CPE Technology Bhd (CPE) was listed on Bursa Malaysia on 7 December 2023. In writing this, its market capitalisation stands at RM 691.5 million, thus, making it the largest successful IPO in recent months. Here, I’ll list down 7 things that you need to know from its IPO Prospectus (Part 1, Part 2, Part 3, and Part 4) prior to making an investment decision. They are as follows:

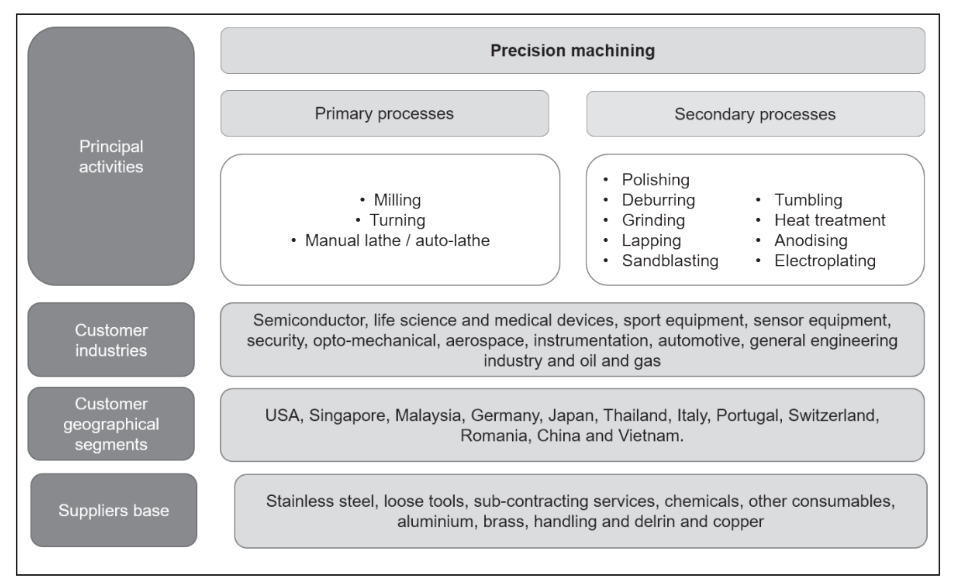

1. Business Model

CPE manufactures precision-machined parts and components which are used in different industries such as semiconductor, life science, medical devices, sensor equipment, sport equipment, and security industries. Presently, CPE operates 4 plants in Johor and its products are mainly exported to the United States and to Singapore, where both countries accounted for 85.76% of its 2023 revenues.

2. Profitability

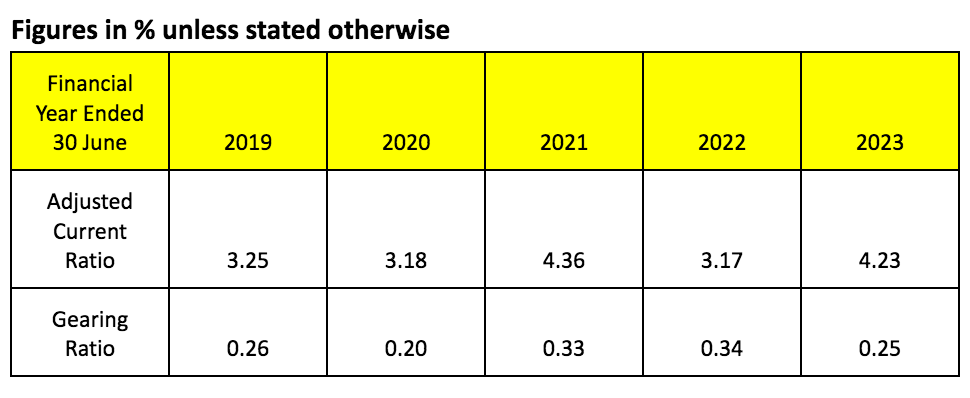

CPE had reported growth in revenue, adjusted PAT, and operating cash flows for the past 5 years. This is contributed by higher orders from its main customers in the United States and Singapore and effective cost control during the period. As such, CPE was able to maintain a healthy balance sheet as follows:

3. Balance Sheet

During the 5-year period, CPE has maintained >1.0 in adjusted current ratio and <50% in gearing ratio. It means the company has more than sufficient capital to meet its current liabilities while remaining conservatively geared.

4. Utilization of IPO Proceeds

CPE has raised RM 179.6 million in gross proceeds from its IPO listing. Of which, the company intends to allocate them as follows:

1. Industrial Lands and New Plants (RM 69.6 million)

CPE plans to acquire new industrial lands in Johor and expand its operations via building a 2-Storey office building & a 2-Storey factory building in its new plants each. Upon completion, CPE plans to relocate all of its operations in Plant 1 and Plant 5 and some of the manufacturing activities in Plant 2 to these new Plants. As a result, CPE’s total built-up area of its manufacturing activities shall increase by 245.32% from 96,586 sq. ft. to 333,534 sq. ft. upon its completion.

