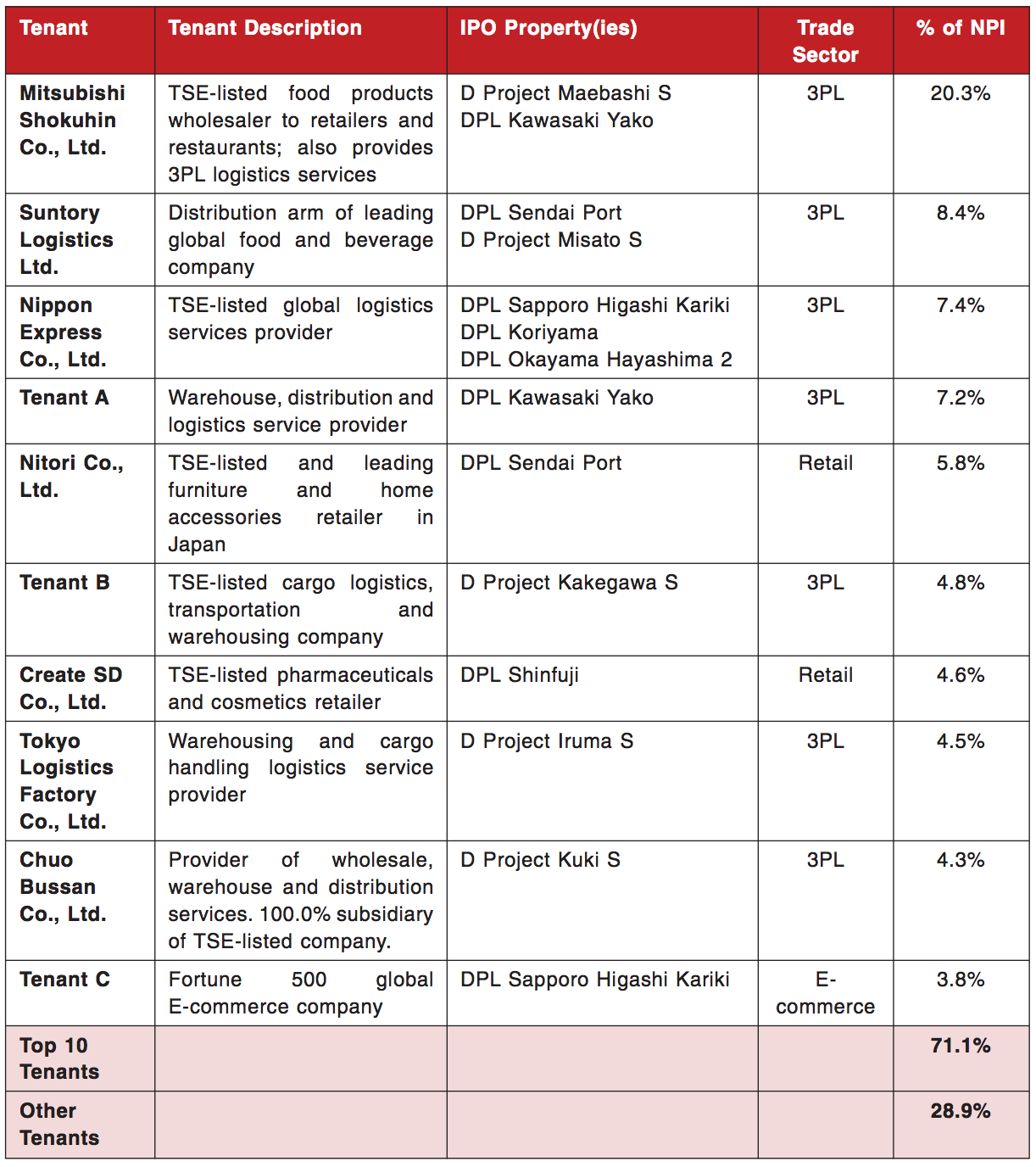

As of 1 October 2021, DHLT’s portfolio occupancy rate stands at 96.1%, where it achieved full occupancy in 12 out of 14 properties. DHLT has 26 tenants and the top 10 tenants are listed as follow:

DHLT has 7 single-tenant properties and 7 multi-tenanted properties. Currently, the 7 single-tenant properties are 100% occupied and have a Weighted Average Lease Expiry (WALE) of 11.2 years.

