Investing in shares is one of the most popular ways to grow your wealth and achieve your financial goals.

However, the strategies and preferences among investors vary when it comes to the dynamics of buying and selling shares. While some choose the traditional way of stocks investing, others like to engage in trading contracts for difference (CFDs), which enable them to put up a smaller capital outlay and also benefit from short-selling (later on this).

In this article, we will elaborate on the main differences between CFDs and stocks, and how they can suit different types of investors. We will also weigh their respective pros and cons and provide a practical example for clarity.

By the end of the article, you will gain a clearer picture of how the two financial products (CFDs & stocks) work, and determine which one might be more suitable for your investment style.

What is a Contract For Difference (CFD)?

For a quick background, a CFD is a type of financial agreement between you and a broker that allows you to trade on the price changes of an asset without actually owning it.

Here’s how it works: Let’s say you want to trade a CFD for a stock. If you think the stock’s price will go up, you go long (buy) the CFD. If you expect the price to go down, you go short (sell) the CFD. The profit or loss is determined by the difference between the entry and exit prices.

Simply put, CFDs offer a flexible way to trade various assets without owning them outright, making it a popular choice for those looking to speculate on market movements.

Pros and Cons of CFDs

As with any investment product, CFDs also come with their pros and cons. Let’s take a good look at them below.

Firstly, on top of the usual Buying Long trade, you now gain the ‘ability’ to short a position where you think the particular investment is going downhill (i.e. Oil prices plummeted during Covid).

Secondly, you have access to a wide array of investments in numerous global markets. This can make it easier and cheaper for you to diversify your investments.

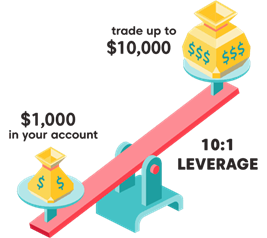

Thirdly, you need lesser capital to start investing. Based on a deposit margin of 10%, a capital outlay of US$1,000 allows you to take on a US$10,000 position (depending on broker). If the position gains by 10%, you can make US$1,000 (before fees) in profits, translating into a 100% return (10x leverage).

However, you can lose that deposit just as quickly – and have your position closed – if the market moves the same amount against you.

Moving over to the cons, CFDs do potentially have much higher fees. For instance, you will incur financing costs as you borrow from the broker to ‘magnify’ your holdings (buying $10K position instead of a $1K position).

Next, the underlying markets from which CFDs derive their value can be volatile – they can rise quickly, but also go the other way just as quickly. Since CFDs track that movement, CFD trades change in value at the same speed as the underlying market. Prudent management of your trades such as using stop-losses is something worth considering.

With all that said, are you still a bit confused on CFDs?

No worries, we will do a comparison between CFDs and Stocks followed by an example of Microsoft stock so that you can get the ebbs and flows of CFDs fairly quickly.

Differences Between CFDs and Stocks

Right off the bat, here’s a quick comparison table where you can see their main differences at one glance.

| Contract for Difference (CFD) | Stocks | |

| Ownership of Investments | No ownership. No rights to dividends (adjustments to represent dividends offered by some providers). | Full ownership. Rights to dividends. |

| Type of Investment Assets | Almost all types of assets. | Only Shares and ETFs. |

| Fees | Spread, commission, and overnight funding adjustments | Commission for buying and selling of shares. |

| Leverage | Yes. Traders put up margin – a percentage of the trade’s full value – to open and maintain the trade. | No – Investors pay Full Value upfront |

| Risks | High. An investor could make losses higher than their capital and deposit. | Limited to capital the investor put in. |

| Trading Hours | Typically 24 hours | Market hours (normally 9 am to 5 pm) |

| Ability to go ‘Short’ – sell and take advantage of falling prices | Yes | No |

To summarize the table above, I would say that CFDs offer much more flexibility for a knowledgeable trader where he/she can trade Long or Short positions with a lower capital outlay.

The bigger pool of financial products and longer trading hours will also be a boon to the trader although the risk factor is something that he/she has to contend with.

Next, we dive into a short example of the process behind buying ‘Microsoft’ using shares or CFDs.

Investing in Microsoft (CFD vs Stock)

Close your eyes and imagine this.

Microsoft is firing on all cylinders with the cloud computing (Azure) growth and its developments in the AI space.

You have a good feeling about Microsoft, and you think its share price still have potential to increase from US$400 (its current price) onwards.

Now you have two choices.

The first one is taking US$40,000 of your money to invest in 100 shares of Microsoft directly.

The second one is to utilize CFDs where you can still take a US$40,000 position on Microsoft but you only need to offer about US$4,000 based on the 10% margin offered by your broker.

You opted for CFDs as you are more comfortable putting up US$4,000.

1 month later, Microsoft’s price went up 5% and you informed your broker that you wanted to close (sell) your position and now it’s time to calculate your profits.

For direct stocks investing, you would have put up the US$40,000 capital and made US$2,000 (5%).

For CFDs, you would have put up only US$4,000 capital and made US$2,000 (50% return).

Conversely, imagine the market price dropped 5%. In both the traditional stock investment and CFD trade, you would lose US$2000. 50% of your CFD trade, but 5% of your stock buy.

This is a 10x difference in % returns or losses when you utilize CFDs vs stocks trading.

At this point, while you are getting excited, do take note that we have assumed no fees/commissions for either option.

Start your CFD Trading journey with Capital.com

Too many brokers to choose from and not sure which one to go for?

Start trading CFDs using Capital.com today and experience its intuitive platforms, advanced charts and analytical tools.

Be it on desktop (browser), iOS or Android apps, the accessibility ensures you can engage in comprehensive trading analysis anytime, anywhere. Make use of its integrated smart risk-management tools and multi-platform support to blaze forward in your investment journey.

You can take positions on thousands of stocks with Capital.com using CFDs. Since you don’t own the underlying stock, you can use CFDs to go short if you think a price will fall, as well as long if you think a price will rise – something you can’t do with a traditional stockbroker.

You can usually use CFDs to take a position on a stock for less than the price of buying it outright, thanks to leverage. However, leverage can result not only in large, fast gains but also in large and fast losses, so it’s important to understand how CFDs work before trading.

If you are looking for a reputable broker to get started on CFD stock trading, click on the image right now:

Disclaimer: This sponsored post is brought to you by Capital.com to provide valuable insights.

The views expressed herein are solely those of the author and do not necessarily reflect the opinions of Capital.com.