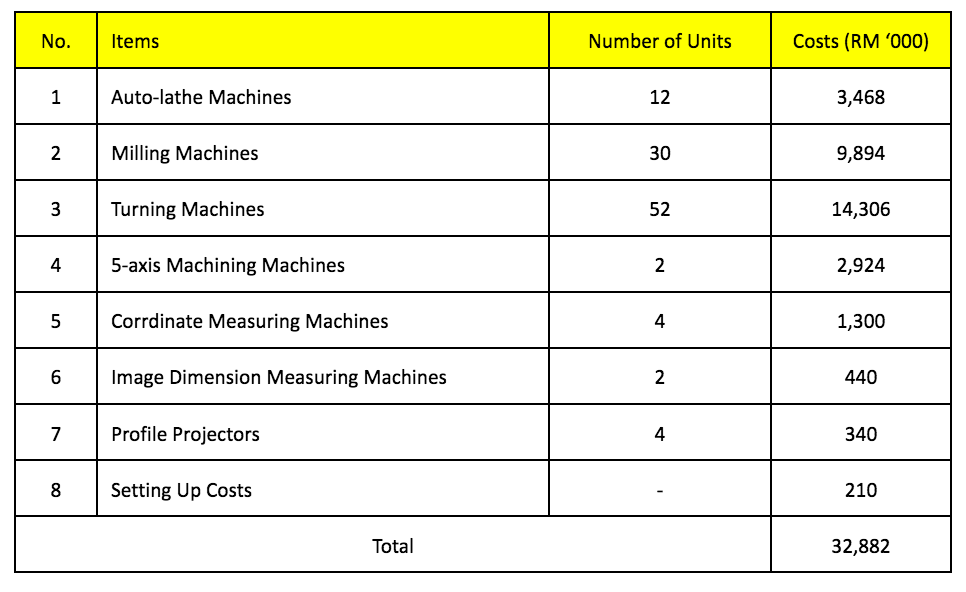

2. Purchase of New Machinery and Equipment (RM 32.9 million)

This would include the following purchases to support its expansion plan:

3. Repayment of Bank Borrowings (RM 17.45 million)

This would generate RM 0.78 million in interest cost savings to CPE.

4. Working Capital Expenditures (RM 46.9 million)

CPE allocates RM 7.0 million in acquiring raw materials namely, stainless steel & aluminum. The remaining RM 39.9 million would be set aside for administrative and daily operation expenses.

5. Other Capital Expenditures (RM 1.4 million)

This refers to the purchase / replacements / upgrades on laptops & IT servers.

6. Listing Expenses (RM 11.3 million)

5. Major Shareholders

Mr. Lee Chen Yeong, Mr. Foo Ming, and Mr. Mu Woon Chai would remain as the three largest shareholders of CPE via 32.5%, 19.5% and 13.0% shareholdings. At present, Mr. Lee sits in the board as its Group CEO while Mr. Foo and Mr. Mu sit in the board as its non-executive director and executive director respectively.

6. Risks

CPE has revealed that it is exposed to the following key risks:

1. Regulatory Risks

Several of CPE’s subsidiaries had failed to comply with regulatory requirements. The full details are revealed in Page 194-196 of the IPO prospectus. In brief, CPE had operated under subsidiaries: Champion PT and Champion C without having the licenses or approvals from MITI as stated below:

2. Concentration Risk on Major Customers

The top 5 major customers accounted for 78.29% of CPE’s revenues in 2023.

7. Valuation

Based on its current price of RM 1.03 a share, CPE is valued at P/E Ratio of 22.6.

8. Dividend Policy

CPE plans to distribute 25%-50% of its annual PAT in dividends to shareholders.

Conclusion:

CPE had reported a set of solid financial results with a healthy balance sheet for the last 5 years. It also intends to expand its production capacity with the “New Plants” in Johor in the next 3 years. However, it is also evident that it decided to operate without obtaining the necessary licenses or approvals. This would pose regulatory risk that may impact the operational and finances of CPE. Besides, in its IPO Prospectus, CPE’s growth was clearly attributed to its key customers and thus, posing concentration risk. At P/E Ratio of 22.6, it is important for investors to weigh in the pros and cons & compare it with peers & other stocks which are of similar P/E Ratio to determine if CPE is suitable for investment.

[…] CPE Technology Bhd: 7 Key Things Investors Should Know […]