How SRS works

The Supplementary Retirement Scheme (SRS) is a voluntary scheme by the Singapore government to encourage individuals to save for retirement.

It is part of the Singapore government’s plan to address the financial needs of a graying population and complements the Central Provident Fund (CPF).

CPF savings are meant to provide for housing and medical needs and for basic living needs after retirement. Unlike the CPF scheme, participation in SRS is voluntary.

SRS members can contribute a varying amount to SRS (subject to a cap) at their own discretion. The contributions may be used to purchase various investment instruments.

Advantages

- You can claim tax relief for contributions made to SRS.

Each dollar of SRS contribution will reduce your income chargeable to tax by a dollar.

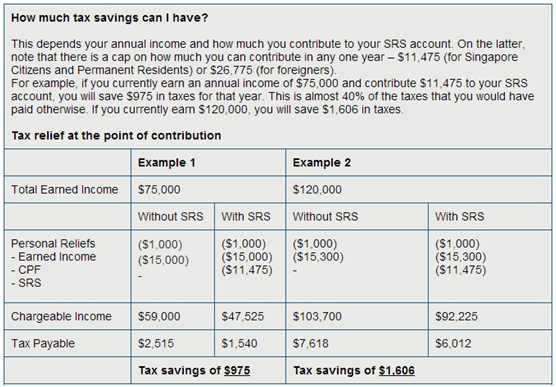

A comparison of Annual income of $75,000 vs $120,000

[The more you earn, the higher tax savings you earn]

- Investment gains will accumulate tax-free in SRS [Perfect for long-term investors]

- Contribution is voluntary. You can skip that year’s contribution or reduce it if you are cash-tight.

- Tax will be payable only when you withdraw your savings from SRS.

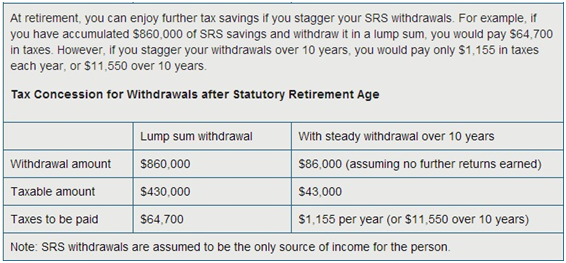

If you withdraw your savings upon retirement, only 50% of the savings withdrawn will be subject to tax.

Here’s 1 important thing to note: You may spread your withdrawals over a period of up to 10 years to meet your financial needs. Spreading out your withdrawals will generally result in greater tax savings as the illustration below proves.

Disadvantages

- Most importantly, the SRS program is primarily intended to be a long-term savings scheme. Thus, penalties and taxes are imposed on premature withdrawals [5% penalty].

- And if the contributor withdraws the SRS before the statutory retirement age of 62 [subject to changes], he/she will be taxed on 100% of withdrawals as compared to 50% after the statutory retirement age.

- Unlike the CPF, the SRS does not give a fixed 2.5% interest rate on savings. However, the purpose of SRS is to utilize the cash to invest and earn higher returns! What’s more… it offers tax free investment gains as previously mentioned which can translate to a substantial amount in savings!

- SRS is more suited for people with high average monthly income above $5k to justify the long locked-in period for the tax savings of a few hundred dollars annually. To see how much exactly you can save, look at the next page under “FAQs of SRS account”.

FAQs on using your SRS Account

Firstly, you must have many other FAQs regarding how to utilize SRS.

You can go to this website – http://app.mof.gov.sg/data/cmsresource/srs/SRS_Booklet%20-%2018Feb11.pdf to clarify any doubts.

Secondly, you can check out more details by just going down to any of the 3 local banks and opening an SRS account with them:

- Development Bank of Singapore (DBS) Ltd

- Overseas-Chinese Banking Corporation (OCBC) Ltd

- United Overseas Bank (UOB) Ltd

Many people have the burning question of exactly how much tax savings they will be entitled to according to on their own annual income and personal reliefs.

I have found a calculator from OCBC which you can check out personally – http://www.ocbc.com.sg/personal-banking/Investments/srs-calc.html.