Meanwhile, out of its other 7 multi-tenanted properties, 5 of them are fully-occupied and 2 of them achieved 80+% in rate of occupancy.

The WALE for its 7 multi-tenanted properties is 5.9 years. While most properties are on long WALE, its 3 properties in Hokkaido & Tohoku currently have lower than 3 years in their WALE:

#3 Daiwa REIT Sponsor

Daiwa House Industry Co. Ltd (DHI) is the sponsor of DHLT.

DHI is a construction and real estate firm listed in the Tokyo Stock Exchange and as of 30 September 2021, its market capitalisation stood at S$ 29.5 billion.

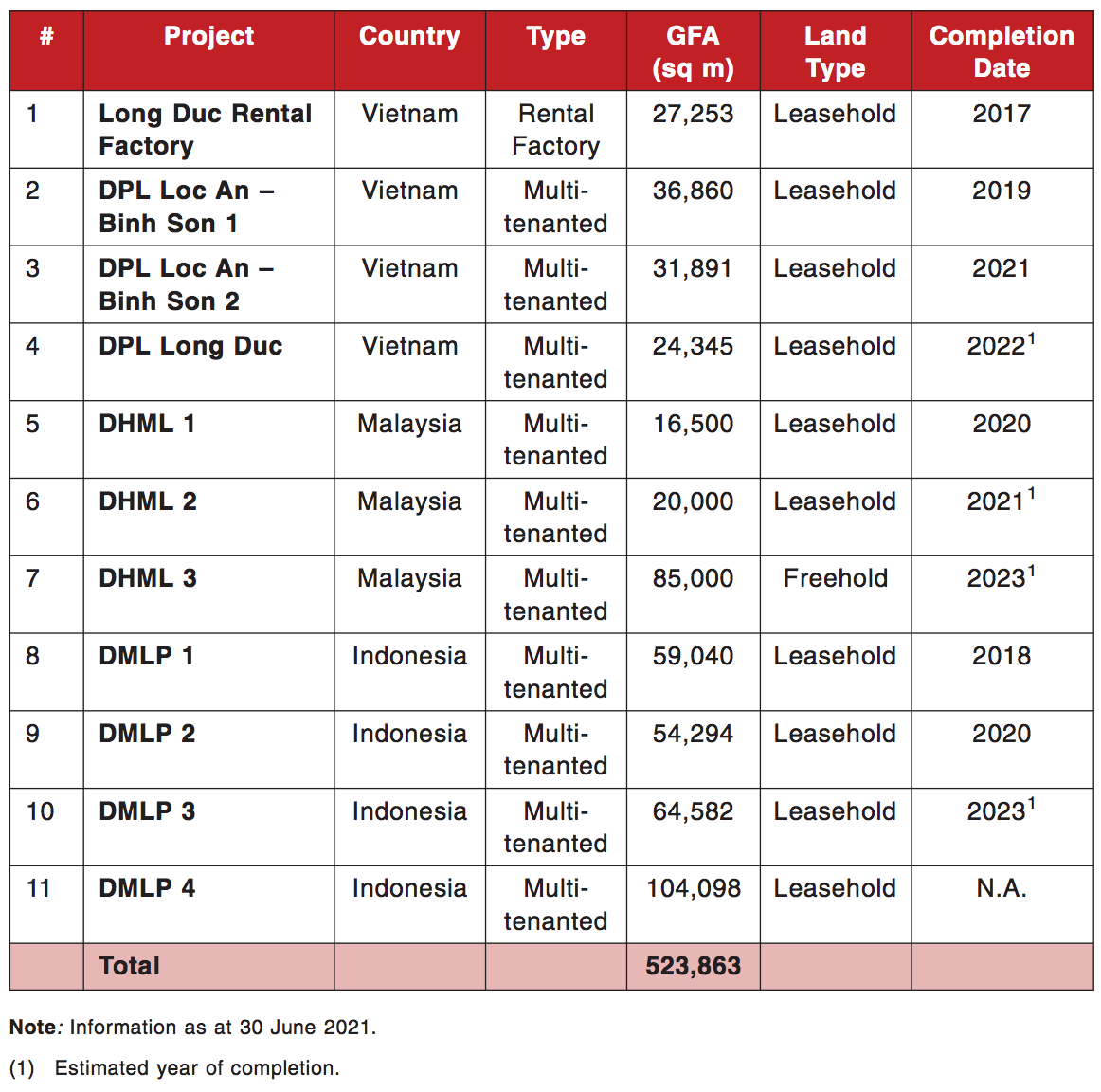

As of now, DHI is Japan’s largest logistics real estate developer and is working to grow its presence in Southeast Asia, namely in Vietnam, Malaysia, and Indonesia.

