CapitaLand Integrated Commercial Trust (CICT) is one of the largest REIT listed on SGX. CICT owns assets primarily used for commercial (including retail and/or office) purpose, located predominantly in Singapore.

As the largest proxy for Singapore commercial real estate, CICT’s portfolio includes 26 properties spread across in Singapore, Germany and Australia with a total property value of S$24.2B.

1. Financial Performance

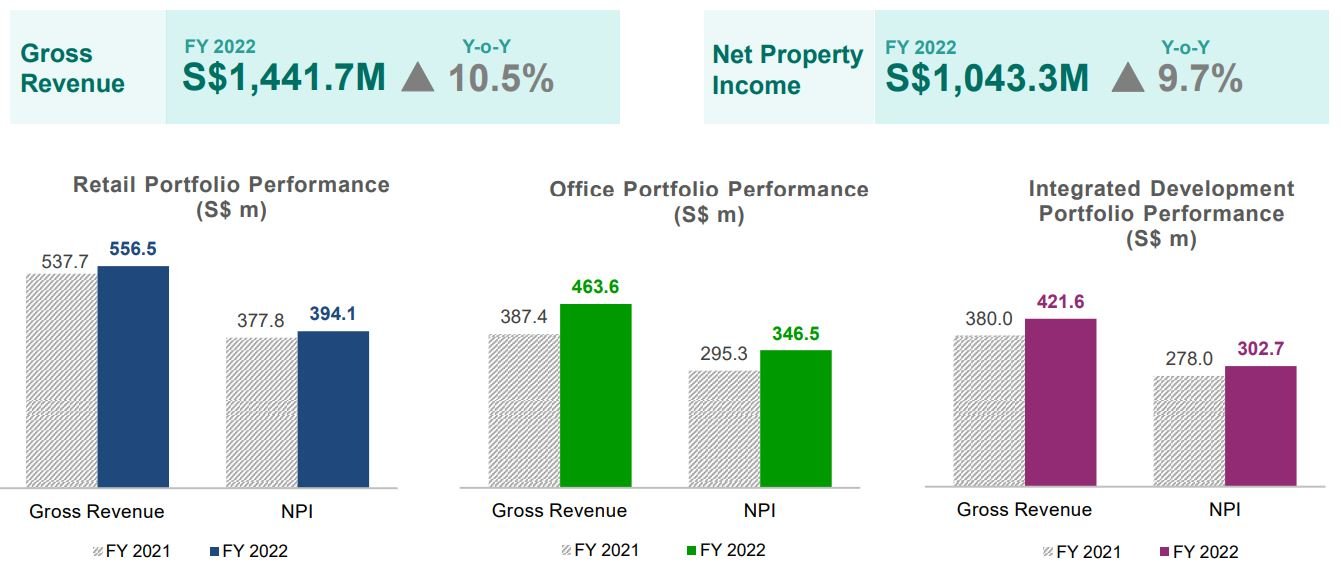

In its latest financial results for FY ended 31 Dec 2022, gross revenue is up 10.5% to S$1,441.7M while net property income is up 9.7% to S$1.,043.3M.

DPU for the year is 10.58 cents, a slight increase from 10.4 cents in 2021.

2. Operational Metrics

CICT released a decent set of operational metrics, Portfolio occupancy is relatively healthy at 95.8%.

It achieved a positive rental reversion of 7.6% for its office portfolio while its retail portfolio achieved rental reversion of only 1.2%.

On a bright note, its retail portfolio tenant sales increased by 22.5% in 2022 due to the full re-opening of borders and Singapore moving to endemic phase.

3. Capital Management

CICT gearing ratio is 40.4% as at 31 Dec 2022 while interest coverage has decreased to 3.7x.

81% of its borrowings is hedged on fixed interest rates and the cost of debt has increased to 2.7%.

CICT gearing ratio could be a cause for concern. A gearing ratio above 40% tend to have fund raising exercise in the foreseeable future.

Hence, it will be prudent to monitor the gearing ratio as a fund raising exercise may not benefit shareholders even though CICT has a strong sponsor.

4. Key metrics to look out when investing in CICT

CICT is in many investors’ REITs portfolio as it has a strong sponsor, decent yield and is also one of the biggest commercial REITs in Singapore.

The FTSE REIT index is down about 1% year to date while CICT share price is down 9.85% this year.

Hence, we may need to look at some key metrics when reviewing CICT and find out why CICT has underperform the REIT index:

-

Retention Rate

While CICT achieved a positive rental reversion rate for its office, its retention rate is a cause for concern.

The retention has drop from 91.4% in first half 2022 to the current 81.1% as at 31 Dec 2022.

Does this deteriorating metric point to a sign of worsening outlook for the office sector?

-

Rental reversion

While it achieve a positive rental reversion for its retail portfolio, the increase is merely 1.2% – which could mean that CICT cant afford to increase rents any further due to the worsening economic outlook.

-

Gearing and cost of debt

CICT gearing ratio is relatively high at above 40%. As mentioned in our other REIT articles such as this and this, any ratio above 40% could be a cause for concern.

The cost of debt has also increased – it was 2.3% in 2021 compared to 2.7% in 2022. This will definitely lead to higher interest costs and will affect DPU.

Conclusion

When investing in REITs, it is imperative that we look at certain key metrics as mentioned above.

Of course, there are many other factors to look at, which we will cover in future articles so stay tuned for more REIT articles~

You may wish to check out Capitaland integrated commercial trust website here.

[…] With Entry of New Sponsor- Korean Mirae Asset Global Investments. by Investment Income for Life 4) CapitaLand Integrated Commercial Trust (CICT) FY2022 Results: 3 Key Metrics to look at by Small Cap … 5) Has United Hampshire US REIT Done Well In FY2022? by Passive […]

1) Bought this baby in 2015 during the great Singapore sale. Added more during subsequent sales. Collected 8 years worth of ang pow.

2) With a low average cost & a juicy yield, I hardly look at her nowadays, only checking twice a year to see how heavy is the ang pow & when it will be credited.

3) Isn’t that what passive income is all about…