Investing with SRS Funds

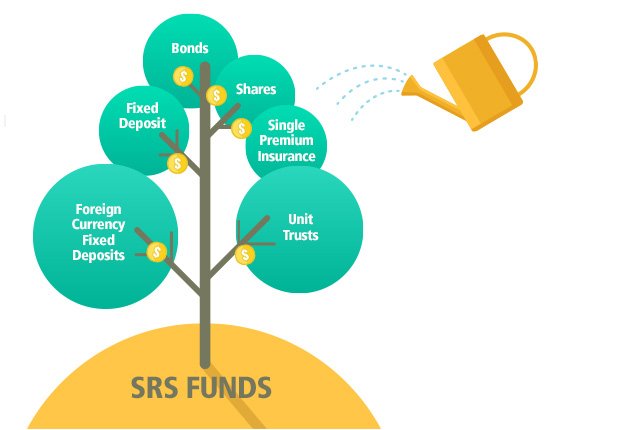

And here comes the most awaited question: What investment instruments can I purchase using my SRS funds?

You may invest in a wide range of financial assets, including those offered by financial institutions (product providers) other than your SRS operator.

Your product providers will be able to provide information on the products that they are offering for SRS. However, direct property investments are not allowed.

Acceptable financial instruments include:

- Unit trusts

- Insurance products

- Stocks

- Bonds

- Fixed Deposits

As for life insurance products, the following conditions shall apply:

- Only single premium products are allowed (including recurrent single premium products, encompassing both annuity and non-annuity plans).

- Life cover (including total and permanent disability benefits) will be capped at 3 times the single premium.

- Plans can allow for a contribution continuation feature/benefit upon disability.

- Other types of life insurance e.g. critical illness, health and long-term care are excluded.

- Trust nomination is not allowed for life insurance products purchased using SRS funds.

Conclusion

Returns: Tax Savings of a few hundred dollars to a few thousand dollars

Risks: Penalties on pre-mature withdrawal before retirement age

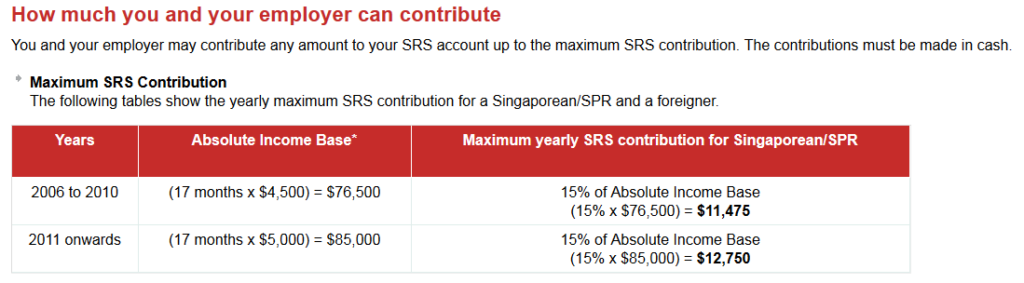

Maximum Contribution (revised on year 2011):

$12,750 (up from $11,475) for Singaporeans and Permanent Residents;

$29,750 (up from $26,775) for foreigners

Singaporeans and PRs earning at least more than $4k monthly.

The tax savings has to be adequate to compensate for the long lock-in period until retirement age!

Foreigners who foresee that they will be staying over 10 years.

They can utilize it as tax reliefs to lower a substantial portion of the taxes.

Recap:

SRS is a scheme initiated by the Singapore government to help people plan for their retirement as many people fail to start planning until too late.

On top of the tax savings you can receive, you can also invest in long term financial instruments like stocks and insurance to increase your returns.

As the slogan says, this is like killing 2 birds with a stone! If you ask me, the steps to fully utilize SRS is by taking the steps below:

- Contribute the maximum amount yearly,

- Use the funds to invest in undervalued companies (e.g. blue chips) over the long term. (find out how investing is like growing bamboo trees!)

- Lastly, spread the withdrawals over 10 years to save on taxes payable during withdrawals.

Happy Investing!~

| SmallCapAsia.com is a website focused primarily on undervalued gems that can generate Big, Fat Returns for investors. Our Slogan is simple: Start Small, Win Big! Subscribe to our FREE e-newsletter to get a regular dose of investment wisdom not found anywhere! |