DHI had granted Rights of First Refusal (ROFR) to DHLT over logistics real estates that are currently owned and developed by DHI across Asia outside of Japan. As for logistics properties within Japan, DHLT ranks fourth in priority, behind Daiwa House REIT and Two Private Funds managed by Daiwa.

The following is a list of logistics properties that DHI owns and is constructing in Southeast Asia:

#4 Property Manager

Daiwa House Property Management Co Ltd (DHPM) is 100%-owned by DHI. It is an experienced property manager that manages 183 properties across Japan as at the end of August 2021.

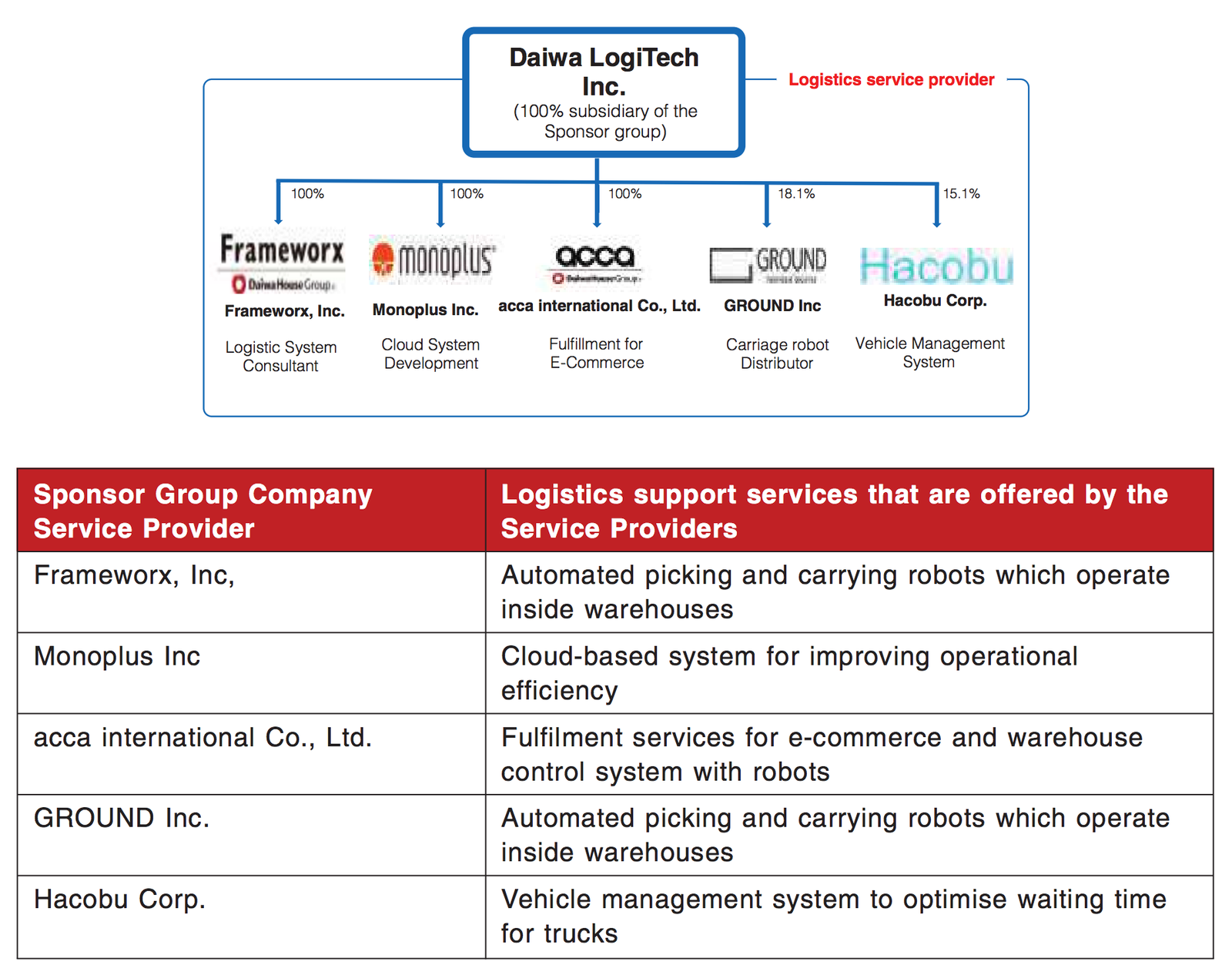

In addition, Daiwa LogiTech Inc (DLT), fully owned by DHI, has a portfolio of companies that offer Value-Added Services such as cloud systems, robotics & automation, and vehicle management and logistics systems which could benefit DHLT’s properties, providing an advantage over its peers.

These companies include:

#5 Daiwa REIT Asset Manager

DHI is also an experienced asset and fund manager via:

– 100%-owned Daiwa House Asset Management Co Ltd

– 100%-owned Daiwa House Real Estate Investment Management Co Ltd

The two firms manage real estate funds with Assets under Management (AUM) of S$ 19.6 billion. These funds include Daiwa House REIT, 2 unlisted REITs, and a number of private funds.

Daiwa House REIT is its biggest real estate fund and as of 30 September 2021, it has an AUM of S$ 10.0 billion.

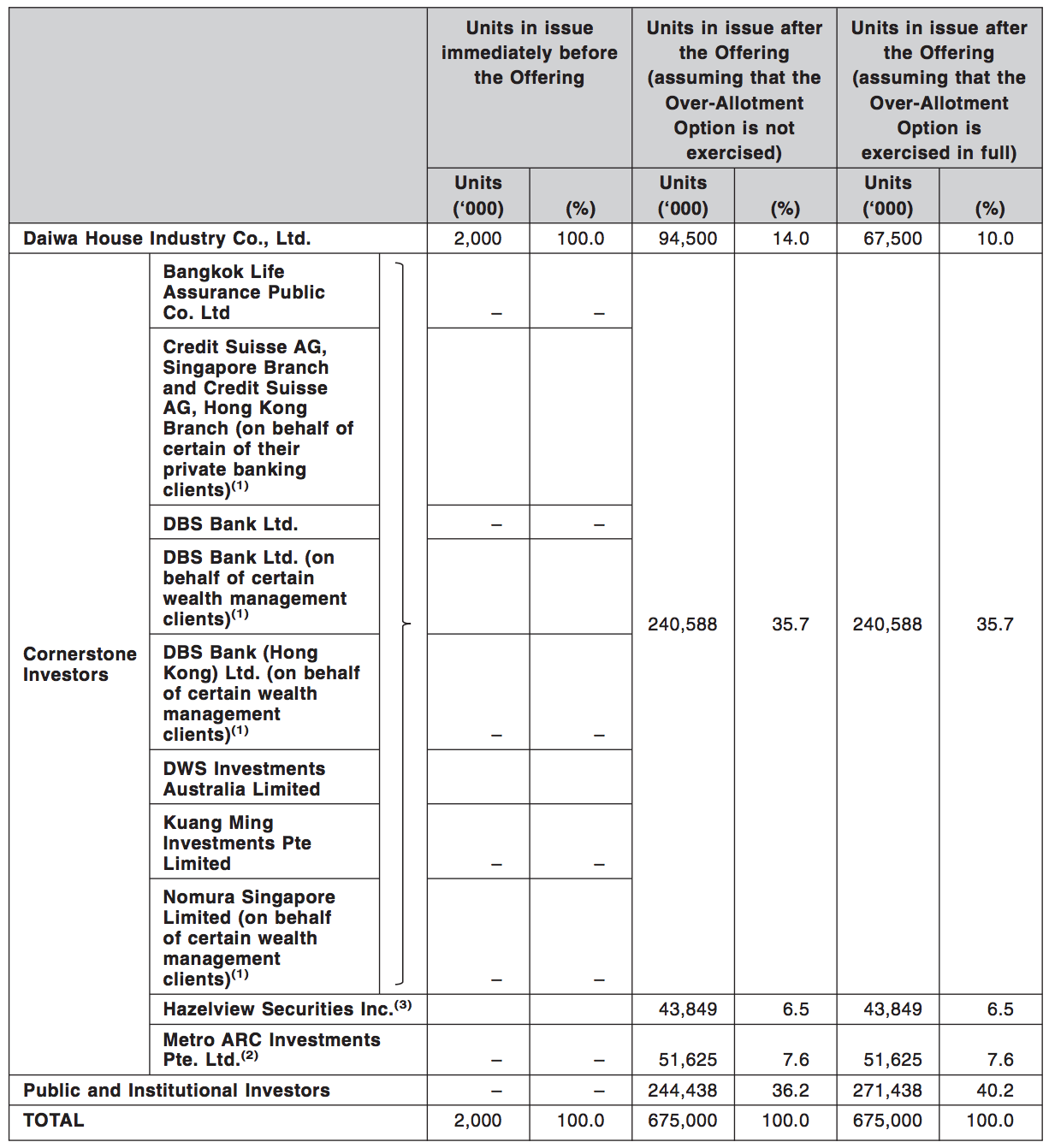

#6 Major Unitholders

DHI, the sponsor, shall remain as the key unitholder of DHLT after its IPO listing. In addition, DHLT would have the following cornerstone investors as follow:

#7 Financial Results

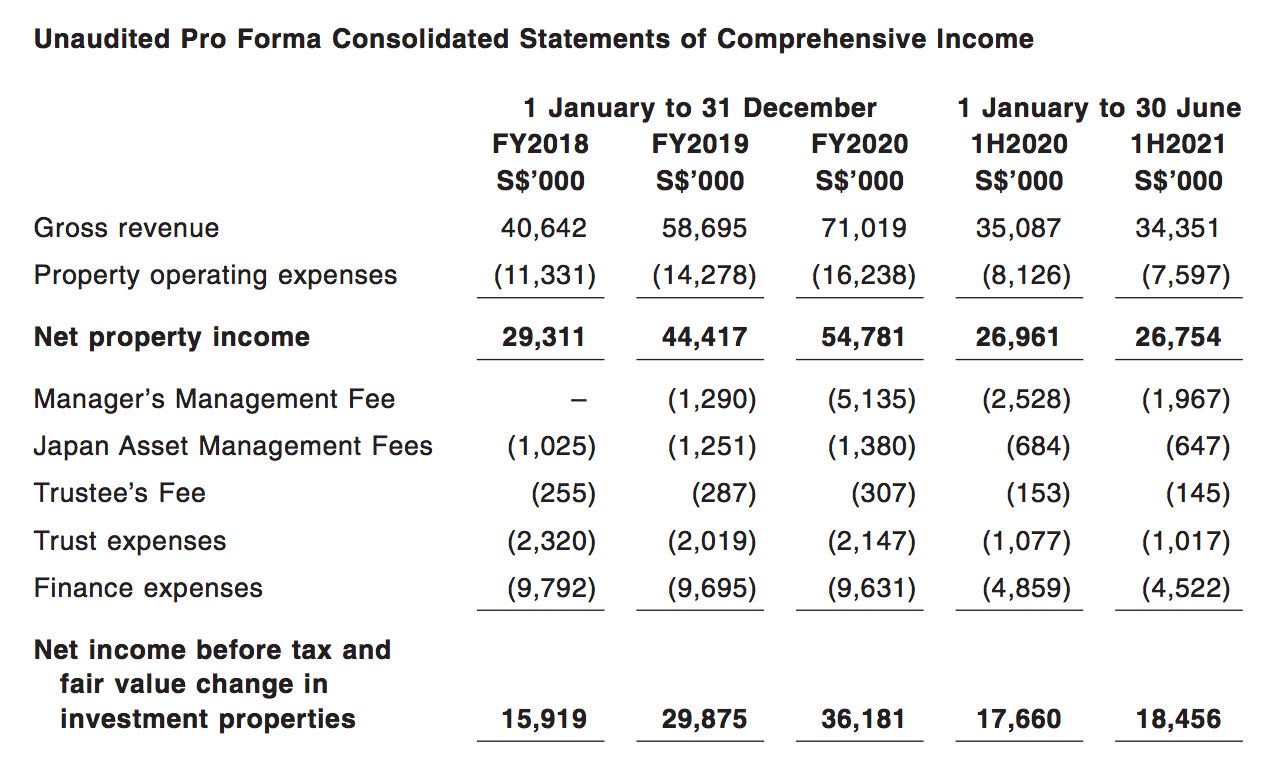

The following is the unaudited financial results of DHLT:

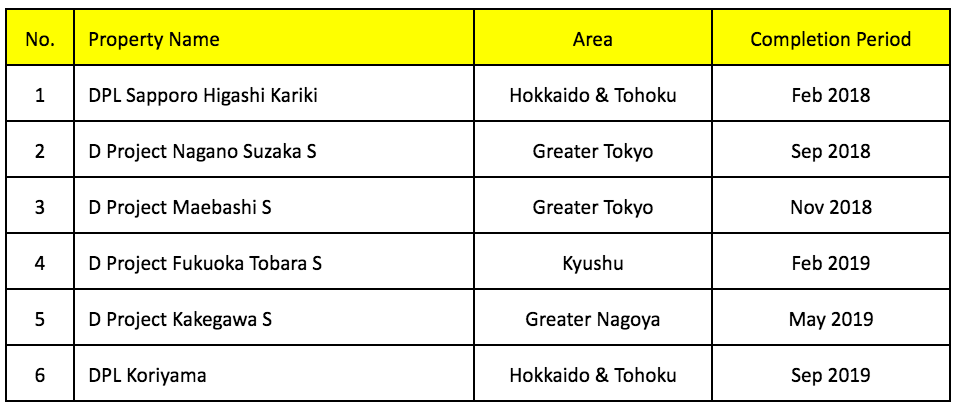

DHLT had achieved growth in gross revenue and net property income in the last 3 years because of additional income contributed by completion of:

DHLT’s gross revenue and net property income in 1H 2021 had remained steady against 1H 2020 as there is no inclusion of new properties in that period.

#8 Aggregate Leverage

As at the listing date, DHLT would have S$ 421.1 million in total borrowings. It is equivalent to around 39.2% in aggregate leverage based on appraised valuation of its properties.

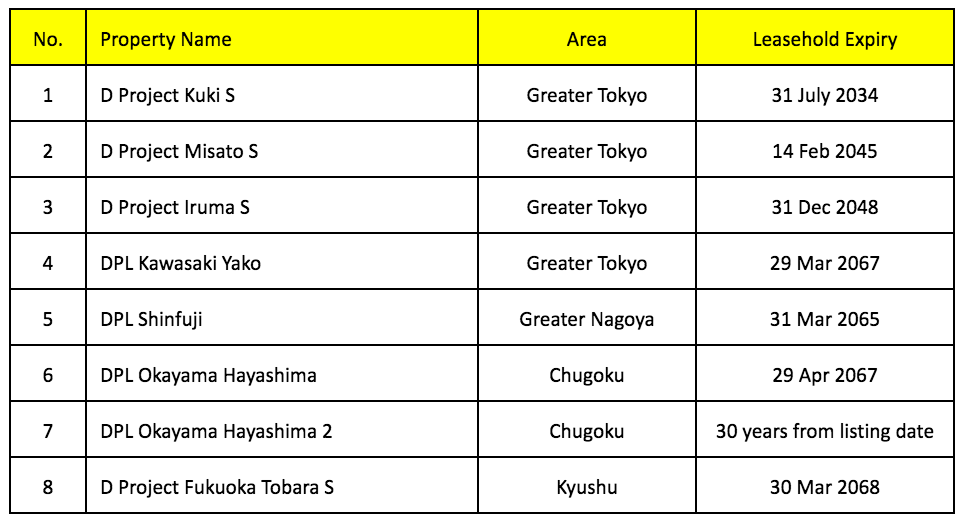

#9 Land Titles

8 out of 14 properties that DHLT owns are leasehold properties.

Under Japanese law, an entity:

– could own buildings and their underlying lands independently.

– has to return the land as it was once their leasehold period expired.

– Thus, it has to demolish these buildings once their leasehold period expires.

– Hence, the value of leasehold properties will fall over their leasehold terms.

– When it happens, costs would be incurred to demolish these buildings.

#10 Valuation

Based on S$ 0.80 per unit, the offer is valued at 1.05x its book value. DHLT’s IPO document had revealed that it had forecasted S$ 0.0521 in distribution per unit (DPU) for financial year 2022.

Thus, its gross distribution yield is 6.5% per year.

Conclusion

DHLT offers an avenue for investors to invest in logistics real estate across Japan and as of today, these properties are relatively new and they recorded 96.1% in portfolio occupancy rate as of 1 October 2021.

DHLT’s sponsor has accumulated vast experiences in the development and management of logistics properties in Japan and offers ROFR to its logistics properties across Southeast Asia.

Investors should consider the following prior to investing in DHLT:

– Low WALE in properties located in the Hokkaido & Tohoku area.

– Leasehold titles of 8 properties owned by DHLT.

– Foreign exchange risks associated with JPY, MYR, VND and INR against SGD.